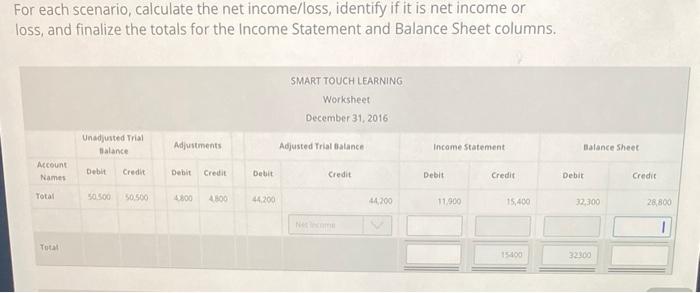

help please and explain how you recieved answerss. provide answer in form of a cart if possible

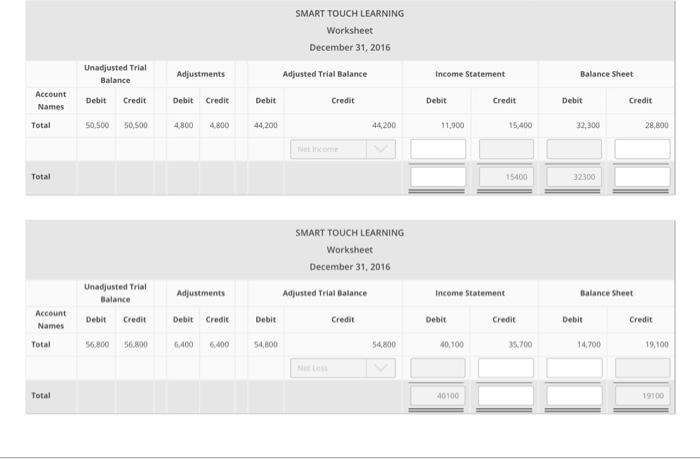

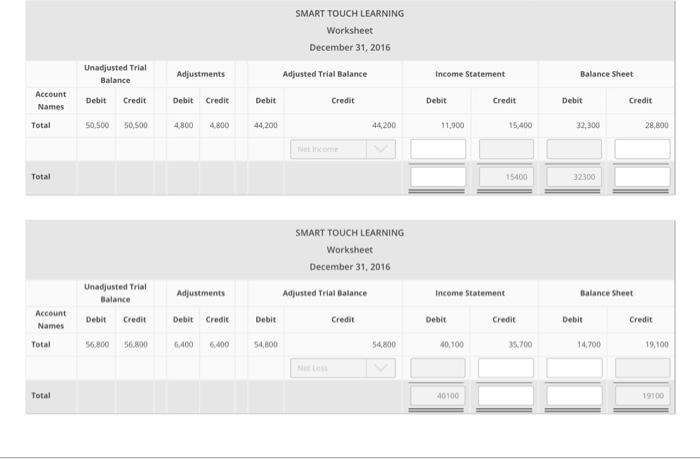

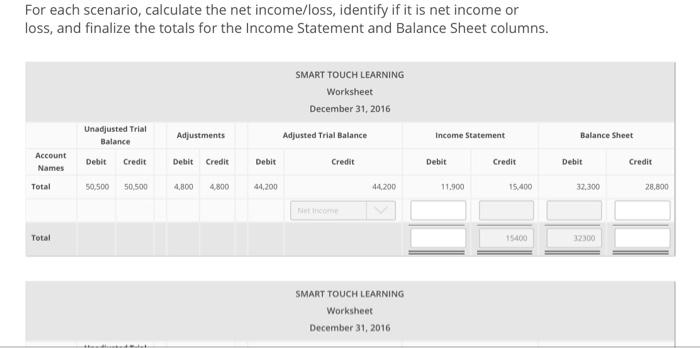

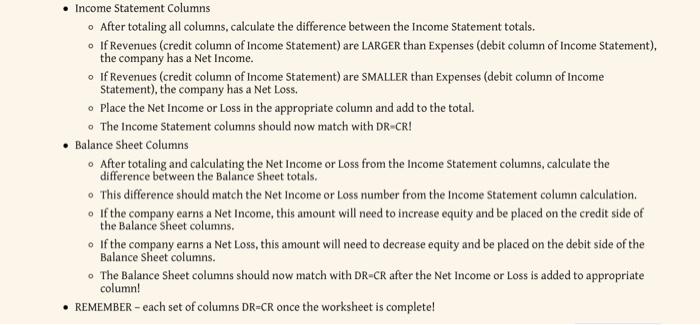

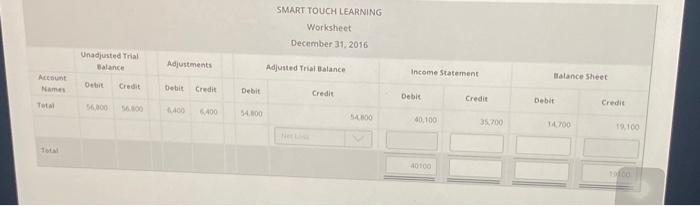

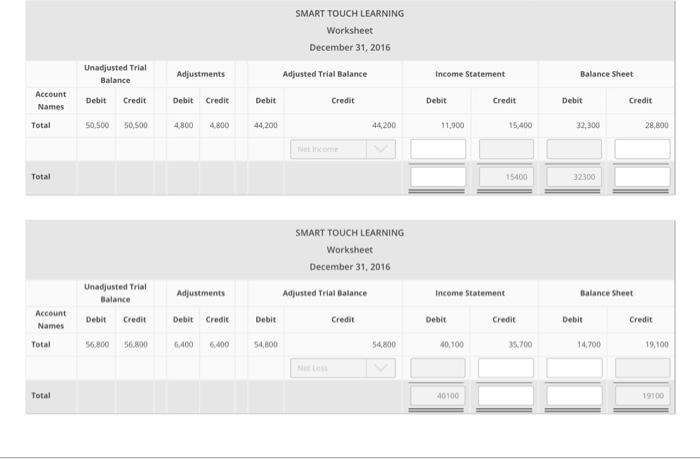

SMART TOUCH LEARNING Worksheet December 31, 2016 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Account Names Total 50.500 50.500 4.800 4.800 44,200 44.200 11.900 15.400 32,300 28.800 Total 15400 32300 SMART TOUCH LEARNING Worksheet December 31, 2016 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Names Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Total 56,800 56.300 6.400 6,400 54,800 54,800 40,100 35.700 14.700 19,100 Total 40100 19100 For each scenario, calculate the net income/loss, identify if it is net income or loss, and finalize the totals for the Income Statement and Balance Sheet columns. SMART TOUCH LEARNING Worksheet December 31, 2016 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Names Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Total 50,500 50,500 4,800 4,800 44,200 44200 11.900 15.400 32.300 28.800 Total 15400 12300 SMART TOUCH LEARNING Worksheet December 31, 2016 Income Statement Columns o After totaling all columns, calculate the difference between the Income Statement totals. If Revenues (credit column of Income Statement) are LARGER than Expenses (debit column of Income Statement), the company has a Net Income. If Revenues (credit column of Income Statement) are SMALLER than Expenses (debit column of Income Statement), the company has a Net Loss. Place the Net Income or Loss in the appropriate column and add to the total. The Income Statement columns should now match with DR-CR! Balance Sheet Columns After totaling and calculating the Net Income or Loss from the Income Statement columns, calculate the difference between the Balance Sheet totals. . This difference should match the Net Income or Loss number from the Income Statement column calculation. If the company earns a Net Income, this amount will need to increase equity and be placed on the credit side of the Balance sheet columns. If the company earns a Net Loss, this amount will need to decrease equity and be placed on the debit side of the Balance Sheet columns The Balance Sheet columns should now match with DR-CR after the Net Income or Loss is added to appropriate column! REMEMBER - each set of columns DR-CR once the worksheet is complete! For each scenario, calculate the net income/loss, identify if it is net income or loss, and finalize the totals for the Income Statement and Balance Sheet columns. SMART TOUCH LEARNING Worksheet December 31, 2016 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Names Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Total asoo SOS 5300 4100 44200 44,200 11.900 15,400 32100 28,800 1 Total SMART TOUCH LEARNING Worksheet December 31, 2016 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Nam De Credit Debit Credit Debit Credit Debic Credit Debit Total SA Credit DO 400 54.100 SAO 10.100 3.700 14700 10.100 10100 fo