Answered step by step

Verified Expert Solution

Question

1 Approved Answer

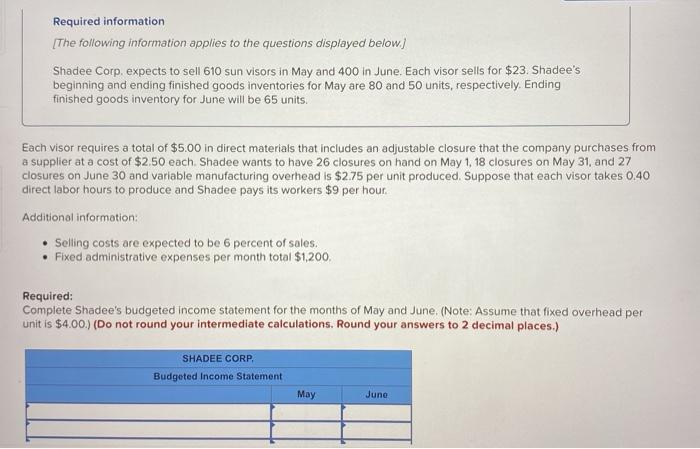

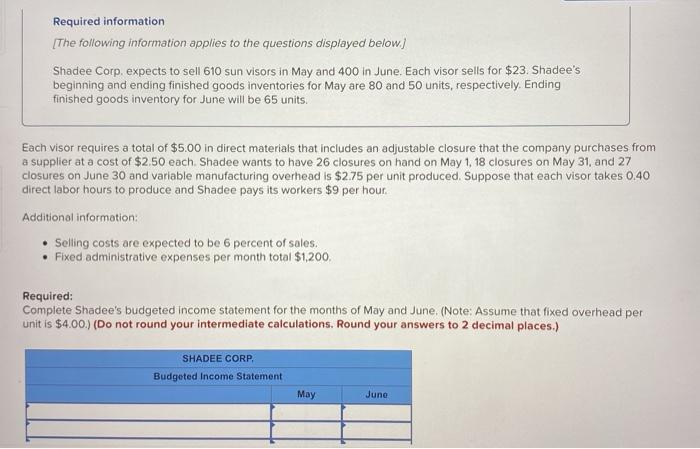

Help please. im stuck and could use some work to help. thanks Required information [The following information applies to the questions displayed below) Shadee Corp.

Help please. im stuck and could use some work to help. thanks

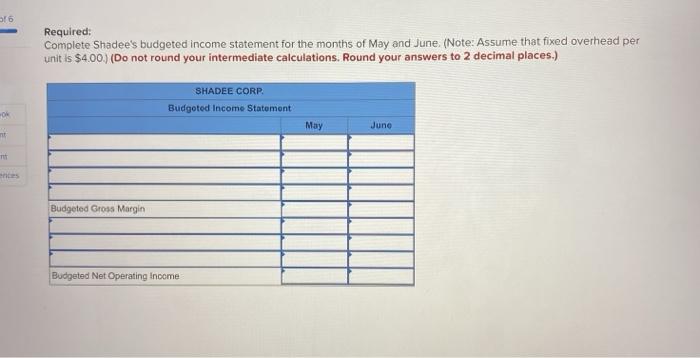

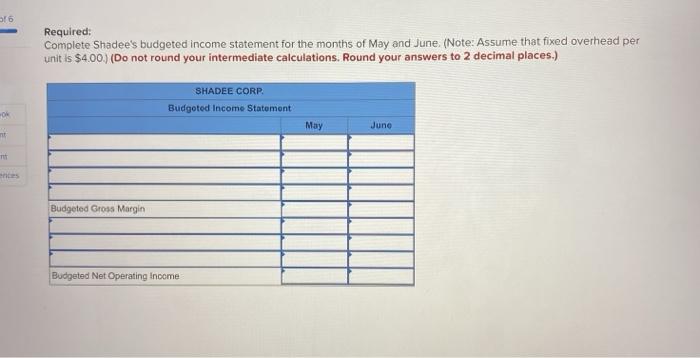

Required information [The following information applies to the questions displayed below) Shadee Corp. expects to sell 610 sun visors in May and 400 in June. Each visor sells for $23. Shadee's beginning and ending finished goods inventories for May are 80 and 50 units, respectively. Ending finished goods inventory for June will be 65 units. Each visor requires a total of $5.00 in direct materials that includes an adjustable closure that the company purchases from a supplier at a cost of $2.50 each Shadee wants to have 26 closures on hand on May 1, 18 closures on May 31, and 27 closures on June 30 and variable manufacturing overhead is $2.75 per unit produced. Suppose that each visor takes 0.40 direct labor hours to produce and Shadee pays its workers $9 per hour Additional information: Selling costs are expected to be 6 percent of sales. Fixed administrative expenses per month total $1,200. Required: Complete Shadee's budgeted Income statement for the months of May and June. (Note: Assume that fixed overhead per unit is $4.00.) (Do not round your intermediate calculations. Round your answers to 2 decimal places.) SHADEE CORP Budgeted Income Statement May June 516 Required: Complete Shadee's budgeted income statement for the months of May and June (Note: Assume that fixed overhead per unit is $4.00.) (Do not round your intermediate calculations. Round your answers to 2 decimal places.) SHADEE CORP Budgoted Income Statement OR May June nes Budgeted Gross Margin Budgeted Net Operating Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started