help please!

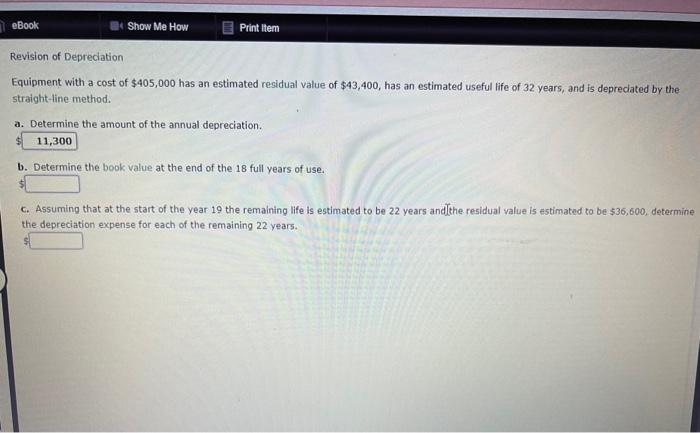

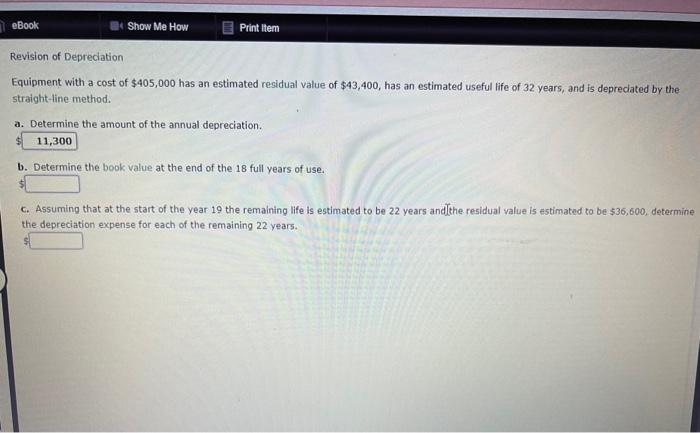

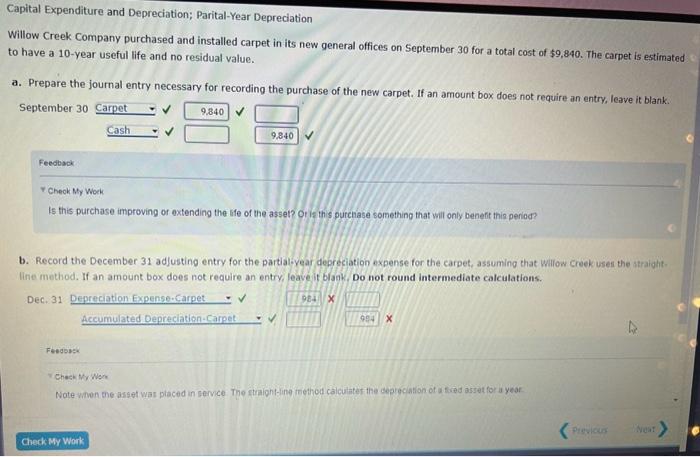

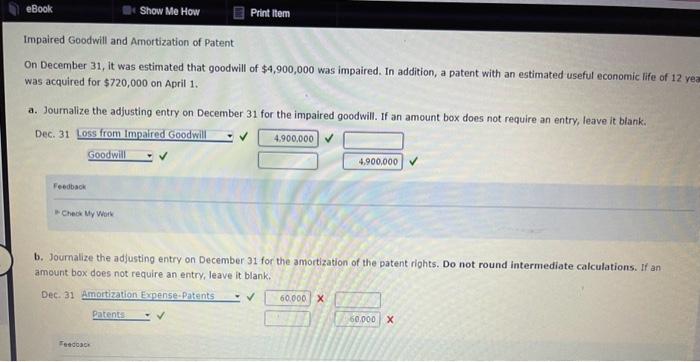

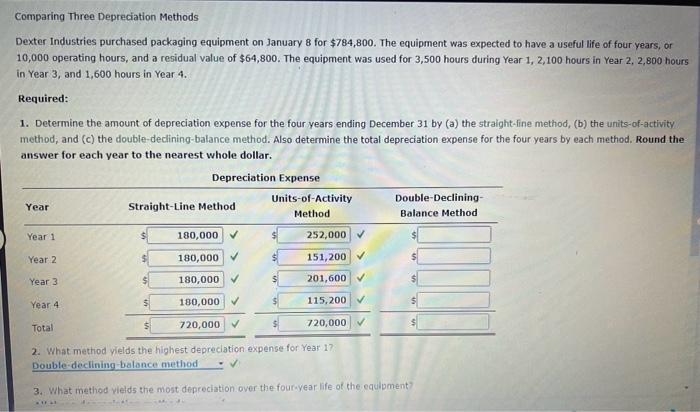

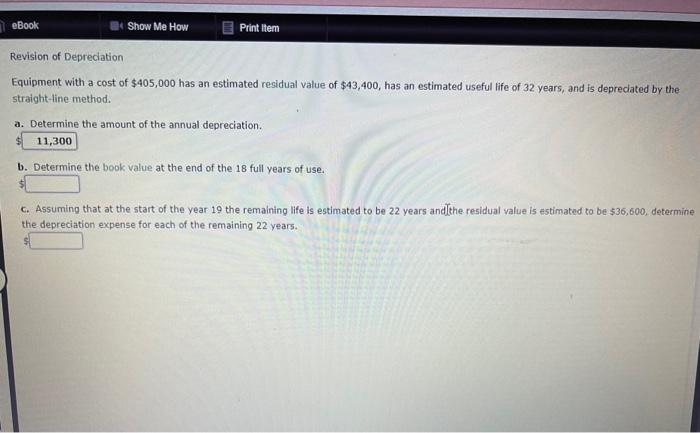

Equipment with a cost of $405,000 has an estimated residual value of $43,400, has an estimated useful life of 32 years, and is depreciated by the straight-line method. a. Determine the amount of the annual depreciation. b. Determine the book value at the end of the 18 full years of use. c. Assuming that at the start of the year 19 the remaining life is estimated to be 22 years andlthe residual value is estimated to be $36,600, determine the depreciation expense for each of the remaining 22 years. Capital Expenditure and Depreciation; Parital-Year Depreciation Willow Creek Company purchased and installed carpet in its new general offices on September 30 for a total cost of $9,840. The carpet is estimated to have a 10 -year useful life and no residual value. a. Prepare the journal entry necessary for recording the purchase of the new carpet. If an amount box does not require an entry, leave it blank. September 30 Feedback v Cheok My Work Is this purchase improving of extending the life of the asset? Oi is this purchase something that will only beneft this period? b. Record the December 31 adjusting entry for the partial-vear depreciation expense for the carpet, assuming that willow creek wset the straialitline method. If an amount box does not require an entry, leave it blank. Do not round intermediate calculations. Dec. Feedosse Chesk Hri Were Note wiven the asset was placed in service The stralight-ine inethod calculater the deareculish of a ficed asset for a year Equipment was acquired at the beginning of the year at a cost of $650,000. The equipment was depreciated using the straight-line method based on an estimated useful life of 9 years and an estimated residual value of $46,045. a. What was the depreciation for the first year? Round your answer to the nearest cent. x b. Using the rounded amount from Part a in your computation, determine the gain or loss on the sale of the equipment, assuming it was sold at the end of year eight for $107,876. Round your answer to the nearest cent. Enter your answer as a dositive amount. Impaired Goodwill and Amortization of Patent On December 31, it was estimated that goodwill of $4,900,000 was impaired. In addition, a patent with an estimated useful economic life of 12 ve was acquired for $720,000 on April 1 a. Joumalize the adjusting entry on December 31 for the impaired goodwill. If an amount box does not require an entry, leave it blank. De Feedback - Cheos My Wook b. Joumalize the adjusting entry on December 31 for the amortization of the patent rights. Do not round intermediate calculations. If an amount box does not require an entry, leave it blank. Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $784,800. The equipment was expected to have a useful life of four years, or 10,000 operating hours, and a residual value of $64,800. The equipment was used for 3,500 hours during Year 1,2,100 hours in Year 2,2,800 hours in Year 3 , and 1,600 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the straight-fine method, (b) the units-of-activity method; and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method. Round the answer for each year to the nearest whole dollar. 2. What method vields the highest depreclation expense for year 17 3. What method vields the most depreciation over the fourayear life of the equlpment