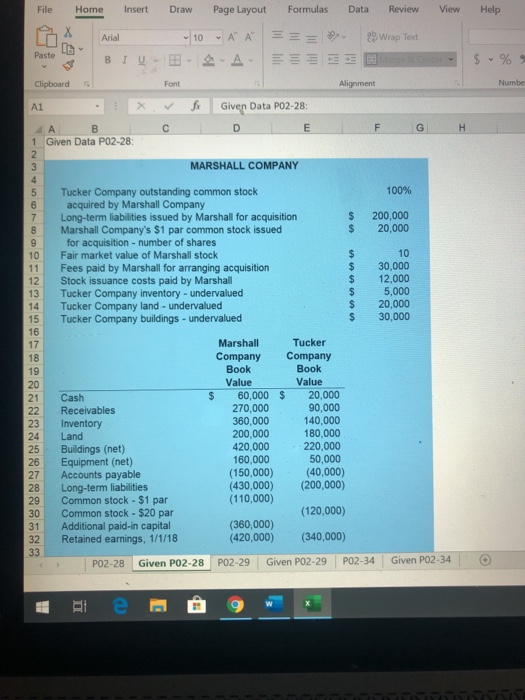

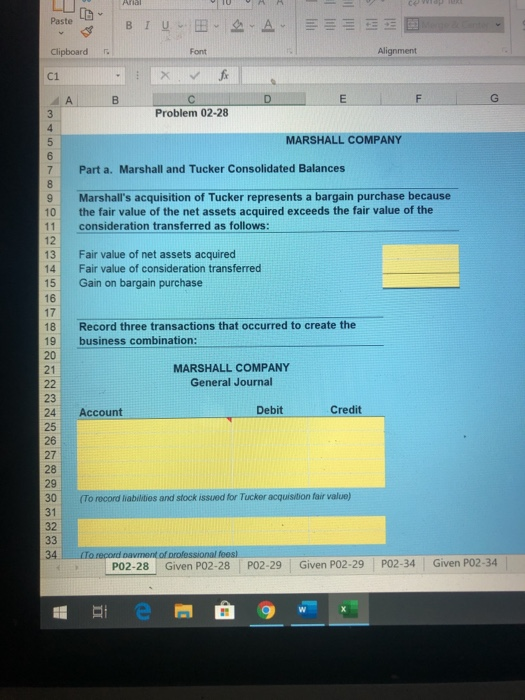

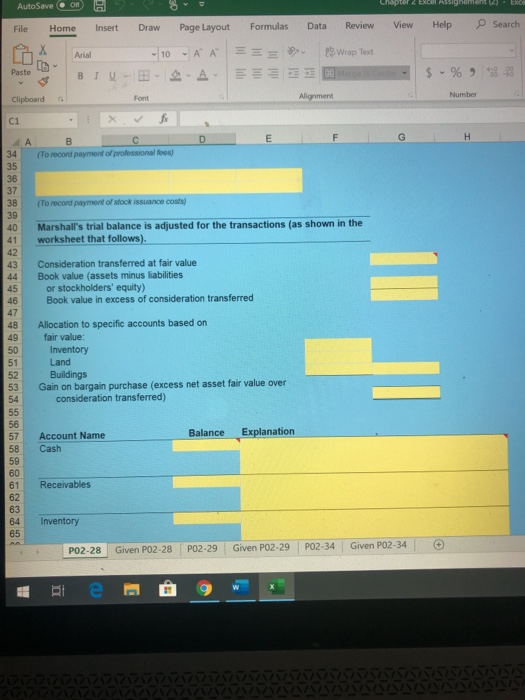

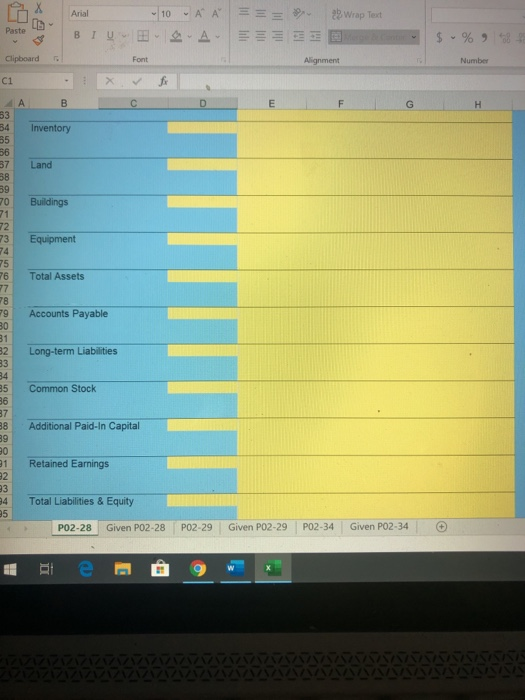

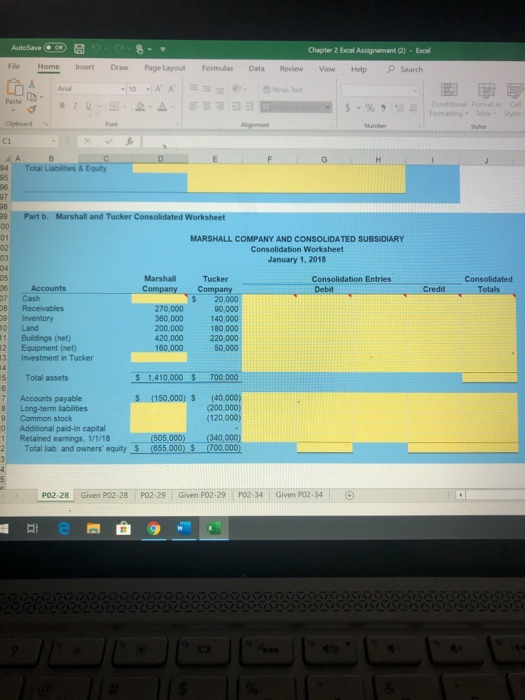

Help Paste Lo $ % % File Home Insert Draw Page Layout Formulas Data Review View Arial 10 A A = = = 2 29 Wrap Test BI UE A 3333 carte Clipboards Font Alignment A1 - X V fo Given Data P02-28: C D E F G 1 Given Data P02-28: MARSHALL COMPANY Numbe 100% 200,000 20,000 Tucker Company outstanding common stock acquired by Marshall Company Long-term liabilities issued by Marshall for acquisition Marshall Company's $1 par common stock issued for acquisition - number of shares Fair market value of Marshall stock Fees paid by Marshall for arranging acquisition Stock issuance costs paid by Marshall Tucker Company inventory - undervalued Tucker Company land - undervalued Tucker Company buildings - undervalued 30,000 12,000 5,000 20,000 30,000 Cash Receivables Inventory Land Buildings (net) Equipment (net) Accounts payable Long-term liabilities Common stock - $1 par Common stock - $20 par Additional paid-in capital Retained earnings, 1/1/18 Marshall Company Book Value 60,000 270,000 360,000 200,000 420,000 160,000 (150,000) (430,000) (110,000) Tucker Company Book Value $ 20,000 90,000 140,000 180,000 220,000 50,000 (40,000) (200,000) 28 (120,000) (360,000) (420,000) (340,000) PO2-28 Given PO2-28 PO2-29 Given PO2-29 PO2-34 Given PO2-34 Paste BIU- B A -EEE 2 Clipboard Alignment . : fx D E F G Problem 02-28 MARSHALL COMPANY NOW Part a. Marshall and Tucker Consolidated Balances Marshall's acquisition of Tucker represents a bargain purchase because the fair value of the net assets acquired exceeds the fair value of the consideration transferred as follows: 14 Fair value of net assets acquired Fair value of consideration transferred Gain on bargain purchase 15 18 Record three transactions that occurred to create the business combination: MARSHALL COMPANY General Journal Account Debit Credit (To record liabilities and stock issued for Tucker acquisition fair value) To record avmant of professional fees! PO2-28 Given P02-28 P02-29 Given P02-29 PO2-34 Given PO2-34 View Help Search AutoSave B S- File Home Insert Draw Page Layout Formulas X Arial 10 - A K = = = BLUE A EZE Clipboard Data Review 28 Wrop Text $%98- Alignment (To record of professionals To record a nd of stock issuance costs) Marshall's trial balance is adjusted for the transactions (as shown in the worksheet that follows) Consideration transferred at fair value Book value (assets minus abilities or stockholders' equity) Book value in excess of consideration transferred Allocation to specific accounts based on fair value: Inventory Land Buildings Gain on bargain purchase (excess net asset fair value over consideration transferred) Balance Explanation Account Name Cash Receivables Inventory PO2-28 Given PO2-28 PO2-29 Given PO2-29 PO2-34 Given PO2-34 = = = 28 Wrap Text | Arial -10 - A BLUE A Font $ % 9483 Clipboard Alignment Number ci Inventory Land Buildings Equipment Total Assets Accounts Payable Long-term Liabilities Common Stock Additional Paid-In Capital Retained Earnings Total Liabilities & Equity PO2-28 Given PO2-28 PO2-29 Given PO2-29 PO2-34 Given PO2-34 AutoSave File Home 9- Insert 8 . Page Layout Chapter 2 Excel Assignment (2) - Excel View Help Search Draw Formulas Data Review Wap LU G H Total Liabilities & Equity Part b. Marshall and Tucker Consolidated Worksheet 0885885 883 3888 MARSHALL COMPANY AND CONSOLIDATED SUBSIDIARY Consolidation Worksheet January 1, 2018 Marshall Company Consolidation Entries Debat Accounts Cash Receivables Inventory 270.000 380.000 200.000 420.000 160.000 Tucker Company 20,000 90.000 140.000 180 000 220,000 50.000 Buildings (net) Equipment (net) Investment in Tucker Total assets $ 1.410.000 $ 700.000 (150.000) $ N - ODGO (40.000) 200.000) (120.000) Accounts payable Long-term liabilities Common stock Additional paid in capital Retained earnings, 1/1/18 Total fab and owners' equity $ (505 000) (655,000) $ (340,000 (700.000) on PO2-28 Given P02-28 P02-29 Given P02-29 P02-34 Given P02-34