Answered step by step

Verified Expert Solution

Question

1 Approved Answer

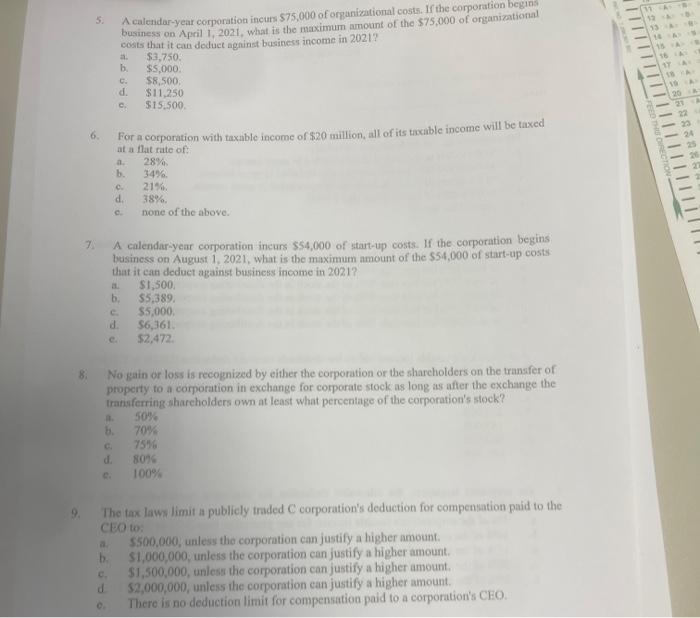

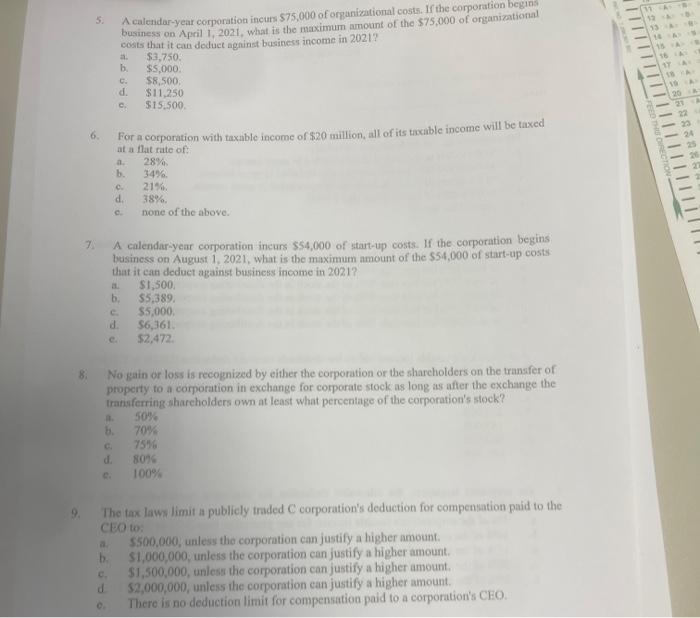

help please im confused 5. A calendar-year corporation incurs $75,000 of organizational costs. If the corporation begins business on April 1, 2021, what is the

help please im confused

5. A calendar-year corporation incurs $75,000 of organizational costs. If the corporation begins business on April 1, 2021, what is the maximum amount of the $75,000 of onganizational costs that it cua doduct agninst business income in 2021? a. $3,750. b. $5,000. c. $8,500. d. $11,250 e. $15.500. 6. For a corporation with taxable income of $20 million, all of its taxable income will be taxed at a flat rate of: a. 28% b. 34%. c. 214 . d. 38%. c. none of the above. 7. A calendar-year corporation incurs $54,000 of start-up costs. If the corporation begins business on August 1,2021 , what is the maximum amount of the $54,000 of start-up costs that it ean deduet against business income in 2021? a. $1,500. b. $5,389. c. $5,000. d. 56,361 . e. $2,472. 8. No gain or loss is recognized by either the corporation or the shareholders on the transfer of property to a corporation in exchange for corporate stock as long as after the cxchange the Iransferring shareholders own at least what percentage of the corporation's stock? 8. 50% b. 70s c. 75% d. 8045 c. 100% 9. The tax laws limit a publicly traded C corporation's deduction for compensation paid to the CEO to: a. 55000,000, unless the corporation can justify a higher amount. b. $1,000,000; unless the corporation can justify a higher amount. c. $1,500,000, unless the corporation can justify a higher amount. d 52,000,000, unless the corporation can justify a higher amount. e. There is no deduetion limit for compensation paid to a corporation's CEO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started