Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help please? Beto Company pays $6.70 per unit to buy a part for one of the products it manufactures. With excess capacity, the company is

Help please?

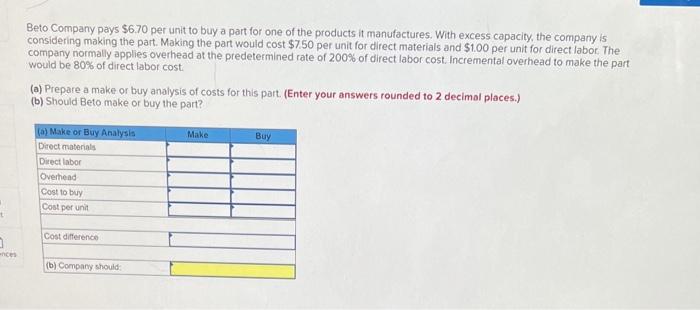

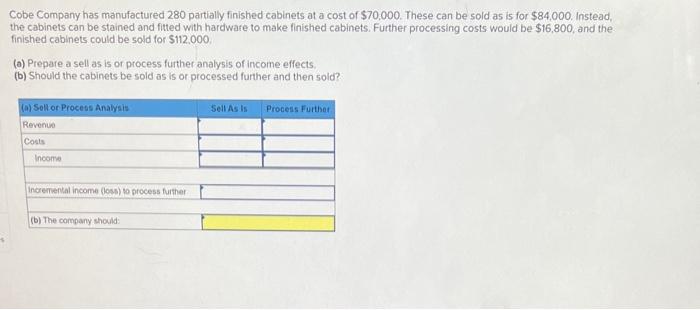

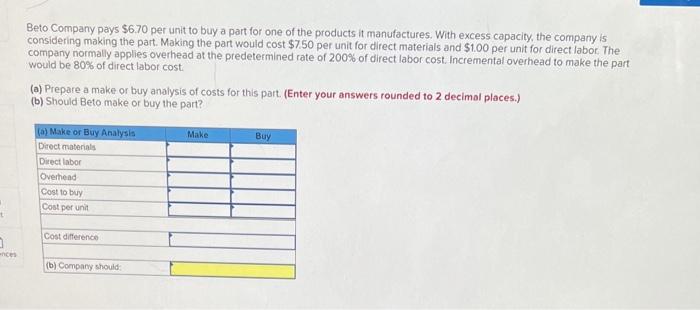

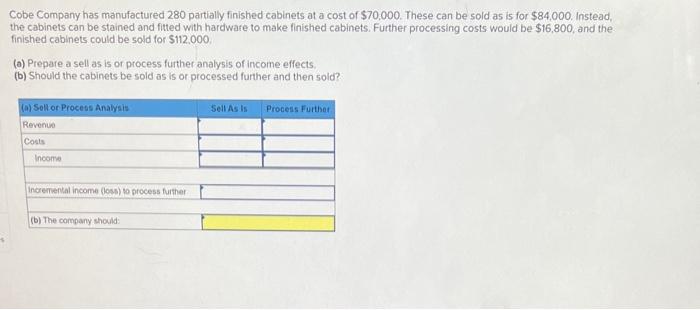

Beto Company pays $6.70 per unit to buy a part for one of the products it manufactures. With excess capacity, the company is considering making the part. Making the part would cost $7.50 per unit for direct materials and $1.00 per unit for direct labor. The company normally applies overhead at the predetermined rate of 200% of direct labor cost. Incremental overhead to make the part would be 80% of direct labor cost (a) Prepare a make or buy analysis of costs for this part. (Enter your answers rounded to 2 decimal places.) (b) Should Beto make or buy the part? Cobe Company has manufactured 280 partially finished cabinets at a cost of $70,000. These can be sold as is for $84.000. Instead, the cabinets can be stained and fitted with hardware to make finished cabinets. Further processing costs would be $16,800, and the finished cabinets could be sold for $112.000, (a) Prepare a sell as is or process further analysis of income effects. (b) Should the cabinets be sold as is or processed further and then sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started