Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please i need help with these please ;( help This is directlybased on the readings for the week. You may take this as many

help please

i need help with these please ;(

help

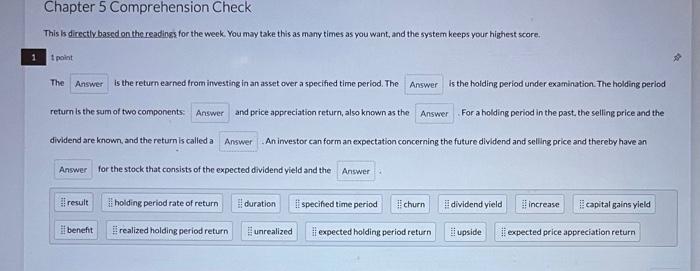

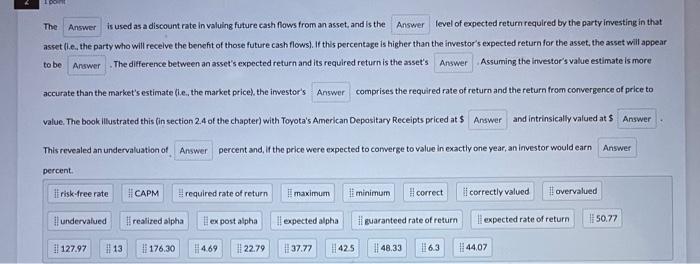

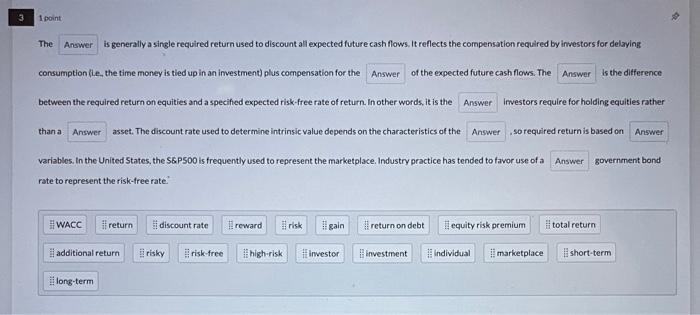

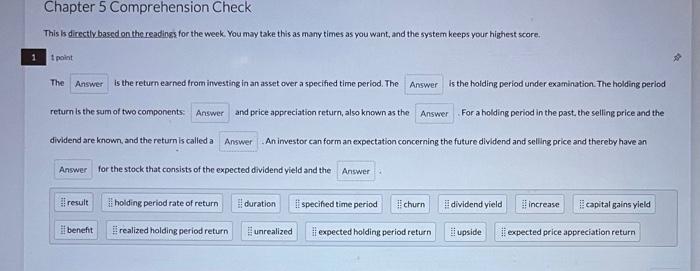

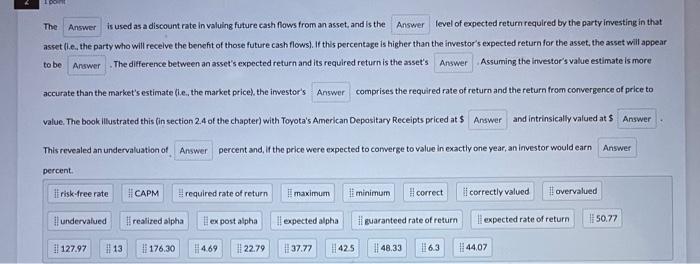

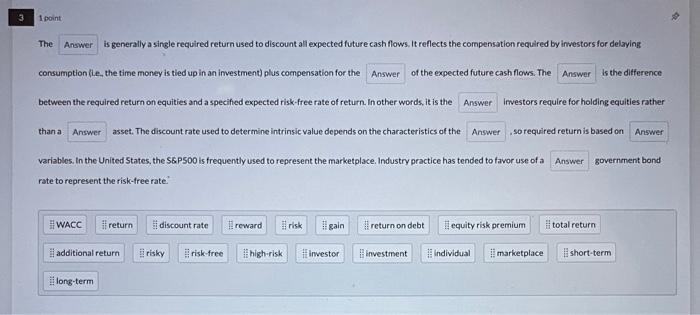

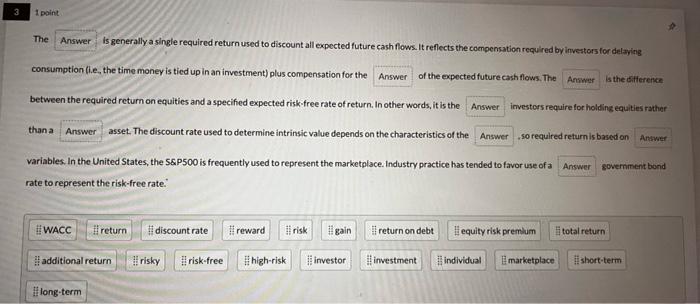

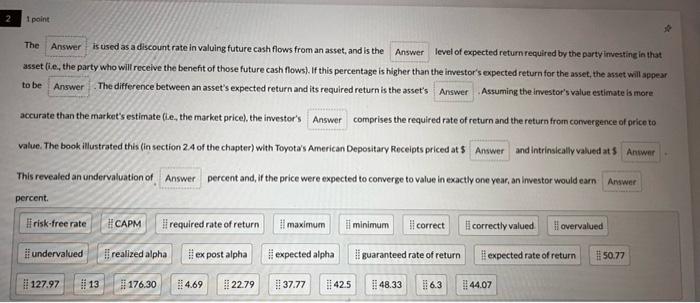

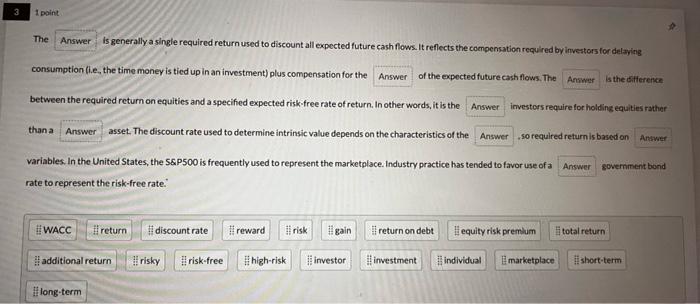

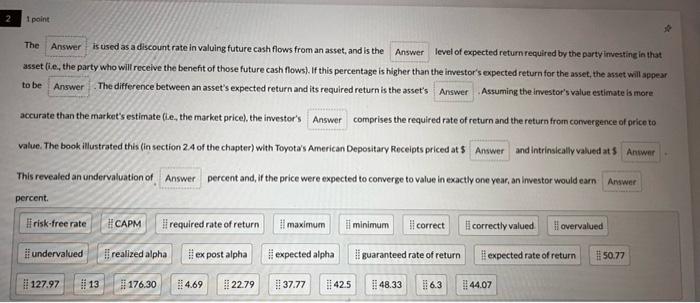

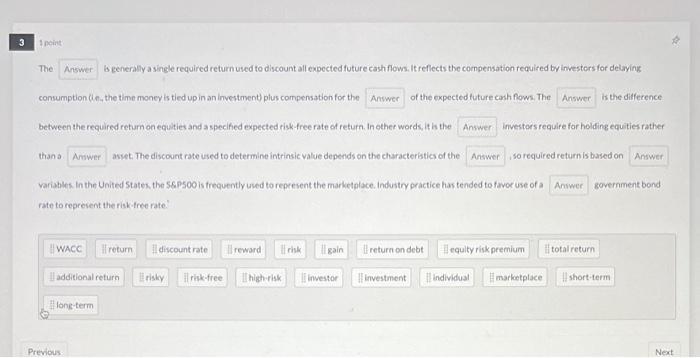

This is directlybased on the readings for the week. You may take this as many times as you want, and the system keeps your highest score. 1 point dividend are known, and the return is called a . An imvestor can form an expectation concerning the future dividend and selling price and thereby have an for the stock that consists of the expected dividend yield and the The is used as a discount rate in valuing future cash fows from an asset, and is the level of expected return required by the party investing in that aspet (li.e. the party who will recelve the benefit of those future cash flows). If this percentage is higher than the investor's expected return for the asset, the asset will appear to be . The difference between an asset's expected return and its required return is the asset's Assuming the investor's value estimate is more accurate than the market's estimate (i.e., the market pricel, the investor's comprises the required rate of return and the return from convergence of price to value. The book illustrated this (in section 2.4 of the chapter) with Toyota's American Depasitary Receipts priced at $ and intrinsically valued at $ Thisrevealed an undervaluation of percent and, if the price were expected to converge to value in exactly one year, an investor would earn percent. 1 boint is generally a single required return used to discount alli expected future cash flows, It reflects the compensation required by inwestors for delaying The consumption (Le., the time money is tied up in an imestment) plus compensation for the of the expected future cash flows. The Is the ditference between the required return on equities and a specified expected risk-free rate of return. In other words, it is the Ifvestors require for holding equities rather than a asset. The discount rate used to determine intrinsicvalue depends on the characteristics of the ,so required return is based on variablos, In the United States, the SE.PSOO is frequently used to represent the marketplace. Industry practice has tended to favor use of a government bond rate to represent the risk-free rate. The Is generally a single required return used to discount all expected future cash flows. It reflects the compensation required by investors for delaying consumption (i.e, the time money is tied up in an investment) plus compensation for the is the citference between the required return on equities and a specified expected risk.free rate of return. In other words, it is the investors require for holding equities rather than a asset. The discount rate used to determine intrinsic value depends on the characteristics of the - so required return is based on variables. In the United States, the SEP500 is frequently used to represent the marketplace. Industry practice has tended to favor use of a rate to represent the risk-free rate. level of expected return required by the party investing in that is tised as a discount rate in valuing future cash flows from an asset, and is the asset (i.e., the party who will receive the benefit of those future cash flows. If this percentage is higher than the investor's expected return for the asset, the asset will appear to be Assuming the investor's value estimate is more accurate than the market's estimate (i.e., the market pricel. the investor's comprises the required rate of return and the return from comergence of price to value. The book illustrated this (in section 2.4 of the chapter) with Toyota's American Depositary Receipts priced at 5 and intrinsleally valied at 3 This revealed an undervaluation of percent and, if the price were expected to corverge to value in exactly one year, an investor would earn percent. The Ib generally a single required return used to discount all expected future cash flows. It reflects the compensation required by investors for delaying consumption (inf the time money is tied up in an investment) plus compensation for the of the expected future cash flows. The is the difference between the required return on equities and a specified expected risk-free rate of return. In other words, it h the investors require for holding equities rather thana asset. The discount rate used to determine intrinsic value depends on the characteristics of the is so required return is based on variables in the United 5 tates, the 589500 is trequently used to repcesent the marketplace. Industry practice has tended to favor use of a government bond rate to represent the risk ctree rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started