Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP. Part Il: Your audit client is ABC Company and you are in the final stages of completing the audit of the December 31, 2018

HELP.

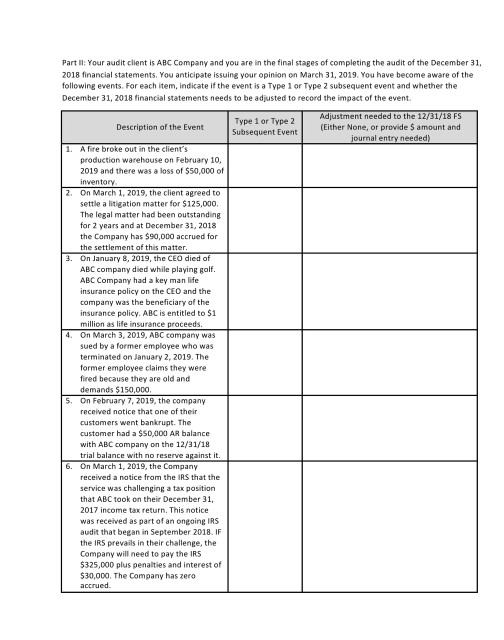

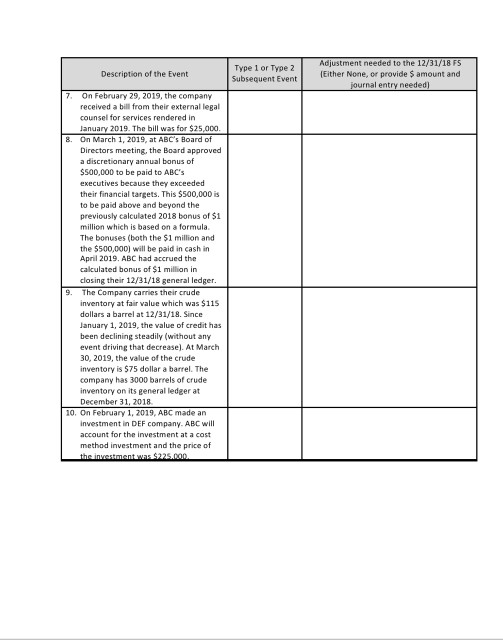

Part Il: Your audit client is ABC Company and you are in the final stages of completing the audit of the December 31, 2018 financial statements, You anticipate issuing your opinion on March 31, 2019. You have become aware of the following events. For each item, indicate if the event is a Type 1 or Type 2 subsequent event and whether the December 31, 2018 financial statements needs to be adjusted to record the impact of the event Adjustment needed to the1 18 FS Type 1 or Type 2 Event (Either None, or provide S amount and Description of the Event 1. A fire broke out in the client's production warehouse on February 10, 2019 and there was a loss of $50,000 of 2. On March 1, 2019, the client agreed to settle a litigation matter for $125,000. The legal matter had been outstanding for 2 years and at December 31, 2018 the Company has $90,000 accrued for the settlement of this matter On January 8, 2019, the CEO died of ABC company died while playing golf. ABC Company had a key man life insurance policy on the CEO and the company was the beneficiary of the insurance policy. ABC is entitled to $1 million as life insurance proceeds 4. On March 3, 2019, ABC company was sued by a former employee who was terminated on January 2, 2019. The former employee claims they were fired because they are old and demands $150,000 5. On February 7, 2019, the company received notice that one of their customers went bankrupt. The customer had a $S0,000 AR balance with ABC company on the 12/31/18 rial balance with no reserve against it 6. On March 1, 2019, the Company received a notice from the IRS that the service was challenging a tax position that ABC took on their December 31, 2017 income tax return. This notice was receved as part of an ongoing IRS audit that began in September 2018. IF the IRS prevails in their challenge, the Company will need to pay the IRS 5325,000 plus penalties and interest of $30,000. The Company has zero or Type 2Adjustment needed to the 12/31/18 FS EventEither None, or provide $ amount and 7. On February 29, 2019, the company lanuary 2019. The bill was for $25,000 On March 1, 2019, at ABC's Board of 8. their financial targets. This $500,000 is previously calculated 2018 bonus of $1 the 5500,000) will be paid in cash in closing their 12/31/18 general ledger dollars a barrel at 12/31/18. Since January 1, 2019, the value of credit has 30, 2019, the value of the crude 10, On February 1, 2019, ABC made arnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started