Answered step by step

Verified Expert Solution

Question

1 Approved Answer

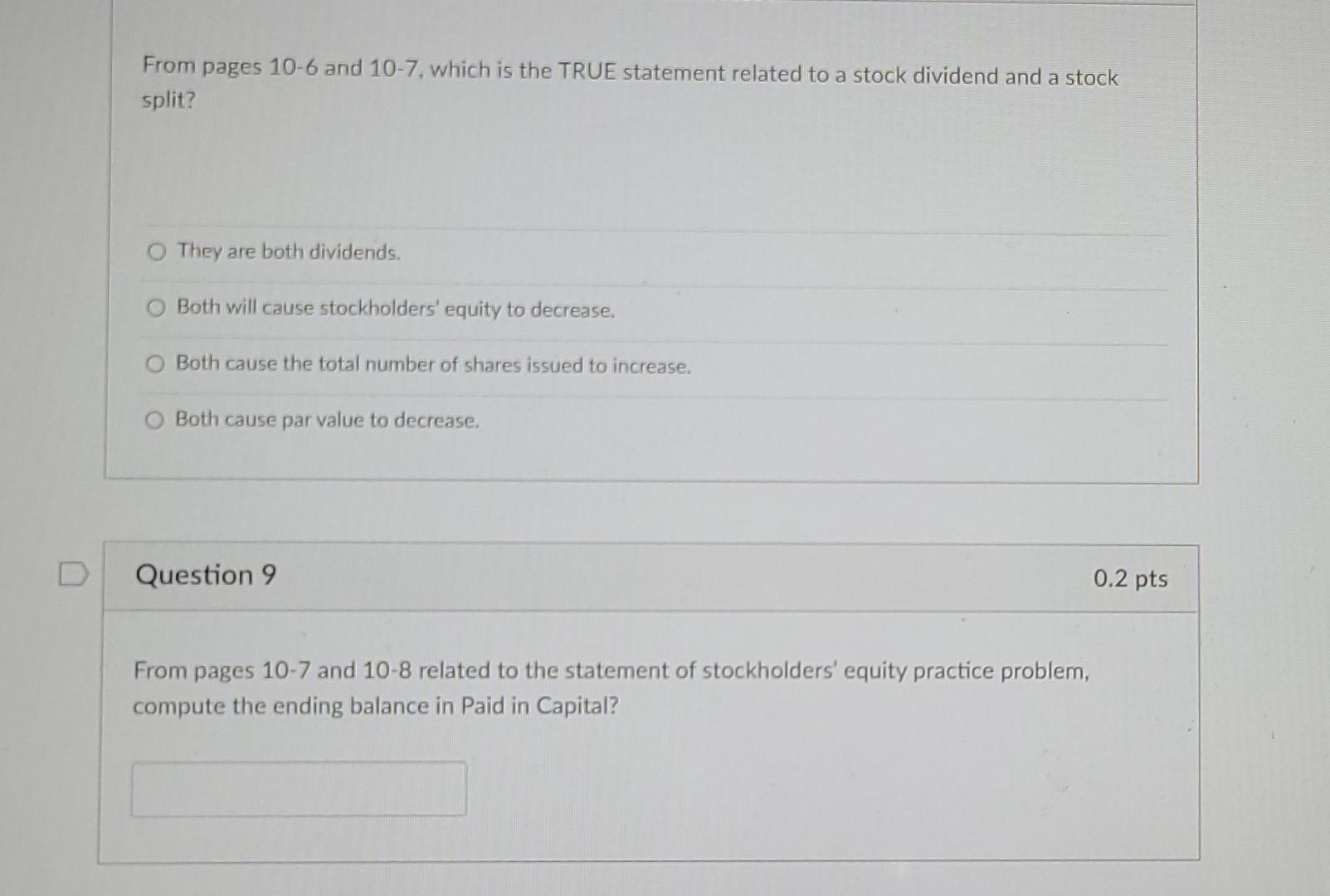

help please answer all of them From pages 10-6 and 10-7. which is the TRUE statement related to a stock dividend and a stock split?

help please answer all of them

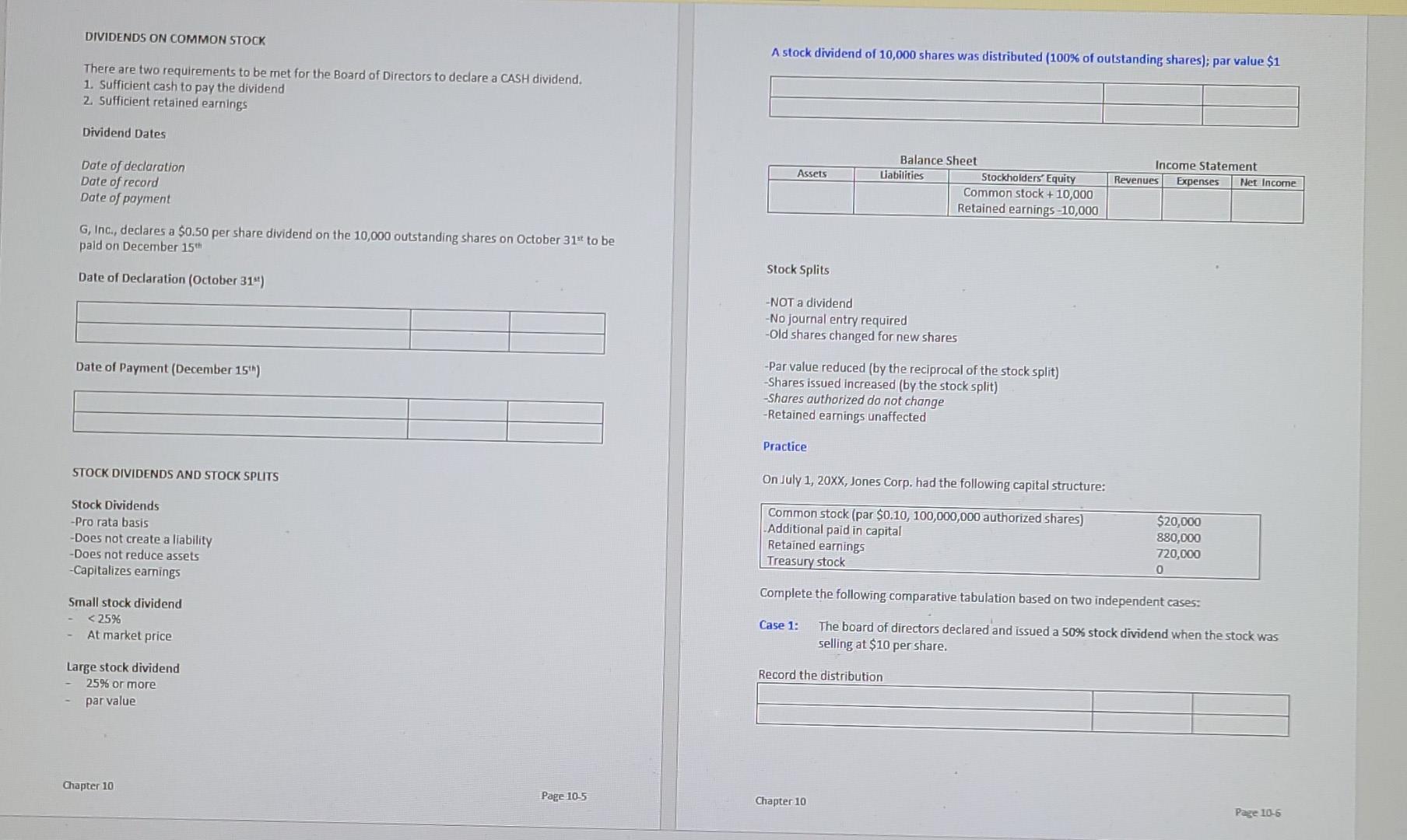

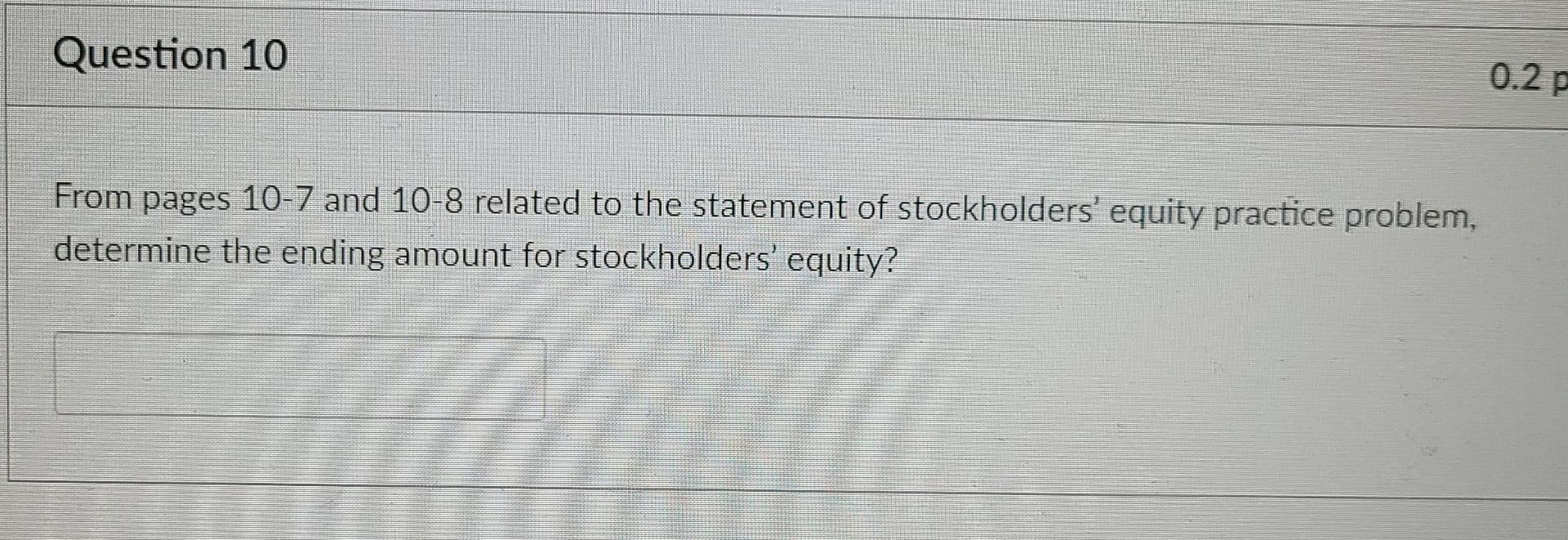

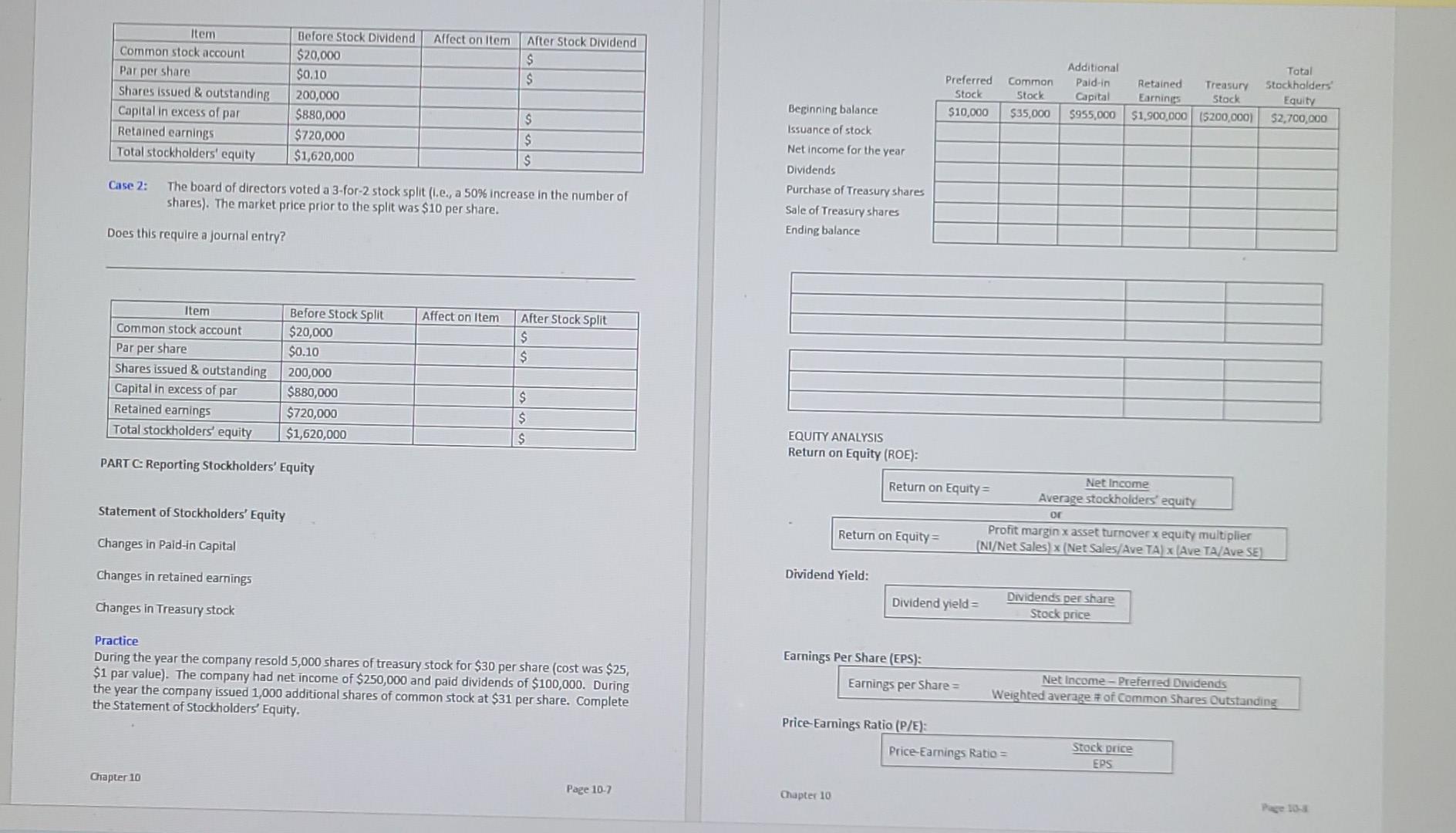

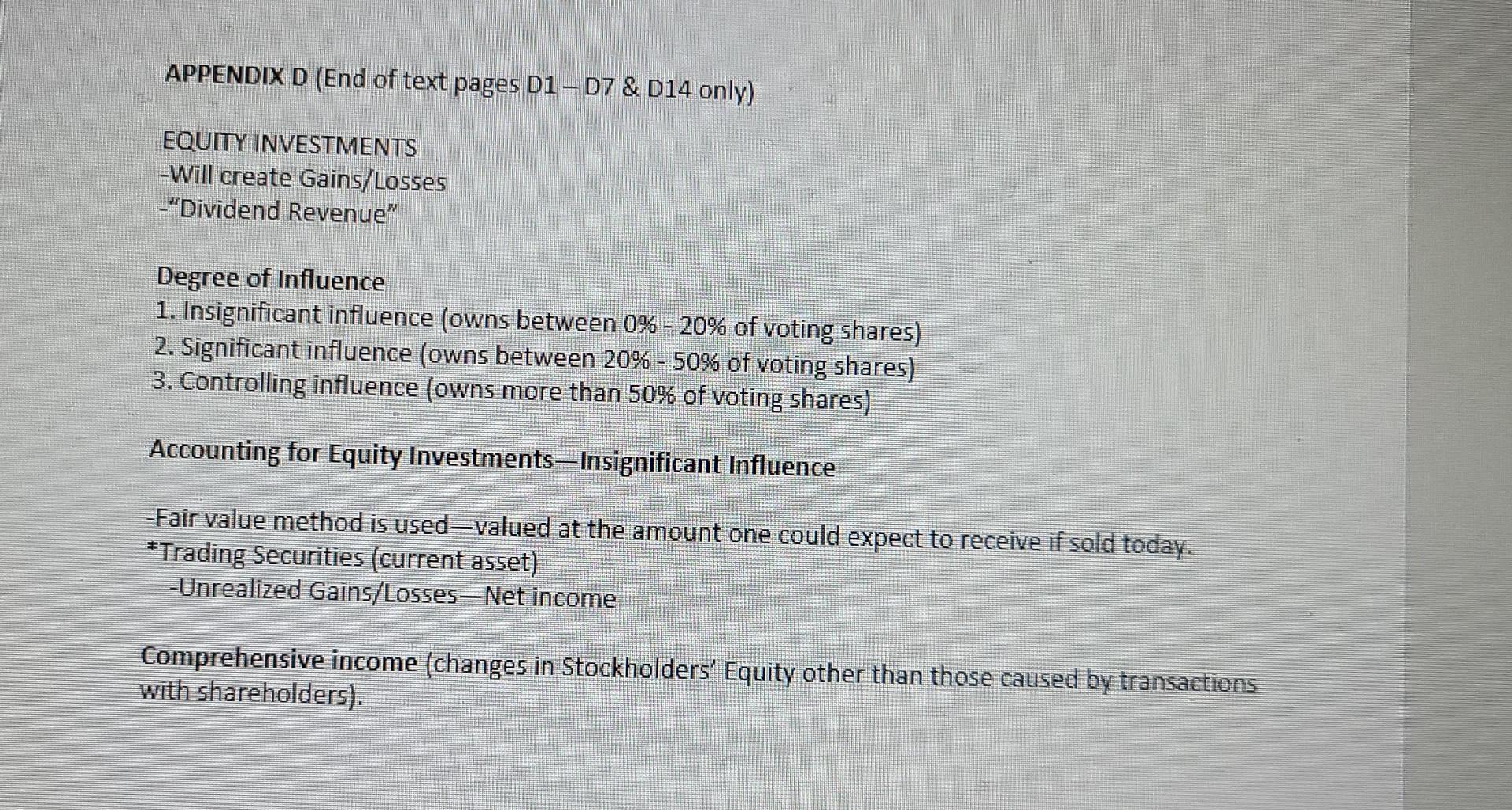

From pages 10-6 and 10-7. which is the TRUE statement related to a stock dividend and a stock split? They are both dividends. Both will cause stockholders' equity to decrease. O Both cause the total number of shares issued to increase. Both cause par value to decrease. Question 9 0.2 pts From pages 10-7 and 10-8 related to the statement of stockholders' equity practice problem, compute the ending balance in Paid in Capital? DIVIDENDS ON COMMON STOCK A stock dividend of 10,000 shares was distributed (100% of outstanding shares); par value $1 There are two requirements to be met for the Board of Directors to declare a CASH dividend. 1. Sufficient cash to pay the dividend 2. Sufficient retained earnings Dividend Dates Assets Date of declaration Date of record Date of payment Balance Sheet Liabilities Stockholders' Equity Common stock +10,000 Retained earnings -10,000 Income Statement Revenues Expenses Net Income G, Inc., declares a $0.50 per share dividend on the 10,000 outstanding shares on October 31 to be pald on December 15th Stock Splits Date of Declaration (October 31") -NOT a dividend -No journal entry required -Old shares changed for new shares Date of Payment (December 15th) -Par value reduced (by the reciprocal of the stock split) -Shares issued increased (by the stock split) -Shares authorized do not change - Retained earnings unaffected Practice STOCK DIVIDENDS AND STOCK SPLITS On July 1, 20XX, Jones Corp. had the following capital structure: Stock Dividends -Pro rata basis -Does not create a liability -Does not reduce assets -Capitalizes earnings Common stock (par $0.10, 100,000,000 authorized shares) Additional paid in capital Retained earnings Treasury stock $20,000 880,000 720,000 0 Complete the following comparative tabulation based on two independent cases: Small stock dividendStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started