Answered step by step

Verified Expert Solution

Question

1 Approved Answer

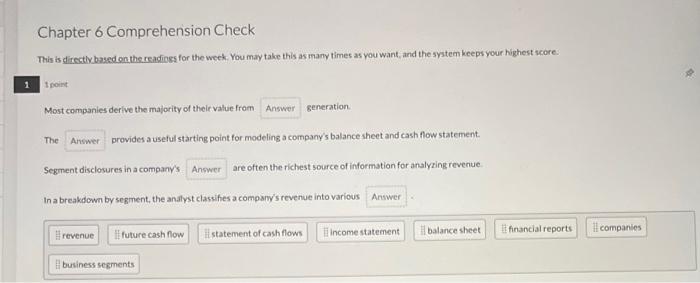

help please Chapter 6 Comprehension Check This is directivbased on the readines for the week. You may take this as many times as you want,

help please

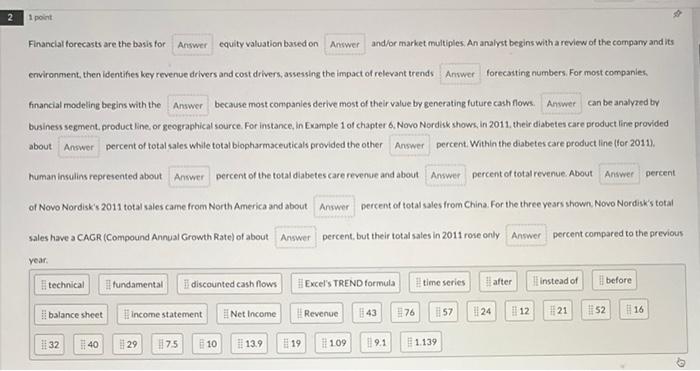

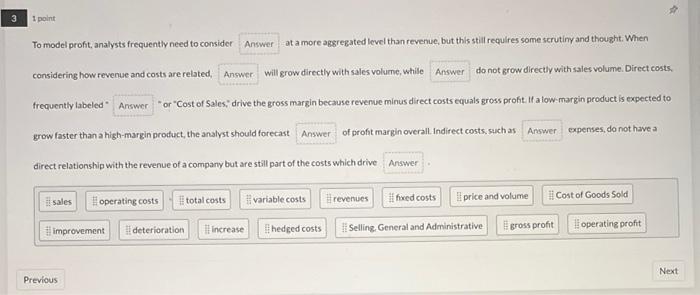

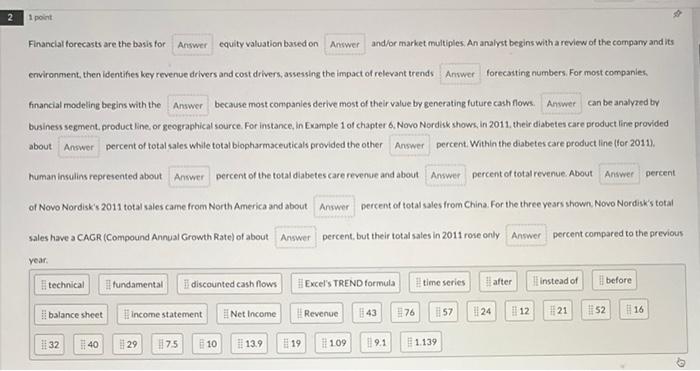

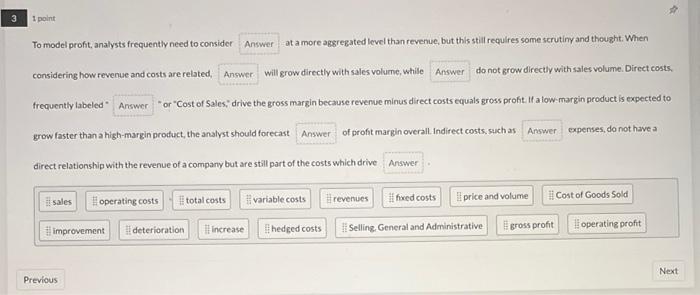

Chapter 6 Comprehension Check This is directivbased on the readines for the week. You may take this as many times as you want, and the system keeps your highest score. Financlal forecasts are the basis for equity valuation baied on and/or market multiples. An analyst begins with a review of the company and its ervironment, then identifies key revenue drivers and cost drivers, assessing the impact of relevant trends forecatting numbers, For most companies financial modeling begins with the because most companies derive most of their value by generating future cash flows. business segment, product line, or geographical source. For instance, in Example 1 of chapter 6, Novo Nordisk shows. in 2011 . their diabetes care product line provided about percent of total sales while total biopharmaceuticals provided the other percent. Within the diabetes care product line (for 2011 . human insulins reperented about _ percent of the total diabetes care revenase and about percent of total revenue. About of Novo Nordisk's 2011 total sales came from North America and about percent of total sales from China. For the three years shown. Novo Nordisk's total sales have a CAGR (Compound Annual Growth Rate) of about _percent compared to the previous year, To model profit, analysts frequently need to consider at a more aggregated level than revenue, but this still requilres some scrutiny and thousht. When considering how revenue and costs are related, will growdirectly with sales volume, while do not grow directly with sales volume. Direct costs. frequenthy labeled * "or "Cost of Sales," drive the gross margin because revenue minus direct costs equals gross proht. If a low: margin product is expected to grow faster than a high-margin product, the analyst should forecast of profit margin overall. indirect costs. such as copenses, do not have a direct relationship with the revenue of a company but are still part of the costs which drive

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started