Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help pelng 20 Pin 4390 l Tliance, Law, and Real Estate Name Last four digits of LD e N your name and ID# on the

help

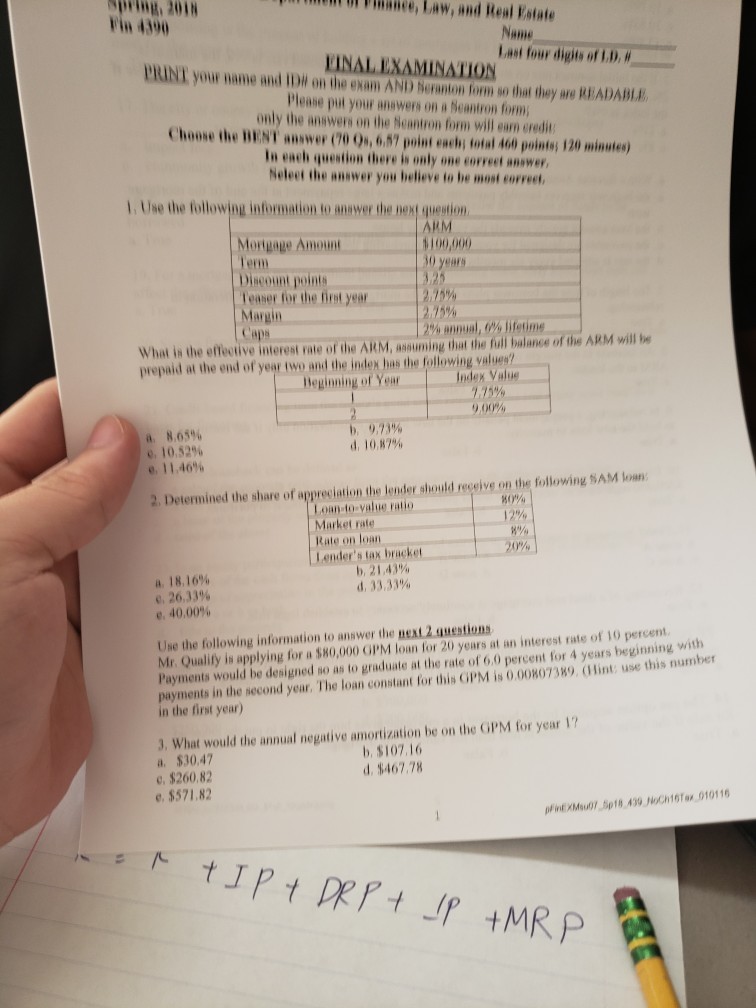

pelng 20 Pin 4390 l Tliance, Law, and Real Estate Name Last four digits of LD e N your name and ID# on the exam AND s ranto, form so that they are READABLE. ELNAL EXAMINAL?ON Please put your anawers on a Seantron fon only the answers on the Neantron form will earn credi Choose the BENT answer (70 0,6.57 point ench; total 460 points; 120 minules) In each question there is only one covreet answer Neleet the answer you believe to he most eovreet I. Use the following information to anawer the next question ARM 100,000 30 years Mortgage Amount Term Discount points Teaser for the first year Margin Caps 75% 275% 2% ennual, em lifetirne What is the effective interest rate of the ARM, assuming that the full balance of the ARM will be prepaid at the end of year two and the index has the following values? deginning of Yeur Index Value 8,65% e, 10.52% e, 11 46% b. 9,73% d. 10.87% 2. Determined the share of appreciation the lender should receive on the following SAM a oan to-value ratio Market rate Rate on loan Lender's tax brucket 18,16% ?. 26,33% e. 40.00% b, 21.43% d. 33.33% Use the following information to answer the next 2 anestions Mr. Qualify is applying for a $80,000 GI'M loan for 20 years at an interest rate of 10 percent. Payments would be designed so as to graduate at the rate of 6.0 percent for 4 years payments in the second year. The loan constant for this GPM is 0,00807389. (Hint: use this num beginning with in the first year) 3. What would the annual negative amortization be on the GPM for year 17 a. 530,47 $260,82 5571.82 b. $107.16 d. 8467.78 pelng 20 Pin 4390 l Tliance, Law, and Real Estate Name Last four digits of LD e N your name and ID# on the exam AND s ranto, form so that they are READABLE. ELNAL EXAMINAL?ON Please put your anawers on a Seantron fon only the answers on the Neantron form will earn credi Choose the BENT answer (70 0,6.57 point ench; total 460 points; 120 minules) In each question there is only one covreet answer Neleet the answer you believe to he most eovreet I. Use the following information to anawer the next question ARM 100,000 30 years Mortgage Amount Term Discount points Teaser for the first year Margin Caps 75% 275% 2% ennual, em lifetirne What is the effective interest rate of the ARM, assuming that the full balance of the ARM will be prepaid at the end of year two and the index has the following values? deginning of Yeur Index Value 8,65% e, 10.52% e, 11 46% b. 9,73% d. 10.87% 2. Determined the share of appreciation the lender should receive on the following SAM a oan to-value ratio Market rate Rate on loan Lender's tax brucket 18,16% ?. 26,33% e. 40.00% b, 21.43% d. 33.33% Use the following information to answer the next 2 anestions Mr. Qualify is applying for a $80,000 GI'M loan for 20 years at an interest rate of 10 percent. Payments would be designed so as to graduate at the rate of 6.0 percent for 4 years payments in the second year. The loan constant for this GPM is 0,00807389. (Hint: use this num beginning with in the first year) 3. What would the annual negative amortization be on the GPM for year 17 a. 530,47 $260,82 5571.82 b. $107.16 d. 8467.78Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started