help please

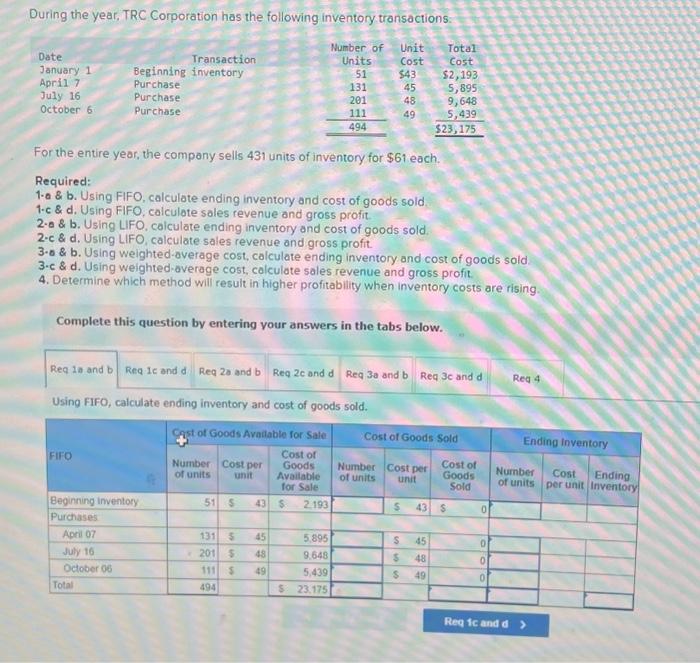

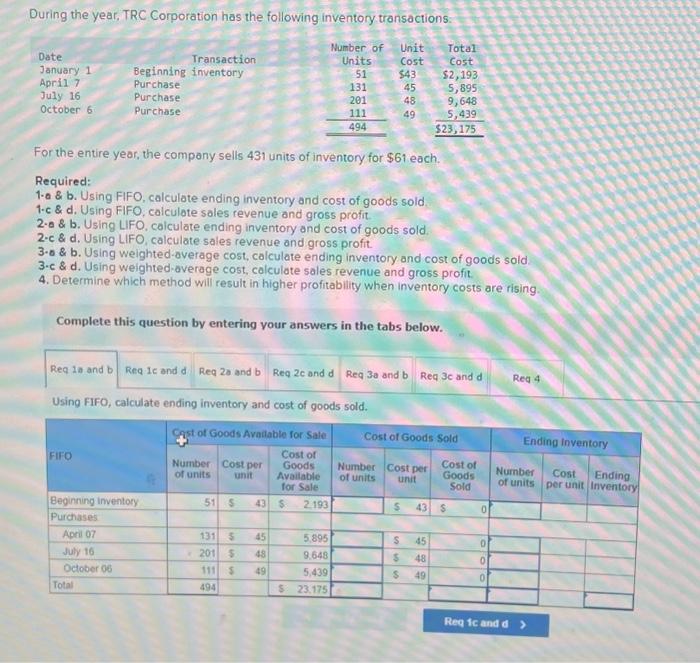

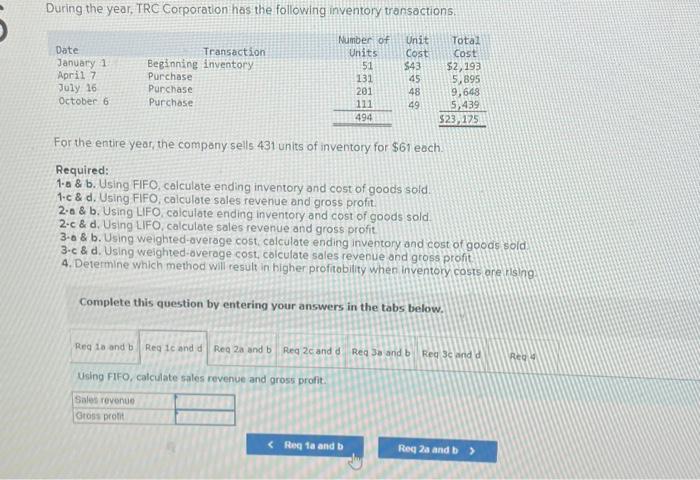

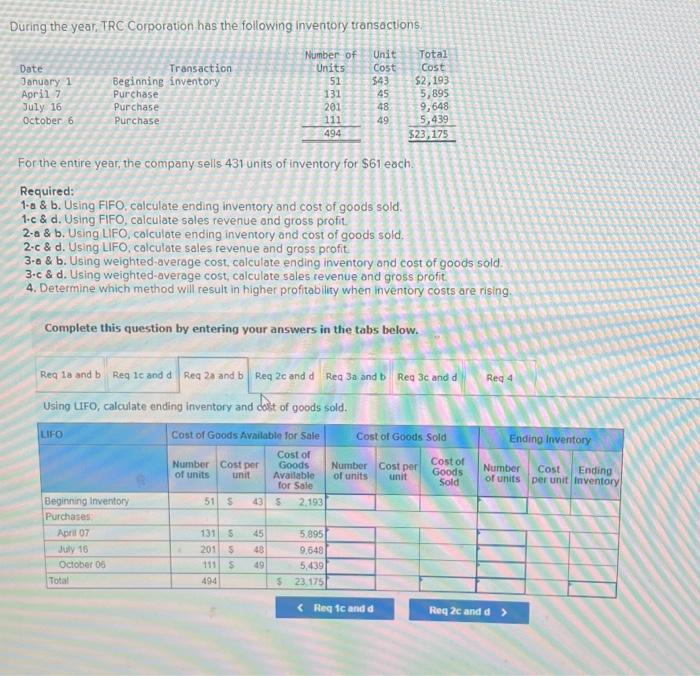

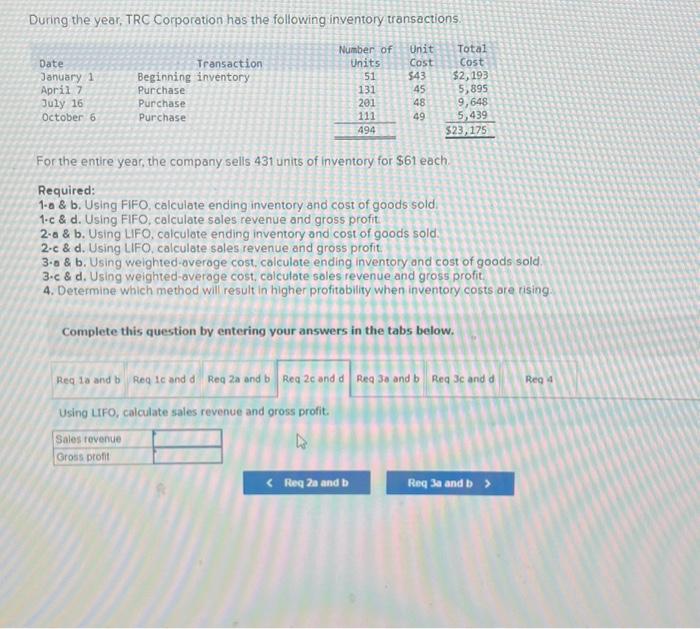

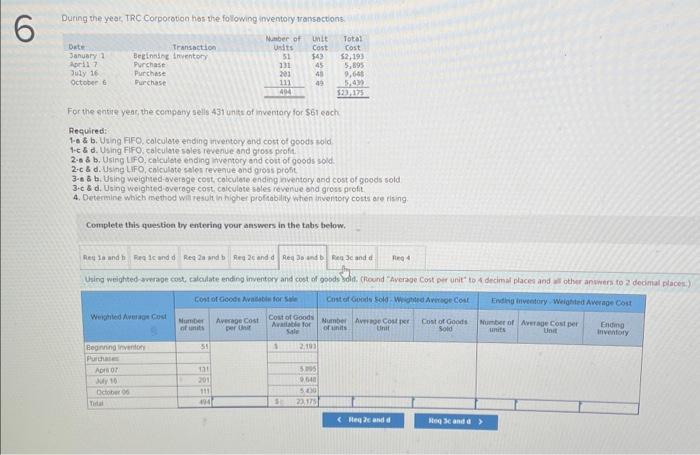

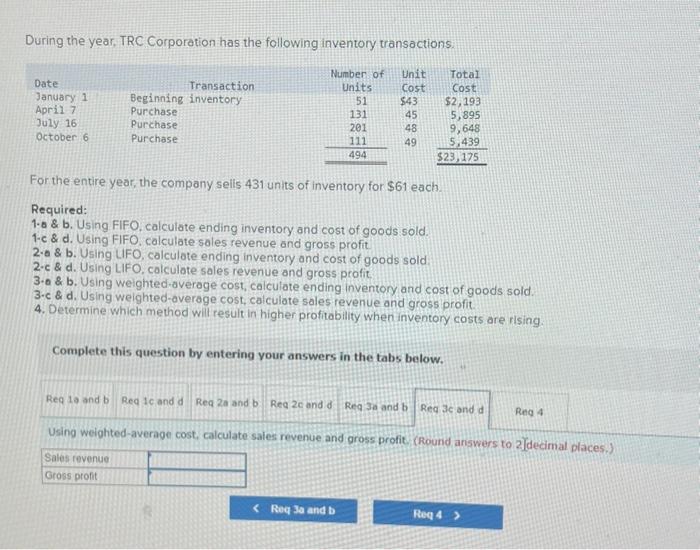

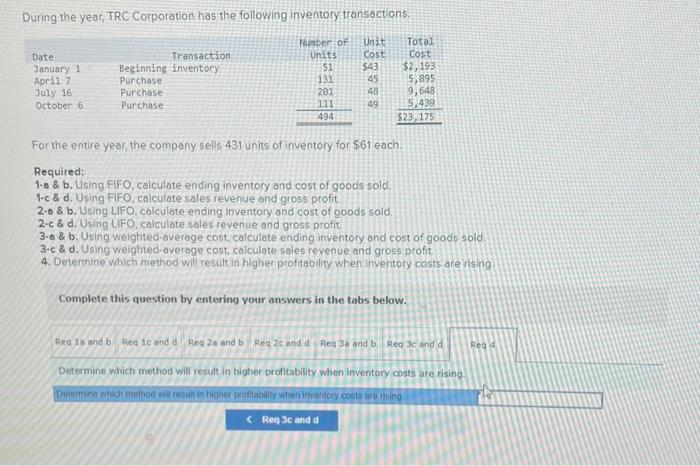

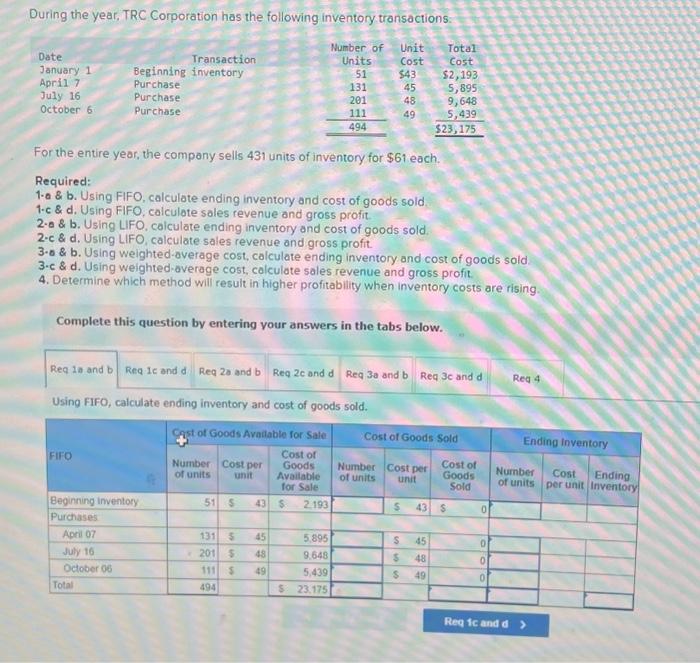

During the year, TRC Corporation has the following inventory transactions. For the entire year, the company sells 431 units of inventory for $61 each. Required: 1ab. Using FIFO, calculate ending inventory and cost of goods sold. 1.c&d. Using FIFO, caiculate sales revenue and gross profit. 2.a \& b. Using LIFO, colculate ending inventory and cost of goods sold 2.c \& d. Using LIFO, calculate sales revenue and gross profit. 3-a \& b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c \& d. Using weighted-average cost, coiculate sales revenue and gross profit 4. Determine which method will result in higher profitobility when inventory cosis ore ils 19 Complete this question by entering your answers in the tabs below. Using FIFO, calculate sales revenue and gross profit. During the year, TRC Corporation has the following inventory transactions For the entire year, the company sells 431 units of inventory for $61 each. Required: 1.a \& b. Using FIFO, calculate ending inventory and cost of goods sold 1.c \& d. Using FIFO, calculate sales revenue and gross profit. 2.a \& b. Using LIFO, calculate ending inventory and cost of goods sold. 2.c \& d. Using LIFO, calculate sales revenue and gross profit. 3-a \& b. Using weighted-overoge cost, calculate ending inventory and cost of goods sold. 3.c \& d. Using weighted-overage cost, calculate soles revenue and gross profit. 4. Determine which method will result in higher profitobility when inventory costs ore rising Complete this question by entering your answers in the tabs below. Using LFO, calculate sales revenue and gross profit. During the year, TRC Corporation has the following inventory transactions. For the entire year, the company sells 431 units of inventory for $61 each. Required: 1. \& \& b. Using FIFO, calculate ending inventory and cost of goods sold. 1c& d. Using FIFO, calculate sales revenue ond gross profit. 20& b. Using LFO. colculate ending inventory ond cost of goods sold. 2- 8 \& d. Using UFO, calculate soles revenue ond gross profit: 3-a \& b. Using weighted-averoge cost, calculate ending inventory ond cost of goods sold. 3c& d. Using weighted-overoge cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory cosis are rising. Complete this question by entering your answers in the tabs below. Determine which method will result in higher profitability when inventory costs are rising. During the year, TRC Corporation has the following inventory transactions: For the entire year, the company sells 431 units of inventory for $61 each. Required: 1.a \& b. Using FIFO, calculate ending inventory and cost of goods sold 1c&d. Using FIFO, calculate sales revenue and gross profit. 2.a \& b. Using LIFO, calculate ending inventory and cost of goods sold. 2-c \& d. Using LIFO, calculate-sales revenue and gross profit. 3.0 \& b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3c& d. Using weighted-average cost, colculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are rising. Complete this question by entering your answers in the tabs below. Using FIFO, calculate ending inventory and cost of goods sold. During the year, TRC Corporotion has the following inventory transactions, For the shire yeat, the company sells 431 unts of inventory for $65 soch Required: 1.e 8 b. Using FFO, colculate ending inventory and cost of goods sold 1+e d d. Using FiFO. calculate soles revenue and gross profit. 2sb b. Using LFO, calculate ending inventory and cout of goods sold. 2c d d.Using LiFO, colculote eales revenue ond gross profit 3. sb. Usibg weighed-overage cost, colculate ending nventory and cost of goods sold 3c \& d. Using Weighted-overoge cost, calculate soles revenue ond gross profit. 4. Determine which method wit result in higher profiability when inventory costs are fising Complete this question iv entering vour answors in the tabs below. During the year, TRC Corporation has the following inventory transactions. For the entire year, the company selis 431 units of inventory for $61 each. Required: 1.0 \& b. Using FIFO, calculate ending inventory and cost of goods sold. 1 -c \& d. Using FIFO, calculate soles revenue and gross profit. 2.a \& b. Using UIFO, calculate ending inventory and cost of goods sold: 2c& d. Using LIFO, colculate sales revenue and gross profit. 3.a \& b. Using weighted-averoge cost, calculate ending inventory and cost of goods sold. 3c& d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are ilsing. Complete this question by entering your answers in the tabs below. Using weighted-average cost, calculate sales revenue and gross profic (Round answers to 2 ldecimal places.)