Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ramona, who is self-employed, had to travel to visit an international client in Rome during the year. She was gone 20 days (including two days

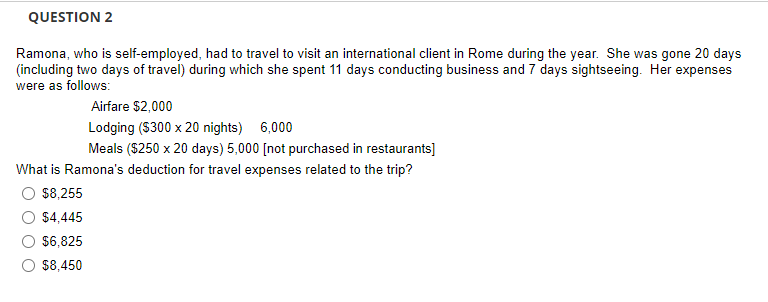

Ramona, who is self-employed, had to travel to visit an international client in Rome during the year. She was gone 20 days (including two days of travel) during which she spent 11 days conducting business and 7 days sightseeing. Her expenses were as follows: Airfare $2,000 Lodging ( $30020 nights) 6,000 Meals ( $25020 days) 5,000 [not purchased in restaurants] What is Ramona's deduction for travel expenses related to the trip? $8,255$4,445$6,825$8,450

Ramona, who is self-employed, had to travel to visit an international client in Rome during the year. She was gone 20 days (including two days of travel) during which she spent 11 days conducting business and 7 days sightseeing. Her expenses were as follows: Airfare $2,000 Lodging ( $30020 nights) 6,000 Meals ( $25020 days) 5,000 [not purchased in restaurants] What is Ramona's deduction for travel expenses related to the trip? $8,255$4,445$6,825$8,450 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started