Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Note: The previous person answered it wrong, so make sure you answer it correctly please. Amazon is planning to launch a new website on the

Note: The previous person answered it wrong, so make sure you answer it correctly please.

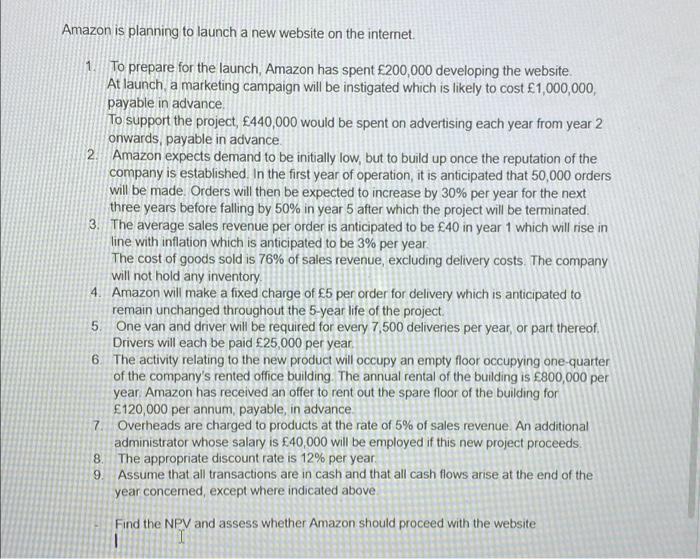

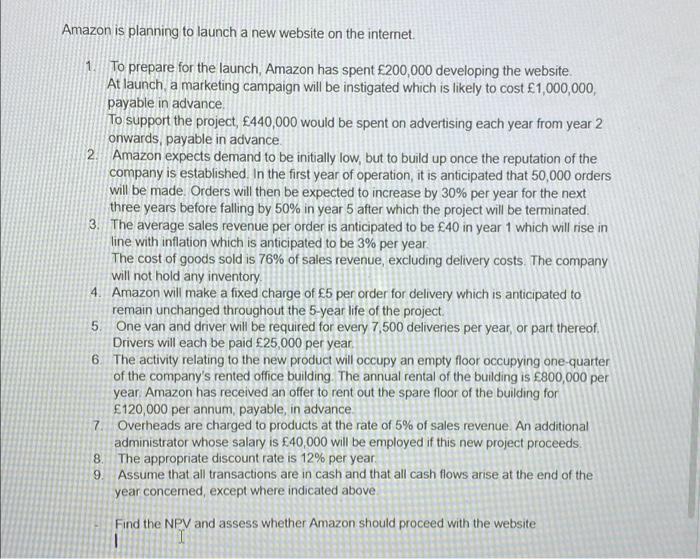

Amazon is planning to launch a new website on the internet. 1. To prepare for the launch Amazon has spent 200,000 developing the website. At launch a marketing campaign will be instigated which is likely to cost 1,000,000, payable in advance To support the project, 440,000 would be spent on advertising each year from year 2 onwards, payable in advance 2. Amazon expects demand to be initially low, but to build up once the reputation of the company is established. In the first year of operation, it is anticipated that 50,000 orders will be made. Orders will then be expected to increase by 30% per year for the next three years before falling by 50% in year 5 after which the project will be terminated. 3. The average sales revenue per order is anticipated to be 40 in year 1 which will rise in line with inflation which is anticipated to be 3% per year The cost of goods sold is 76% of sales revenue, excluding delivery costs. The company will not hold any inventory. 4. Amazon will make a fixed charge of 5 per order for delivery which is anticipated to remain unchanged throughout the 5-year life of the project 5 One van and driver will be required for every 7,500 deliveries per year, or part thereof. Drivers will each be paid 25,000 per year 6. The activity relating to the new product will occupy an empty floor occupying one-quarter of the company's rented office building The annual rental of the building is 800,000 per year Amazon has received an offer to rent out the spare floor of the building for 120,000 per annum payable, in advance 7 Overheads are charged to products at the rate of 5% of sales revenue. An additional administrator whose salary is 40,000 will be employed if this new project proceeds. The appropriate discount rate is 12% per year. Assume that all transactions are in cash and that all cash flows arise at the end of the year concerned, except where indicated above 8 9 Find the NPV and assess whether Amazon should proceed with the website I Amazon is planning to launch a new website on the internet. 1. To prepare for the launch Amazon has spent 200,000 developing the website. At launch a marketing campaign will be instigated which is likely to cost 1,000,000, payable in advance To support the project, 440,000 would be spent on advertising each year from year 2 onwards, payable in advance 2. Amazon expects demand to be initially low, but to build up once the reputation of the company is established. In the first year of operation, it is anticipated that 50,000 orders will be made. Orders will then be expected to increase by 30% per year for the next three years before falling by 50% in year 5 after which the project will be terminated. 3. The average sales revenue per order is anticipated to be 40 in year 1 which will rise in line with inflation which is anticipated to be 3% per year The cost of goods sold is 76% of sales revenue, excluding delivery costs. The company will not hold any inventory. 4. Amazon will make a fixed charge of 5 per order for delivery which is anticipated to remain unchanged throughout the 5-year life of the project 5 One van and driver will be required for every 7,500 deliveries per year, or part thereof. Drivers will each be paid 25,000 per year 6. The activity relating to the new product will occupy an empty floor occupying one-quarter of the company's rented office building The annual rental of the building is 800,000 per year Amazon has received an offer to rent out the spare floor of the building for 120,000 per annum payable, in advance 7 Overheads are charged to products at the rate of 5% of sales revenue. An additional administrator whose salary is 40,000 will be employed if this new project proceeds. The appropriate discount rate is 12% per year. Assume that all transactions are in cash and that all cash flows arise at the end of the year concerned, except where indicated above 8 9 Find the NPV and assess whether Amazon should proceed with the website

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started