Answered step by step

Verified Expert Solution

Question

1 Approved Answer

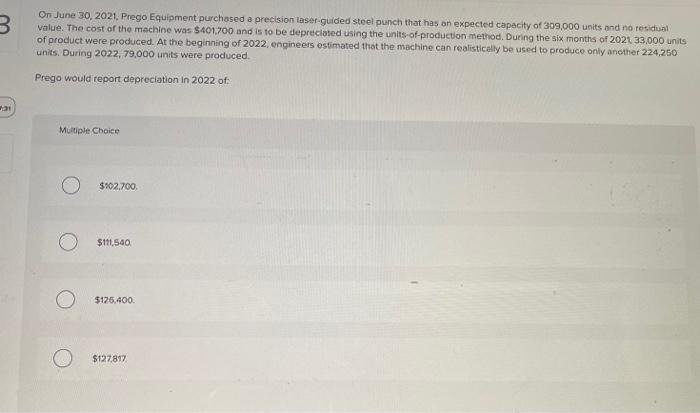

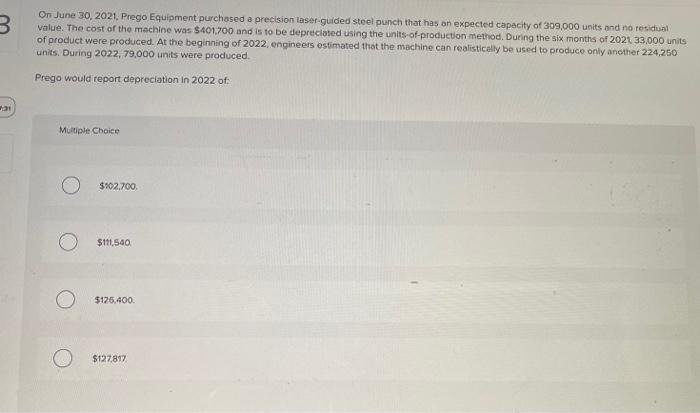

HELP PLEASE 3 On June 30, 2021. Prego Equipment purchased a precision laser-guided steel punch that has an expected capacity of 309,000 units and no

HELP PLEASE

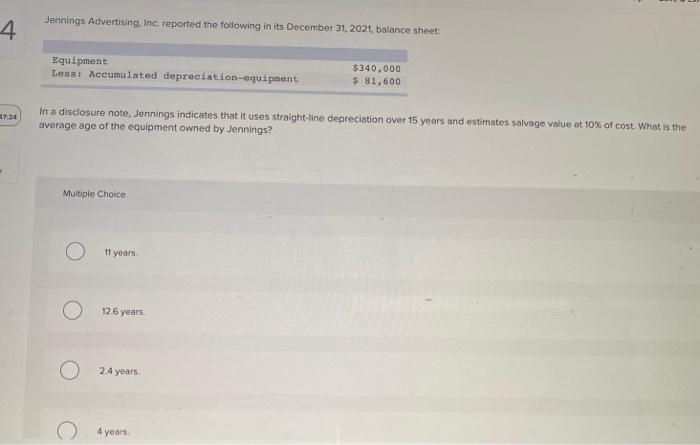

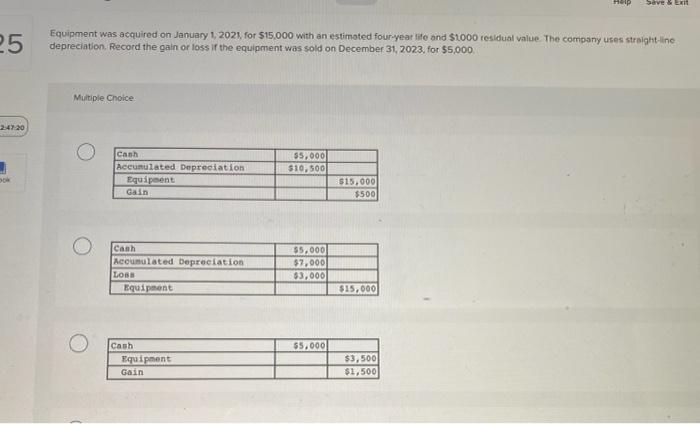

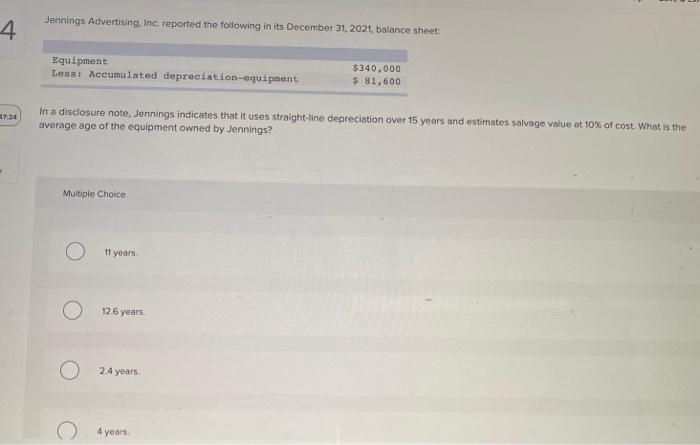

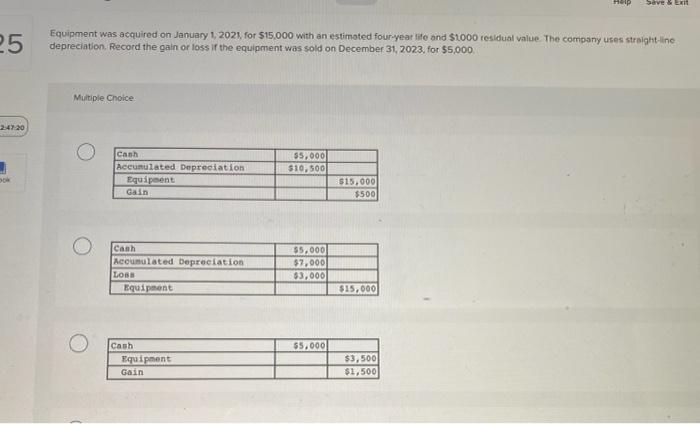

3 On June 30, 2021. Prego Equipment purchased a precision laser-guided steel punch that has an expected capacity of 309,000 units and no residual value. The cost of the machine was $401.700 and is to be depreciated using the units-of-production method. During the six months of 2021 33,000 units of product were produced. At the beginning of 2022, engineers estimated that the machine can realistically be used to produce only another 224.250 units. During 2022, 79,000 units were produced. Prego would report depreciation in 2022 of: ar Multiple Choice $102,700 $111.540 O $126,400 $127.817 Jennings Advertising, Inc. reported the following in its December 31, 2021, balance sheet: 4 Equipment Less: Accumulated depreciation equipment $340,000 $ 81,600 17:24 In a disclosure note, Jennings indicates that it uses straight-line depreciation over 15 years and estimates salvage value at 10% of cost. What is the average age of the equipment owned by Jennings? Multiple Choice 11 years 126 years 2.4 years 4 years Seve & Exit 25 Equipment was acquired on January 1, 2021 for $15,000 with an estimated four-year life and $1000 residual value The company uses straight-line depreciation Record the gain or loss if the equipment was sold on December 31, 2023, for $5,000 Multiple Choice 2:47:20 Cash Accumulated Depreciation Equipaent Gas $5,000 $10,500 $15,000 $500 Can Accumulated Depreciation Loss Equipment $5,000 $7,000 $3,000 $15,000 $5,000 Cash Equipment Gain $3,500 $1,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started