Answered step by step

Verified Expert Solution

Question

1 Approved Answer

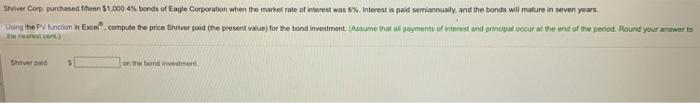

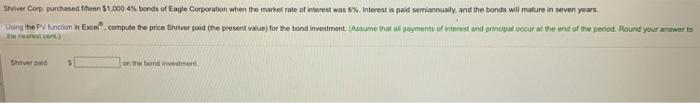

Help!!! Please and thanks! SI Comp purchased than $1.0004% bonds of Eagle Corporation when the market rate of interest was 6% Interest is paid semiannunity,

Help!!! Please and thanks!

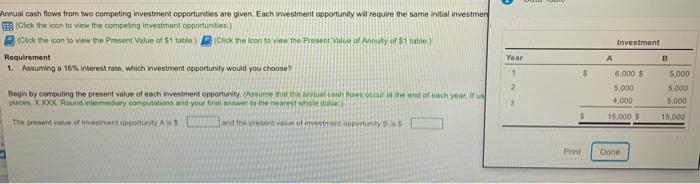

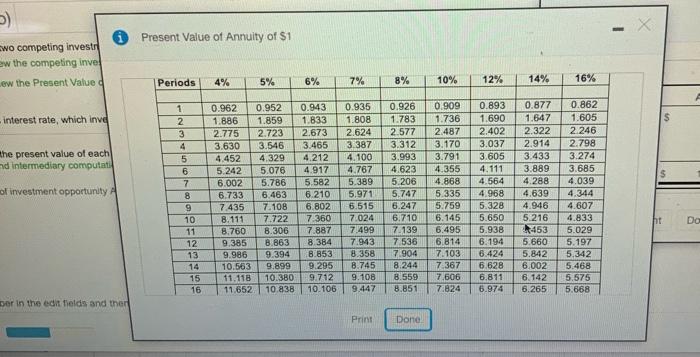

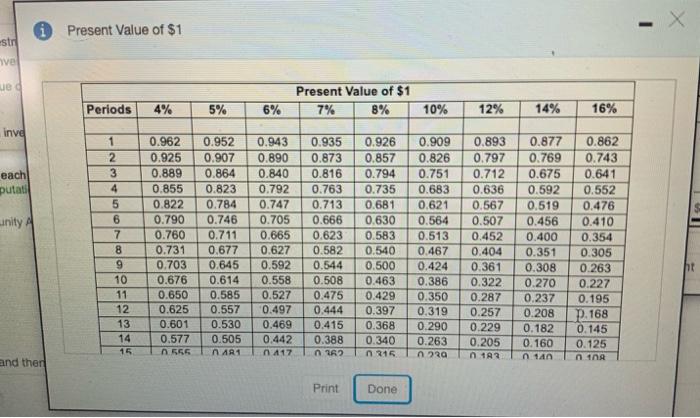

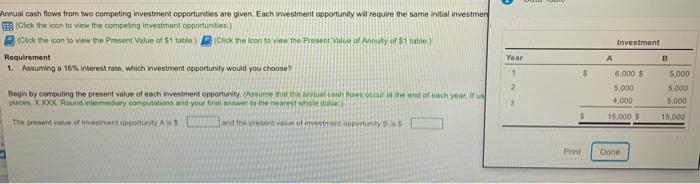

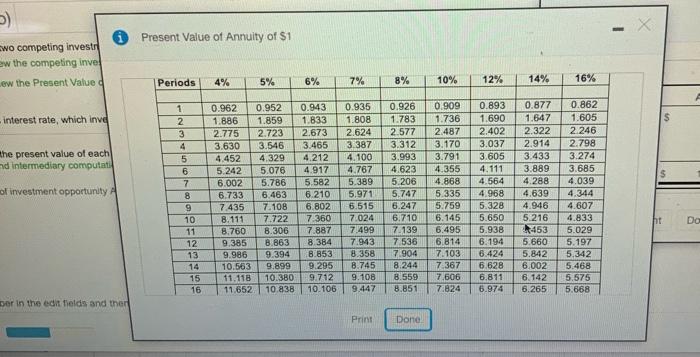

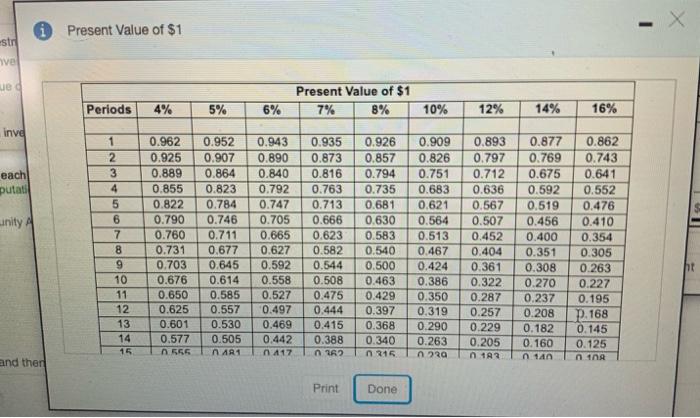

SI Comp purchased than $1.0004% bonds of Eagle Corporation when the market rate of interest was 6% Interest is paid semiannunity, and the bonds will mature in seven years. Using the function in Excel" compute the price Shriver paid che present value) for the bond investment. Assume that of payments of interest and principal occur at we end of the period. Round your answer to Shpad on the bonne Annual cash flows from two competing investment opportunities are given. Each investment opportunity will require the same initial investmen Click the icon to view the competing investment opportunities Click the icon to view the Present Value of S1 table click the loan to view the Present Value of Annuity of $1 table) Requirement 1. Asuming a 16% interest rate, which investment opportunity would you choose? Investment Year A B 5 2 6,000 5 5.000 4.000 5,000 5.000 5.000 15.000 1 Tegin by computing the present value of each investment opportunity that the record of ach year i acus. X.XXX Round indiary computation and your finalwer to the nearest whow di The value of investment opportunity thereof invoimet porton ONS 5 15.000 5 Print Done Present Value of Annuity of $1 wo competing investr ew the competing inve Periods 4% 5% 6% ew the Present Value 7% 8% 10% 12% 14% 16% interest rate, which inve S the present value of each nd intermediary computati 1 2 3 4 5 6 7 8 9 10 of investment opportunity 0.962 0.952 1.886 1.859 2.775 2.723 3.630 3.546 4.452 4.329 5.242 5.076 6.002 5.786 6.733 6.463 7.435 7.108 8.111 7.722 8.76 8.306 9.385 8.863 9.986 9.394 10.563 9.899 11.118 10.380 11.652 10.838 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 9.447 Ellen 11 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7536 7.904 8.244 8.559 8.851 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7367 7.506 7.824 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 453 5.660 5.842 6.002 6.142 6.265 0.862 1.605 2 246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5.575 5.668 ht DO 12 13 14 15 16 + per in the edit fields and then Print Done i Present Value of $1 Str ve ue Present Value of $1 7% 8% Periods 4% 5% 6% 10% 12% 14% 16% invd each putati unity 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 n. 556 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 AR1 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0417 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 22 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 215 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 239 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 1A 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 14 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 ht P.168 0.145 0.125 nina and then Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started