Answered step by step

Verified Expert Solution

Question

1 Approved Answer

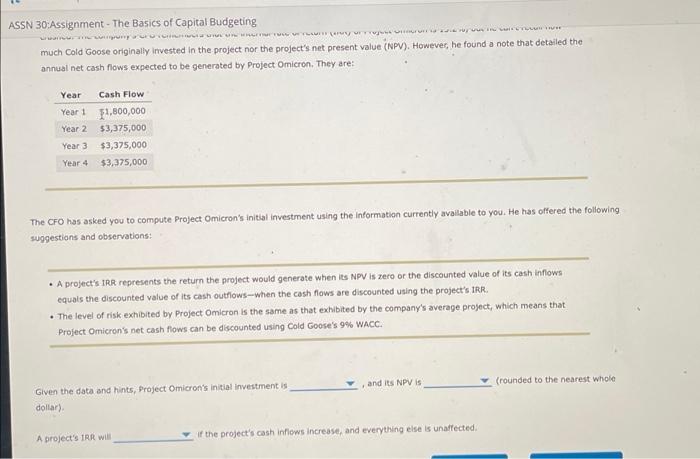

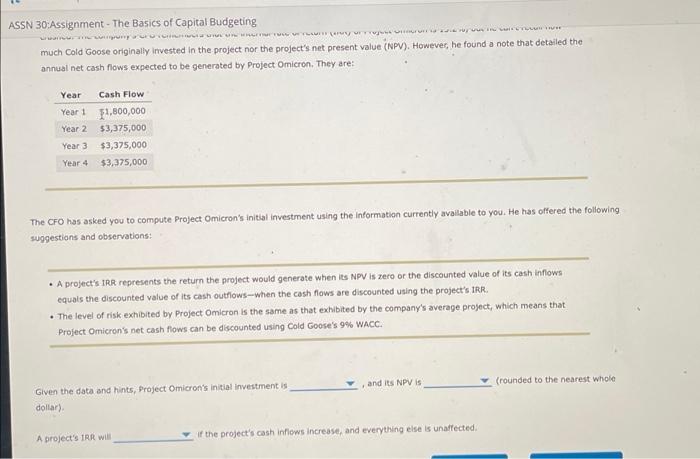

help please ASSN 30: Assignment - The Basics of Capital Budgeting wwwwwwwwwww much Cold Goose originally invested in the project nor the project's net present

help please

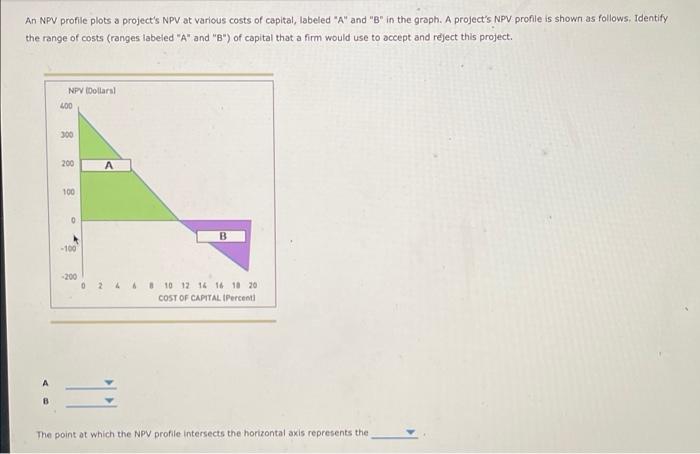

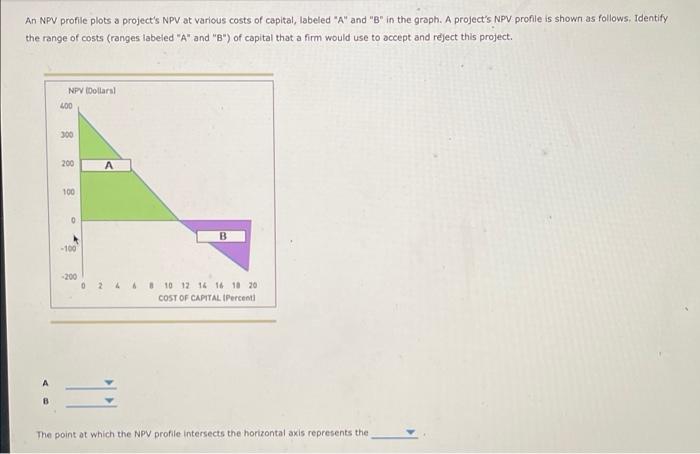

ASSN 30: Assignment - The Basics of Capital Budgeting wwwwwwwwwww much Cold Goose originally invested in the project nor the project's net present value (NPV). However, he found a note that detailed the annual net cash flows expected to be generated by Project Omicron. They are: Year Cash Flow Year 1 51,800,000 Year 2 53,375,000 Year 3 $3,375,000 Year 4 $3,375,000 The CFO has asked you to compute Project Omicron's initial investment using the information currently available to you. He has offered the following suggestions and observations: A project's IRR represents the return the project would generate when its NPV is zero or the discounted value of its cash inflows equals the discounted value of its cash outflows-when the cash flows are discounted using the project's IRR. The level of risk exhibited by Project Omicron is the same as that exhibited by the company's average project, which means that Project Omicron's net cash flows can be discounted using Cold Goose's 9% WACC. and its NPV is (rounded to the nearest whole Given the data and hints, Project Omicron's initial investment is dollar) A project's IRR will of the project's cash inflows increase, and everything else is unaffected An NPV profile plots a project's NPV at various costs of capital, labeled "A" and "B" in the graph. A project's NPV profile is shown as follows. Identify the range of costs (ranges labeled "A" and "B") of capital that a firm would use to accept and reject this project. NPV Dollars 400 300 200 A 100 0 B -100 200 0 24 6 10 12 14 16 18 20 COST OF CAPITAL (Percent The point at which the NPV profile intersects the horizontal axis represents the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started