Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please!! As of December 31, Marr, Inc., has accrued benefits to its employees for medical insurance (in the amount of $12,000 ) and a

help please!!

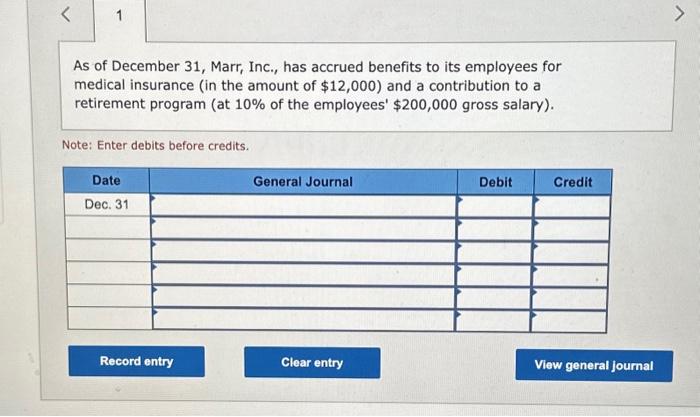

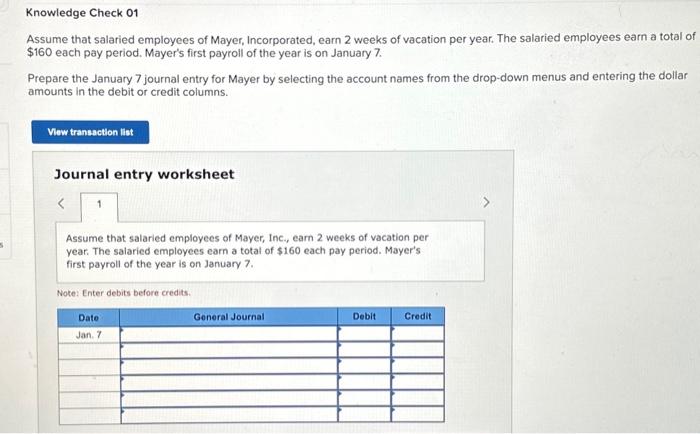

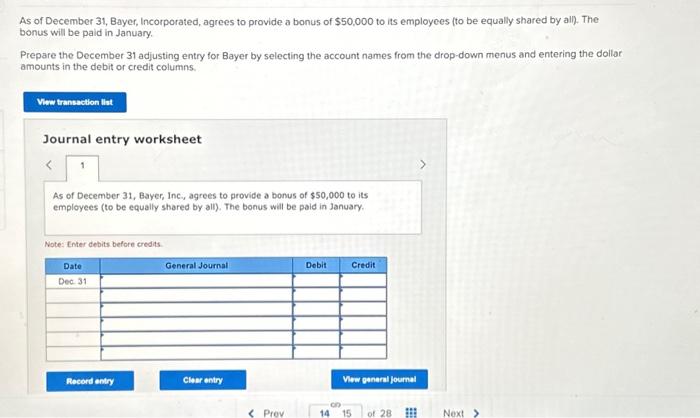

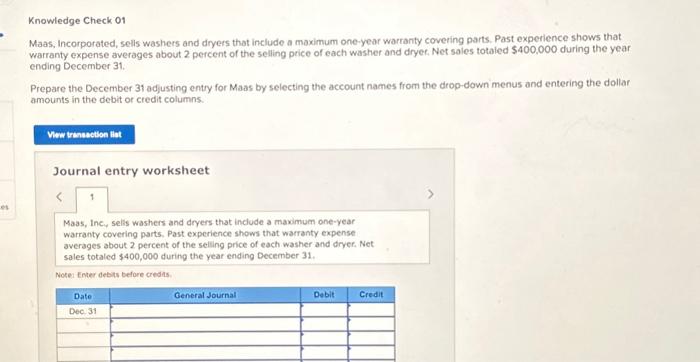

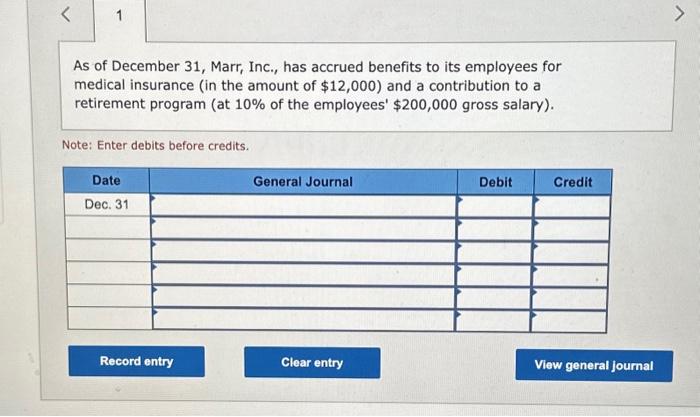

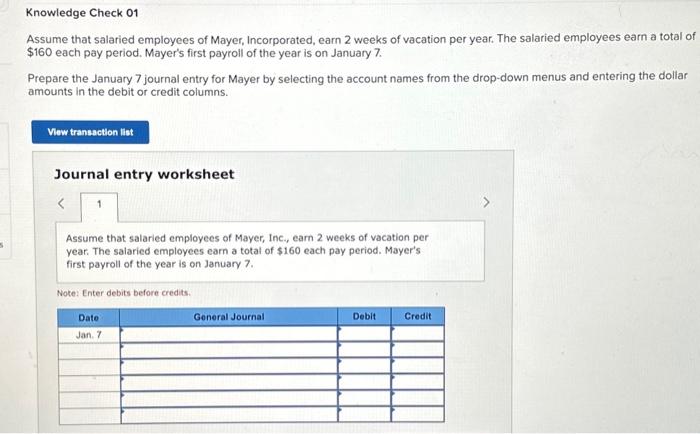

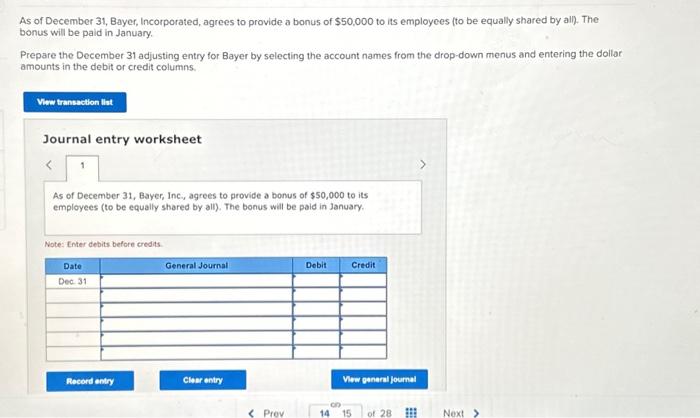

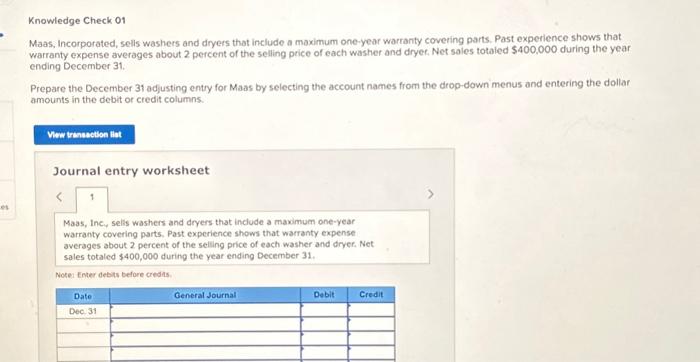

As of December 31, Marr, Inc., has accrued benefits to its employees for medical insurance (in the amount of $12,000 ) and a contribution to a retirement program (at 10% of the employees' $200,000 gross salary). Note: Enter debits before credits. Knowledge Check 01 Assume that salaried employees of Mayer, Incorporated, earn 2 weeks of vacation per year. The salaried employees earn a total of $160 each pay period. Mayer's first payroll of the year is on January 7. Prepare the January 7 journal entry for Mayer by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns. Journal entry worksheet Assume that salaried employees of Mayer, Inc., earn 2 weeks of vacation per year. The salaried employees earn a total of $160 each pay period. Mayer's first payroll of the year is on January 7. Note: Enter debits before credits. As of December 31, Bayer, Incorporated, agrees to provide a bonus of $50,000 to its employees (to be equally shared by all). The bonus will be paid in January. Prepare the December 31 adjusting entry for Bayer by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns. Journal entry worksheet As of December 31, Bayer, Inc, agrees to provide a bonus of $50,000 to its employees (to be equally shared by ali). The bonus will be paid in January. Note: Enter debits before credis Knowledge Check 01 Maas, Incorporated, sells washers and dryers that include a moximum one-year warranty covering parts. Past experience shows that warranty expense averages about 2 percent of the selling price of each washer and dryer. Net sales totaled $400,000 during the year ending December 31 . Prepare the December 31 adjusting entry for Maas by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns. Journal entry worksheet Maas, Inc., selis washers and dryers that include a maximum one-year warranty covering parts, Past experience shows that warranty expense averages about 2 percent of the selling price of each washer and dryer. Net sales totaled \$400,000 during the year ending December 31. Noke: Enter debits before credas

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started