Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help please. I got stuck. Cashflow for year 1 is not correct =( Thank you! You are evaluating a project for The Ultimate recreational tennis

Help please. I got stuck. Cashflow for year 1 is not correct =( Thank you!

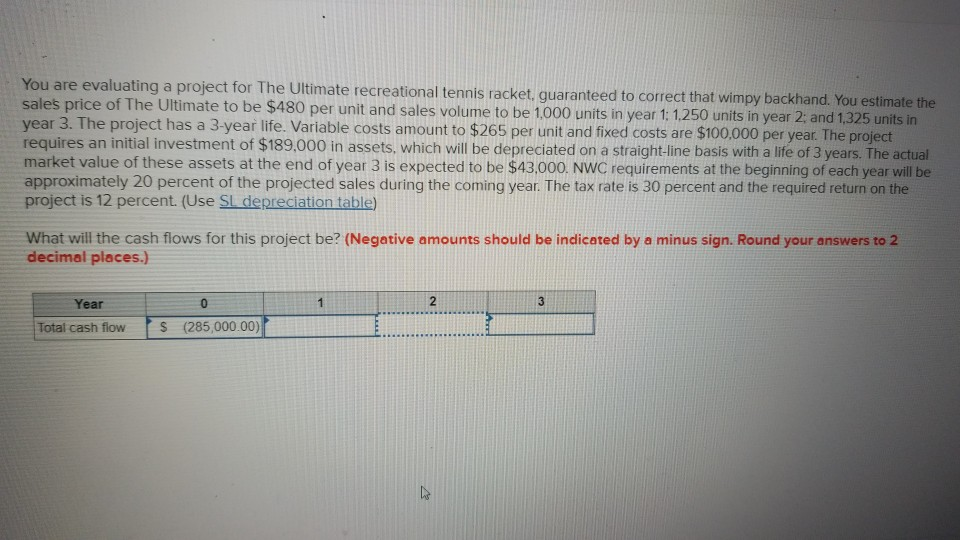

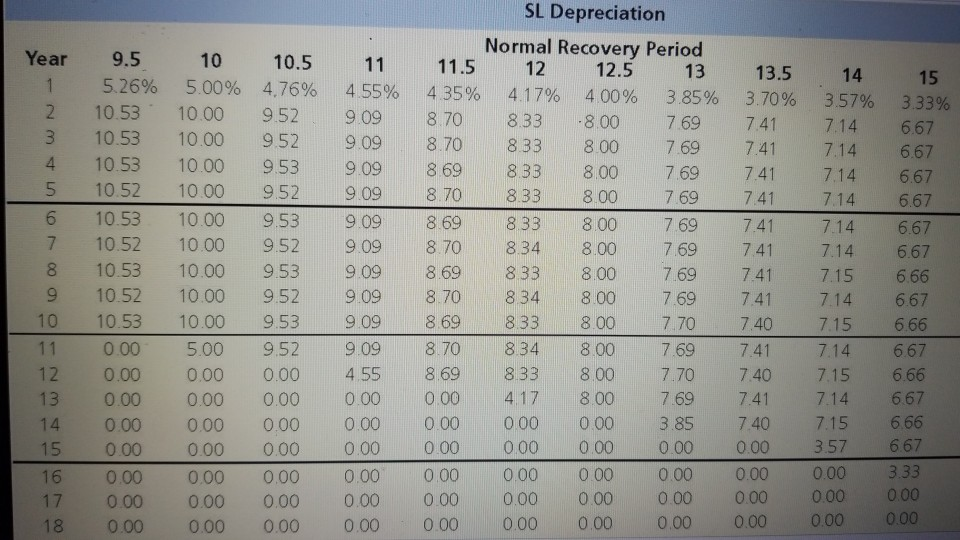

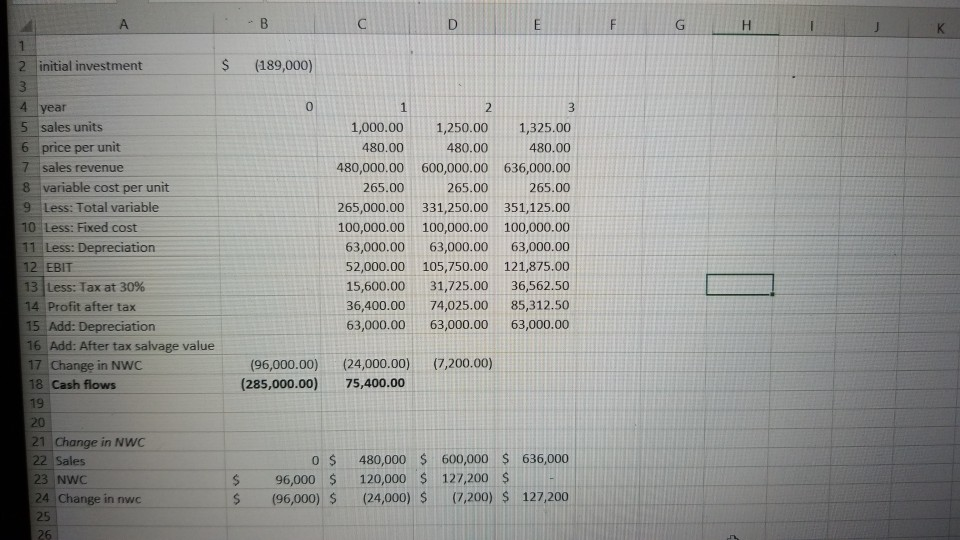

You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy backhand. You estimate the sales price of The Ultimate to be $480 per unit and sales volume to be 1000 units in year 1: 1250 units in year 2: and 1,325 units in year 3. The project has a 3-year life. Variable costs amount to $265 per unit and fixed costs are $100,000 per year The project requires an initial investment of $189,000 in assets which wll be depreciated on a straight-line basis with a life of 3 years. The actual market value of these assets at the end of year 3 is expected to be $43.000. NWC requirements at the beginning of each year will be approximately 20 percent of the projected sales during the coming year. The tax rate is 30 percent and the required return on the project is 12 percent. (Use SL depreciation table) What will the cash flows for this project be? (Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) 2 Year (285,000.00) $ Total cash flow SL Depreciation Normal Recovery Period Year 9.5 10 10.5 11 11.5 12 12.5 13 13.5 14 15 385% 1 2 10.53 10.00 9.52909 3 10.53 1000 952 9.09 8.70 8 4 10.53 1000 9 53 9 09 869 8 33 800 769 741 714 667 5 10.52 10.00 9.52 6 10.53 10.00 953 909869 8 33 800 769 741 7 10.52 10.00 952 9 09 8 70 834 800 769 741 7.14 667 8 10.53 10.00 953 909869 833 800 769 741 7.15 666 9 10.52 10.00 952 909 870 834 8.00 769 741 714 667 10 10.53 10.00 9.53 9.09 869 833 8 00 7.70 740 7.15666 11 0.00 500 952 9098.70 834 800 769 741 714 667 12 0.00 000 0.00 4.55 869833 8.007.70 7.40 7.15 6.66 13 000 0.0 00 000 000 417 800 769 741 714 667 14 0 00 0.00 0 00 000 000 000 000 385 740 715 666 15 0 00 000 00 000 000 000 000 0.00 000 3.57 667 16 000 0.00 000 000 000 000 000 0.00 0.00000 3.33 17 0.00 0.00 0.00 0.00 0.00000 000 0 00 000 000 000 18 0.00 000 000 0.00 000000 0.00 0.00 000 000 526% 500% 4,76% 455% 435% 417% 8 33 833 800 769 741 714 667 400% 370% 357% 333% 8 00 769 741 7.14 667 9.09 8.70 8.33 8.00 7 69 741 7.14 667 (189,000) 2 initial investment 4 year 5 sales units 6 price per unit 7 sales revenue 8 variable cost per unit 9 Less: Total variable 10 Less: Fixed cost 11 Less: 12 EBIT 131 Less: Tax at 30% 14 Profit after tax 15 Add: Depreciation 16 Add: After tax salvage value 2 0 1 1,000.00 1,250.00 1,325.00 480.00 480,000.00 600,000.00 636,000.00 265.00 265.00 265,000.00 331,250.00 351,125.00 100,000.00 100,000.00 100,000.00 63,000.00 63,000.00 63,000.00 52,000.00 105,750.00 121,875.00 15,600.00 31,725.00 36,562.50 36,400.00 74,025.00 85,312.50 63,000.0063,000.00 63,000.00 480.00 480.00 0 1 1 1 (96,000.00) (24,000.00) (7,200.00) (285,000.00) 75,400.00 17 Change in NWC 18 Cash flows 21 Change in NWC 0 480,000 $ 600,000 $ 636,000 96,000 120,000 $ 127200 (96,000) (24,000) (7,200) $ 127,200 23 NWC 24 Change in nwc 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started