Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help, please! Help, please! PROBLEM A chemical products company is conducting a site-study to determine where to establish a small, short-term fabrication plant to make

Help, please!

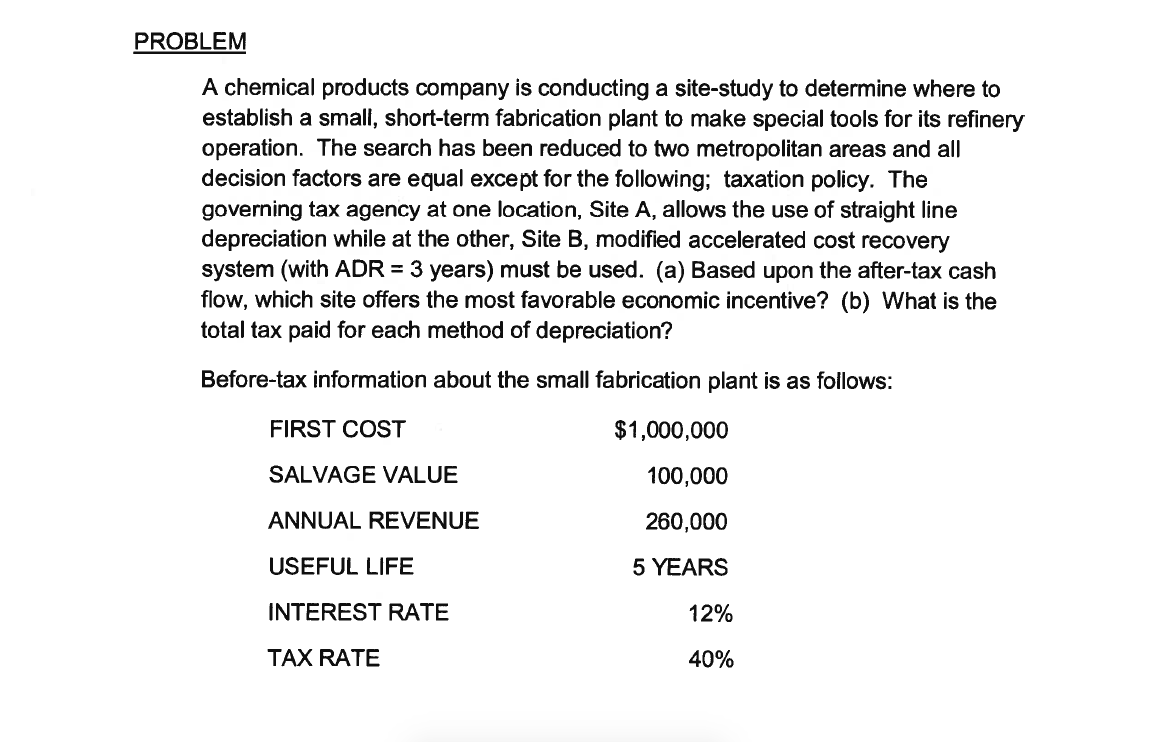

Help, please! PROBLEM A chemical products company is conducting a site-study to determine where to establish a small, short-term fabrication plant to make special tools for its refinery operation. The search has been reduced to two metropolitan areas and all decision factors are equal except for the following; taxation policy. The governing tax agency at one location, Site A, allows the use of straight line depreciation while at the other, Site B, modified accelerated cost recovery system (with ADR = 3 years) must be used. (a) Based upon the after-tax cash flow, which site offers the most favorable economic incentive? (b) What is the total tax paid for each method of depreciation? Before-tax information about the small fabrication plant is as follows: FIRST COST $1,000,000 SALVAGE VALUE 100,000 ANNUAL REVENUE 260,000 USEFUL LIFE 5 YEARS INTEREST RATE 12% TAX RATE 40%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started