Answered step by step

Verified Expert Solution

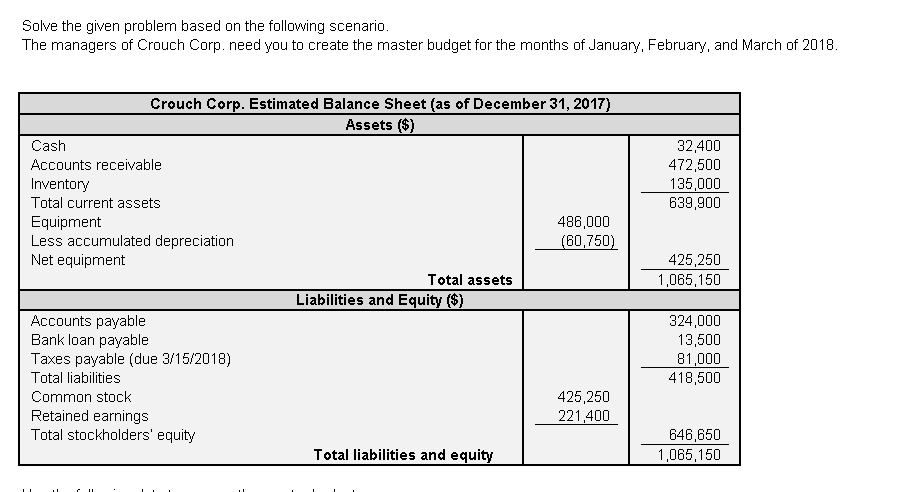

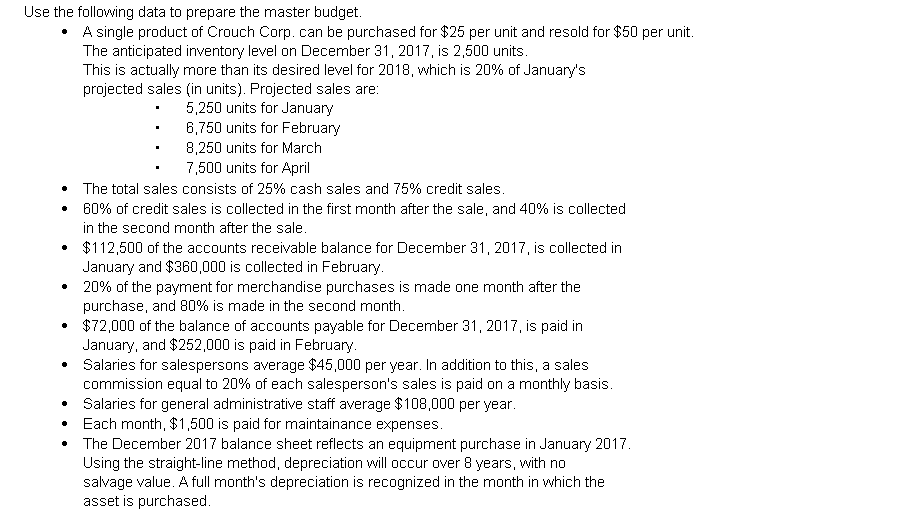

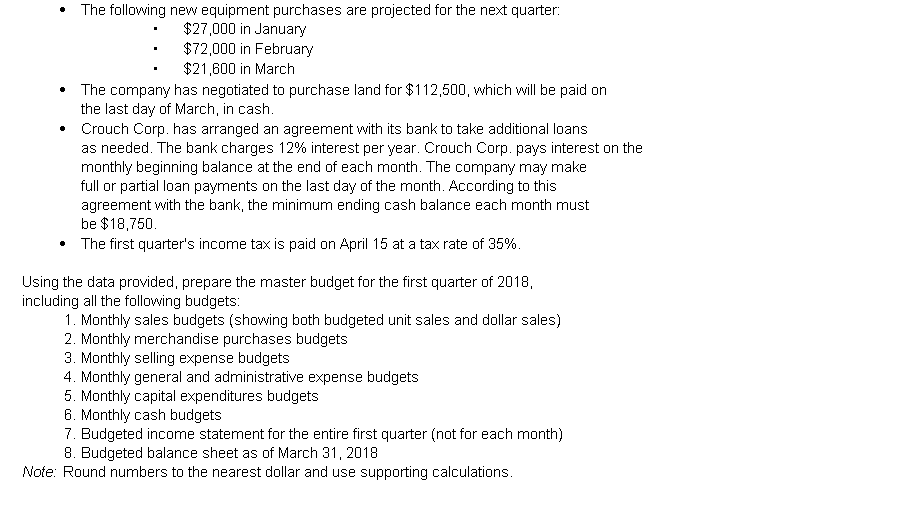

Question

1 Approved Answer

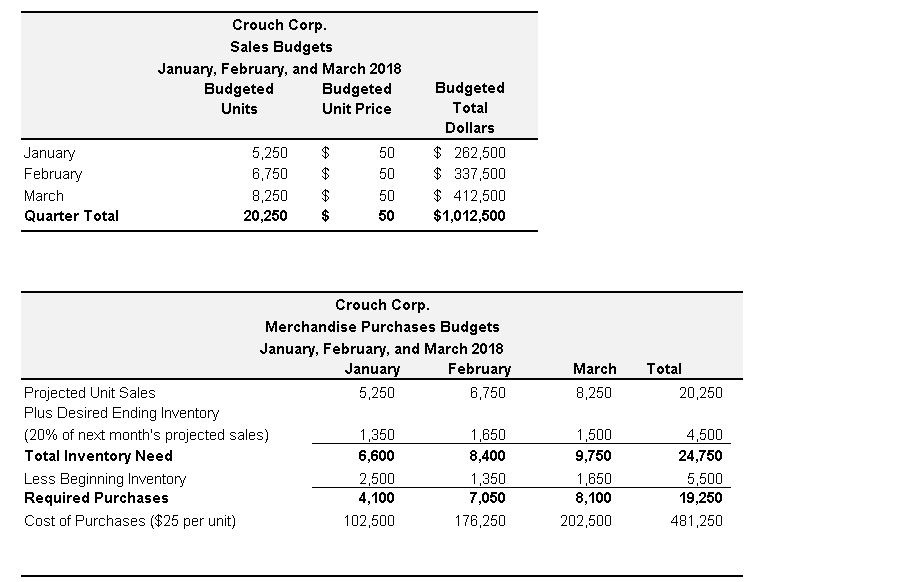

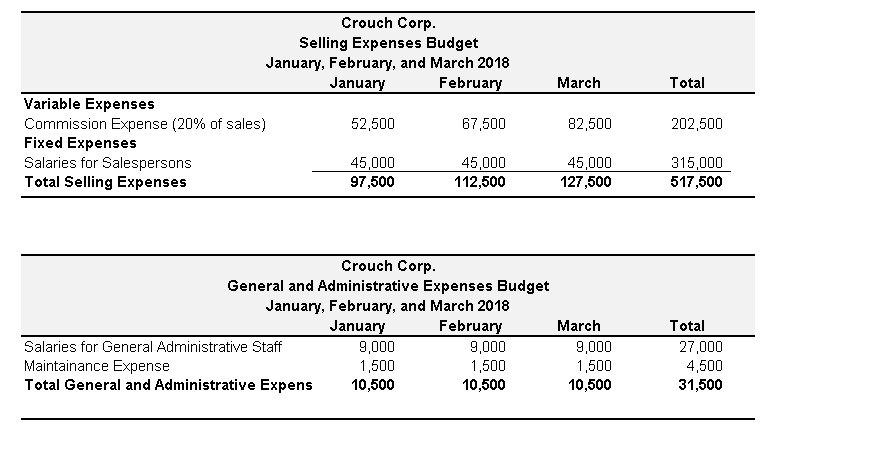

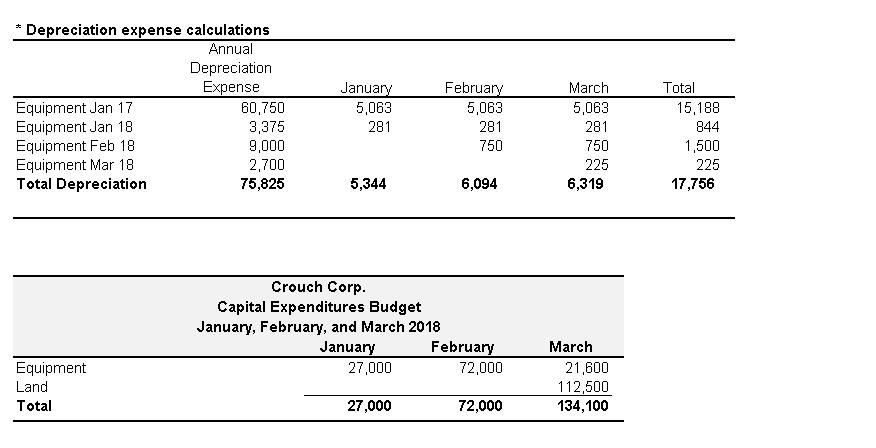

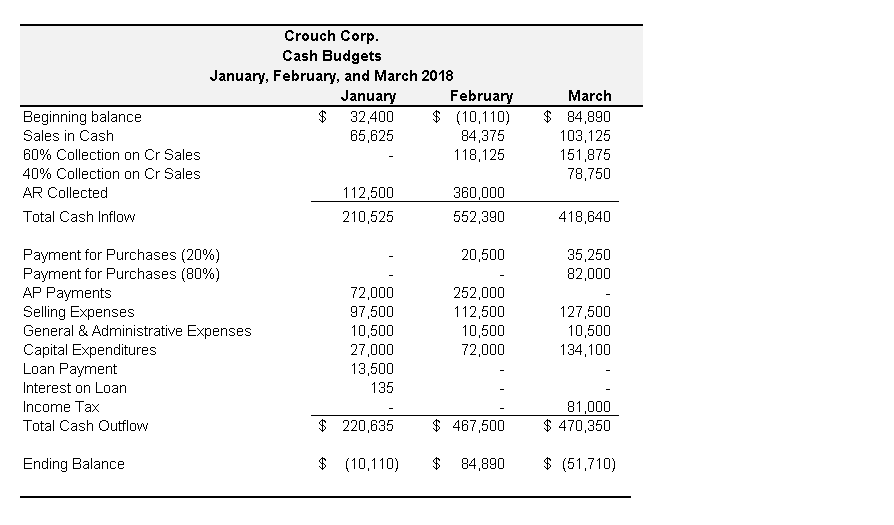

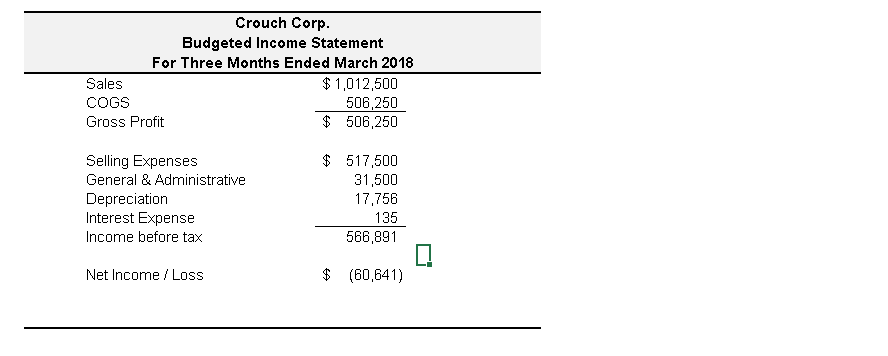

Help please ! 1. Can someone please review the work I already did? I feel like there is a mistake or two somewhere. 2. Can

Help please!

1. Can someone please review the work I already did? I feel like there is a mistake or two somewhere.

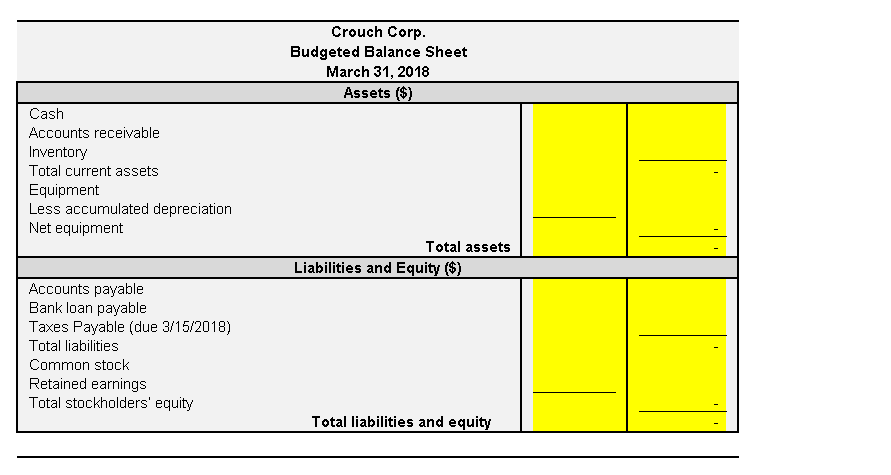

2. Can someone please help me create the budgeted balance sheet as of March 31, 2018? I really appreciate it.

Thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started