Help? Part 2

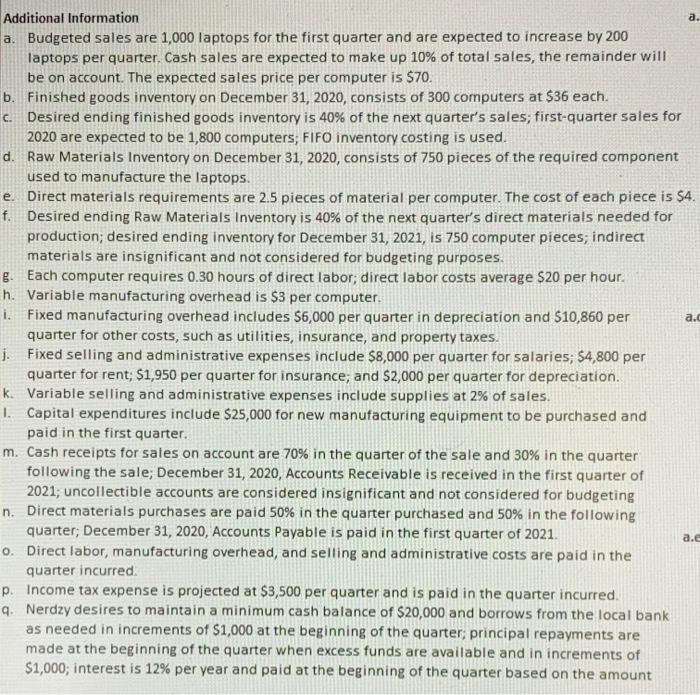

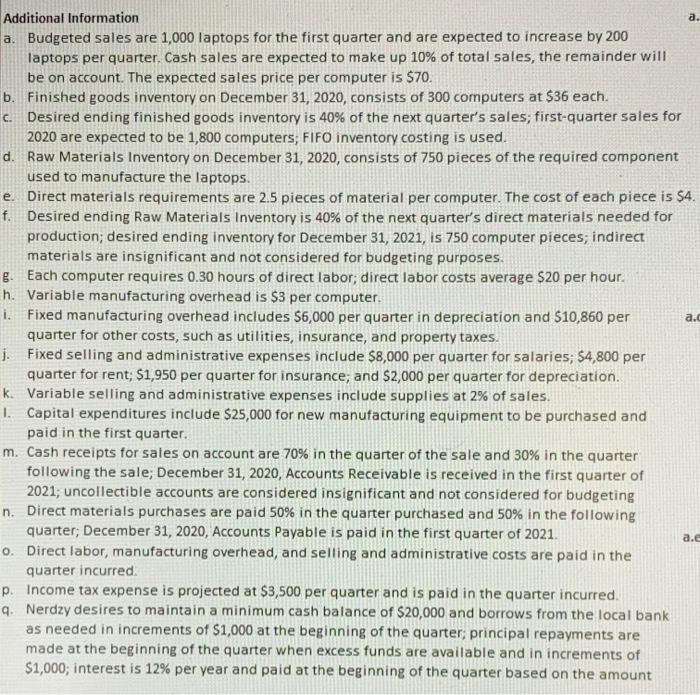

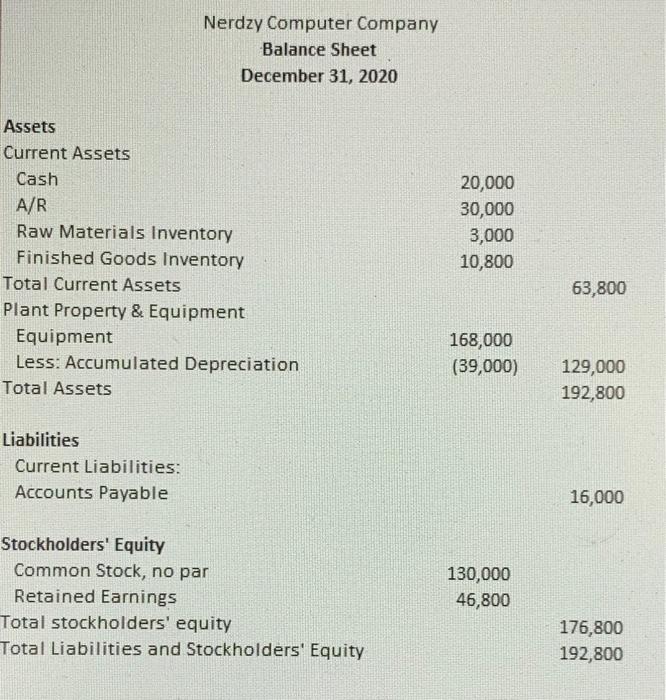

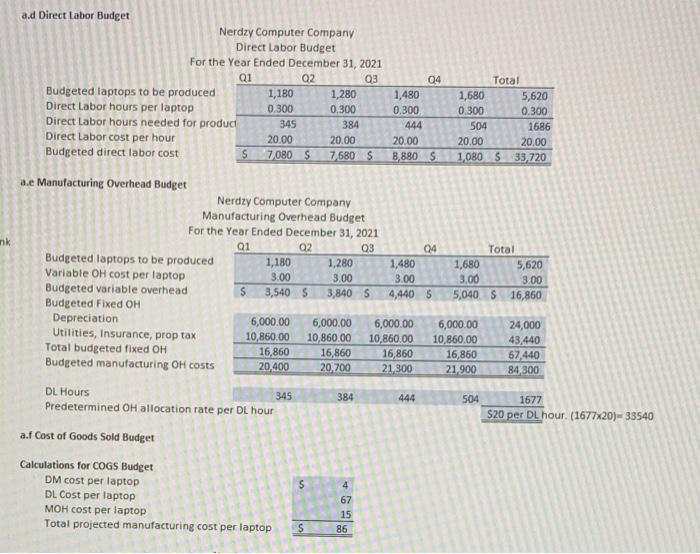

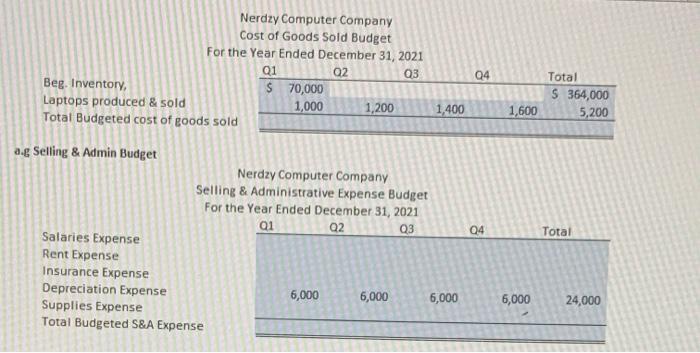

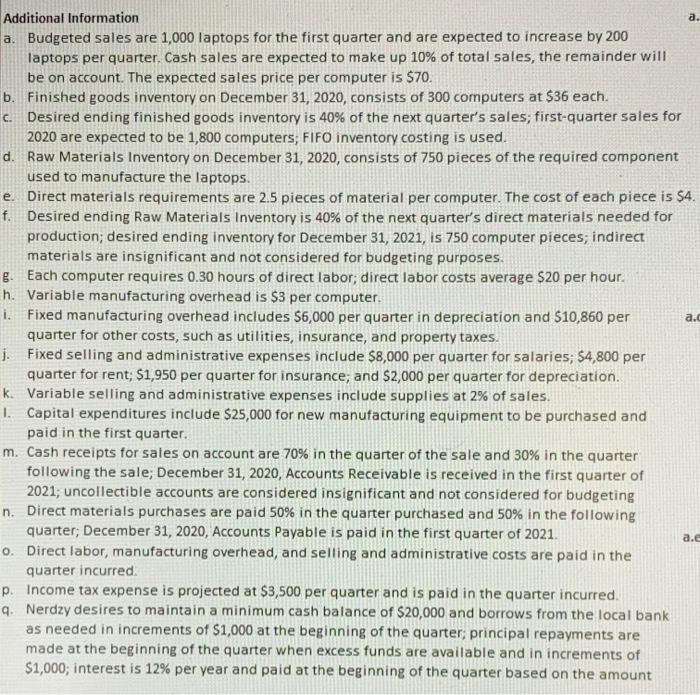

a. c. a.c Additional Information a. Budgeted sales are 1,000 laptops for the first quarter and are expected to increase by 200 laptops per quarter. Cash sales are expected to make up 10% of total sales, the remainder will be on account. The expected sales price per computer is $70. b. Finished goods inventory on December 31, 2020, consists of 300 computers at $36 each. Desired ending finished goods inventory is 40% of the next quarter's sales; first-quarter sales for 2020 are expected to be 1,800 computers; FIFO inventory costing is used. d. Raw Materials Inventory on December 31, 2020, consists of 750 pieces of the required component used to manufacture the laptops. e. Direct materials requirements are 25 pieces of material per computer. The cost of each piece is $4. f. Desired ending Raw Materials Inventory is 40% of the next quarter's direct materials needed for production; desired ending inventory for December 31, 2021, is 750 computer pieces; indirect materials are insignificant and not considered for budgeting purposes. 8. Each computer requires 0.30 hours of direct labor; direct labor costs average $20 per hour. h. Variable manufacturing overhead is $3 per computer. i. Fixed manufacturing overhead includes $6,000 per quarter in depreciation and $10,860 per quarter for other costs, such as utilities, insurance, and property taxes. 1. Fixed selling and administrative expenses include $8,000 per quarter for salaries; 54,800 per quarter for rent; $1,950 per quarter for insurance; and $2,000 per quarter for depreciation. k. Variable selling and administrative expenses include supplies at 2% of sales. 1. Capital expenditures include $25,000 for new manufacturing equipment to be purchased and paid in the first quarter. m. Cash receipts for sales on account are 70% in the quarter of the sale and 30% in the quarter following the sale; December 31, 2020, Accounts Receivable is received in the first quarter of 2021; uncollectible accounts are considered insignificant and not considered for budgeting n. Direct materials purchases are paid 50% in the quarter purchased and 50% in the following quarter December 31, 2020, Accounts Payable is paid in the first quarter of 2021. 0. Direct labor, manufacturing overhead, and selling and administrative costs are paid in the quarter incurred. p. Income tax expense is projected at $3,500 per quarter and is paid in the quarter incurred. q. Nerdzy desires to maintain a minimum cash balance of $20,000 and borrows from the local bank as needed in increments of $1,000 at the beginning of the quarter; principal repayments are made at the beginning of the quarter when excess funds are available and in increments of $1,000; interest is 12% per year and paid at the beginning of the quarter based on the amount a.e Nerdzy Computer Company Balance Sheet December 31, 2020 Assets Current Assets Cash A/R Raw Materials Inventory Finished Goods Inventory Total Current Assets Plant Property & Equipment Equipment Less: Accumulated Depreciation Total Assets 20,000 30,000 3,000 10,800 63,800 168,000 (39,000) 129,000 192,800 Liabilities Current Liabilities: Accounts Payable 16,000 Stockholders' Equity Common Stock, no par Retained Earnings Total stockholders' equity Total Liabilities and Stockholders' Equity 130,000 46,800 176,800 192,800 and Direct Labor Budget Nerdzy Computer Company Direct Labor Budget For the Year Ended December 31, 2021 Q1 Q2 Q3 Budgeted laptops to be produced 1,180 1,280 Direct Labor hours per laptop 0.300 0.300 Direct Labor hours needed for product 345 384 Direct Labor cost per hour 20.00 20.00 Budgeted direct labor cost S 7,080S 7,680S 04 1,480 0.300 444 20.00 8,8805 Total 1,680 5,620 0.300 0,300 504 1686 20.00 20.00 1,080 $33,720 nik de Manufacturing Overhead Budget Nerdzy Computer Company Manufacturing Overhead Budget For the Ended December 31, 2021 Q1 Q2 03 04 Total Budgeted laptops to be produced 1,180 1,280 1,480 1,680 5,620 Variable OH cost per laptop 3.00 3.00 3.00 3.00 Budgeted variable overhead S 3,540 $ 3,840 S 4,440 5 5,040 S 16,860 Budgeted Fixed OH Depreciation 6,000.00 6,000.00 6,000.00 6,000.00 24,000 Utilities, Insurance, prap tax 10,860.00 10,860.00 10,860.00 10.860.00 43,440 Total budgeted fixed OH 16,860 16,860 16,860 16,860 67,440 Budgeted manufacturing OH costs 20,400 20,700 21,300 21.900 84,300 3.00 345 DL Hours Predetermined OH allocation rate per DL hour 384 444 504 1677 $20 per DL hour (1677x20)- 33540 af Cost of Goods Sold Budget Calculations for COGS Budget DM cost per laptop DL Cost per laptop MOH cost per laptop Total projected manufacturing cost per laptop 4 67 15 86 $ Nerdzy Computer Company Cost of Goods Sold Budget For the Year Ended December 31, 2021 01 Q3 Q4 Beg. Inventory, $ 70,000 Laptops produced & sold 1,000 1,200 1,400 Total Budgeted cost of goods sold 02 Total S 364,000 5,200 1,600 Q2 04 a. Selling & Admin Budget Nerdzy Computer Company Selling & Administrative Expense Budget For the Year Ended December 31, 2021 Q1 Q3 Salaries Expense Rent Expense Insurance Expense Depreciation Expense 6,000 6,000 6,000 Supplies Expense Total Budgeted S&A Expense Total 6,000 24,000 a. c. a.c Additional Information a. Budgeted sales are 1,000 laptops for the first quarter and are expected to increase by 200 laptops per quarter. Cash sales are expected to make up 10% of total sales, the remainder will be on account. The expected sales price per computer is $70. b. Finished goods inventory on December 31, 2020, consists of 300 computers at $36 each. Desired ending finished goods inventory is 40% of the next quarter's sales; first-quarter sales for 2020 are expected to be 1,800 computers; FIFO inventory costing is used. d. Raw Materials Inventory on December 31, 2020, consists of 750 pieces of the required component used to manufacture the laptops. e. Direct materials requirements are 25 pieces of material per computer. The cost of each piece is $4. f. Desired ending Raw Materials Inventory is 40% of the next quarter's direct materials needed for production; desired ending inventory for December 31, 2021, is 750 computer pieces; indirect materials are insignificant and not considered for budgeting purposes. 8. Each computer requires 0.30 hours of direct labor; direct labor costs average $20 per hour. h. Variable manufacturing overhead is $3 per computer. i. Fixed manufacturing overhead includes $6,000 per quarter in depreciation and $10,860 per quarter for other costs, such as utilities, insurance, and property taxes. 1. Fixed selling and administrative expenses include $8,000 per quarter for salaries; 54,800 per quarter for rent; $1,950 per quarter for insurance; and $2,000 per quarter for depreciation. k. Variable selling and administrative expenses include supplies at 2% of sales. 1. Capital expenditures include $25,000 for new manufacturing equipment to be purchased and paid in the first quarter. m. Cash receipts for sales on account are 70% in the quarter of the sale and 30% in the quarter following the sale; December 31, 2020, Accounts Receivable is received in the first quarter of 2021; uncollectible accounts are considered insignificant and not considered for budgeting n. Direct materials purchases are paid 50% in the quarter purchased and 50% in the following quarter December 31, 2020, Accounts Payable is paid in the first quarter of 2021. 0. Direct labor, manufacturing overhead, and selling and administrative costs are paid in the quarter incurred. p. Income tax expense is projected at $3,500 per quarter and is paid in the quarter incurred. q. Nerdzy desires to maintain a minimum cash balance of $20,000 and borrows from the local bank as needed in increments of $1,000 at the beginning of the quarter; principal repayments are made at the beginning of the quarter when excess funds are available and in increments of $1,000; interest is 12% per year and paid at the beginning of the quarter based on the amount a.e Nerdzy Computer Company Balance Sheet December 31, 2020 Assets Current Assets Cash A/R Raw Materials Inventory Finished Goods Inventory Total Current Assets Plant Property & Equipment Equipment Less: Accumulated Depreciation Total Assets 20,000 30,000 3,000 10,800 63,800 168,000 (39,000) 129,000 192,800 Liabilities Current Liabilities: Accounts Payable 16,000 Stockholders' Equity Common Stock, no par Retained Earnings Total stockholders' equity Total Liabilities and Stockholders' Equity 130,000 46,800 176,800 192,800 and Direct Labor Budget Nerdzy Computer Company Direct Labor Budget For the Year Ended December 31, 2021 Q1 Q2 Q3 Budgeted laptops to be produced 1,180 1,280 Direct Labor hours per laptop 0.300 0.300 Direct Labor hours needed for product 345 384 Direct Labor cost per hour 20.00 20.00 Budgeted direct labor cost S 7,080S 7,680S 04 1,480 0.300 444 20.00 8,8805 Total 1,680 5,620 0.300 0,300 504 1686 20.00 20.00 1,080 $33,720 nik de Manufacturing Overhead Budget Nerdzy Computer Company Manufacturing Overhead Budget For the Ended December 31, 2021 Q1 Q2 03 04 Total Budgeted laptops to be produced 1,180 1,280 1,480 1,680 5,620 Variable OH cost per laptop 3.00 3.00 3.00 3.00 Budgeted variable overhead S 3,540 $ 3,840 S 4,440 5 5,040 S 16,860 Budgeted Fixed OH Depreciation 6,000.00 6,000.00 6,000.00 6,000.00 24,000 Utilities, Insurance, prap tax 10,860.00 10,860.00 10,860.00 10.860.00 43,440 Total budgeted fixed OH 16,860 16,860 16,860 16,860 67,440 Budgeted manufacturing OH costs 20,400 20,700 21,300 21.900 84,300 3.00 345 DL Hours Predetermined OH allocation rate per DL hour 384 444 504 1677 $20 per DL hour (1677x20)- 33540 af Cost of Goods Sold Budget Calculations for COGS Budget DM cost per laptop DL Cost per laptop MOH cost per laptop Total projected manufacturing cost per laptop 4 67 15 86 $ Nerdzy Computer Company Cost of Goods Sold Budget For the Year Ended December 31, 2021 01 Q3 Q4 Beg. Inventory, $ 70,000 Laptops produced & sold 1,000 1,200 1,400 Total Budgeted cost of goods sold 02 Total S 364,000 5,200 1,600 Q2 04 a. Selling & Admin Budget Nerdzy Computer Company Selling & Administrative Expense Budget For the Year Ended December 31, 2021 Q1 Q3 Salaries Expense Rent Expense Insurance Expense Depreciation Expense 6,000 6,000 6,000 Supplies Expense Total Budgeted S&A Expense Total 6,000 24,000