Answered step by step

Verified Expert Solution

Question

1 Approved Answer

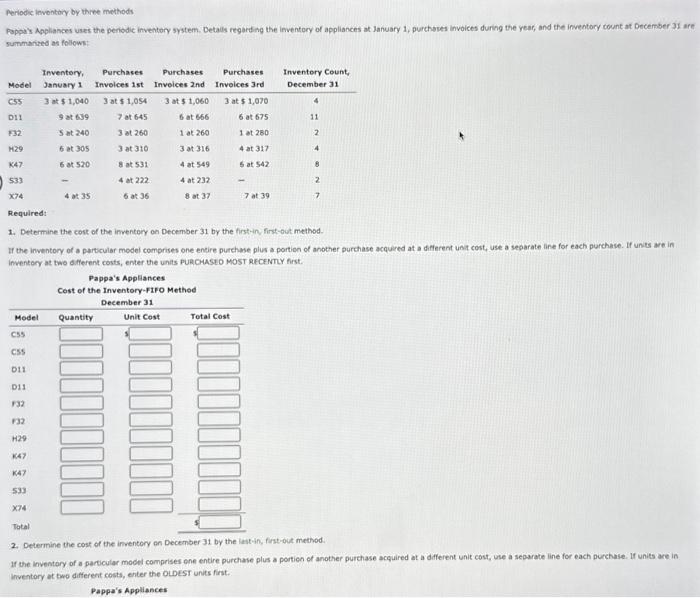

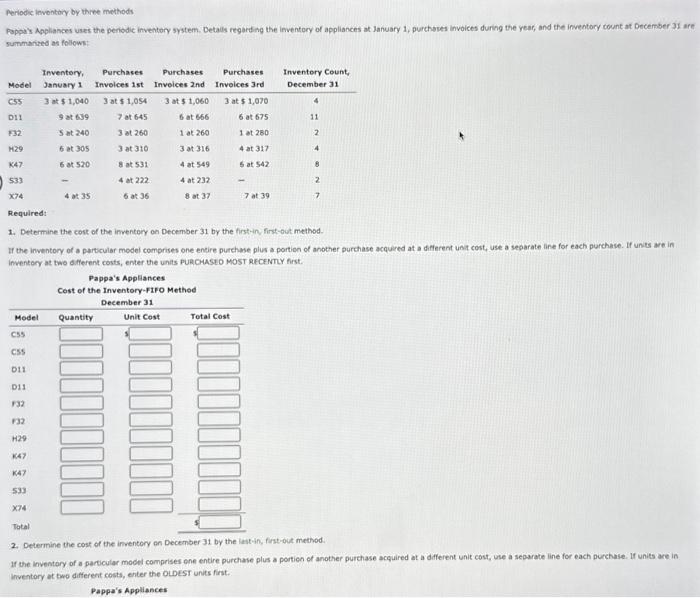

Help. Periodic inventary by three methods summarited as follows: Required: 1. Detemine the cost of the imventary on December 31 by the first-iny first-out methodinventery

Help.

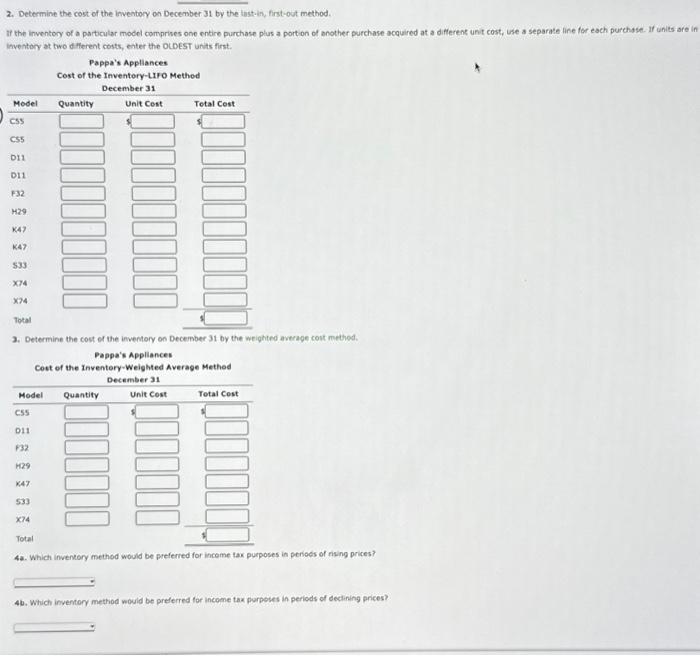

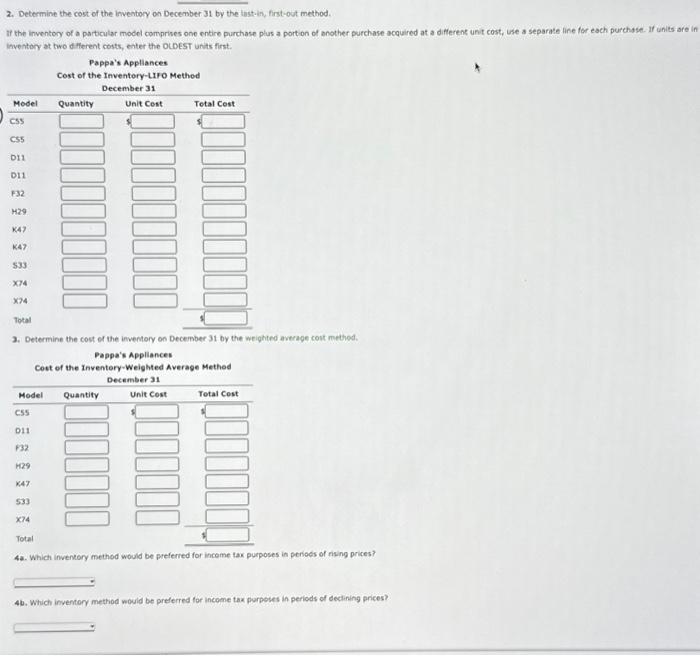

Periodic inventary by three methods summarited as follows: Required: 1. Detemine the cost of the imventary on December 31 by the first-iny first-out methodinventery at two different costs, enter the units puachasto MosT RFCENTH first. 2. Determine the cost of the inventory on December 31 by the last-in, first-out method. inventory at towo different costs, enter the OLDEST units first. Pappa's Appliances 2. Determine the cost of the inventory on December 31 by the lustin, first-out method. If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separake line for each purchsie. If units are in inventory at two different costs, enter the OCDEST units first. 3. Determine the cost of the inventory on December 3t by the weighted average cout method. Pappa's Appliances Cost of the Inventery-Weighted Average Method 42. Which inventory method would be preferred for income tax purposes in periods of rising prices? 46. Which inventory method would be preferred for income tax purposes in periods of declining prices

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started