Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP PLEASE In questions 1-6 below, classify the following costs as PRODUCT or PERIOD. Then further classify each cost as Direct Materials, Direct Labor, Overhead,

HELP PLEASE

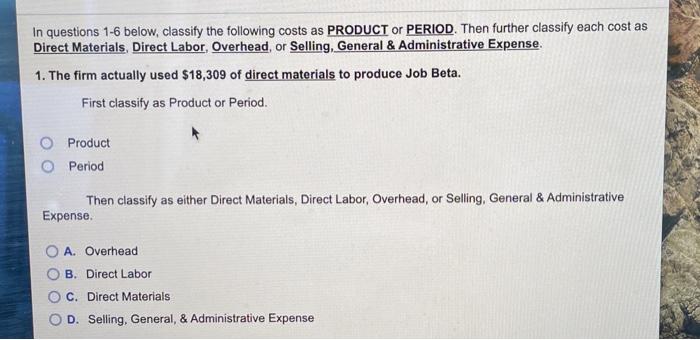

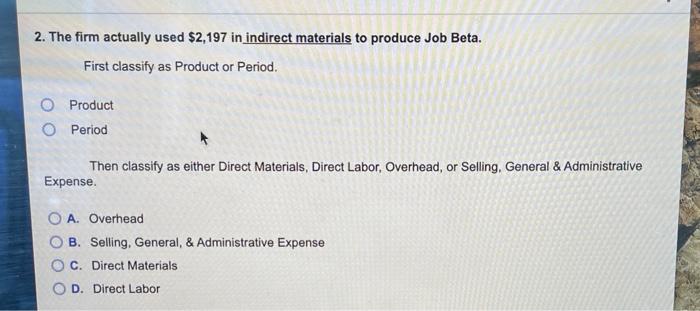

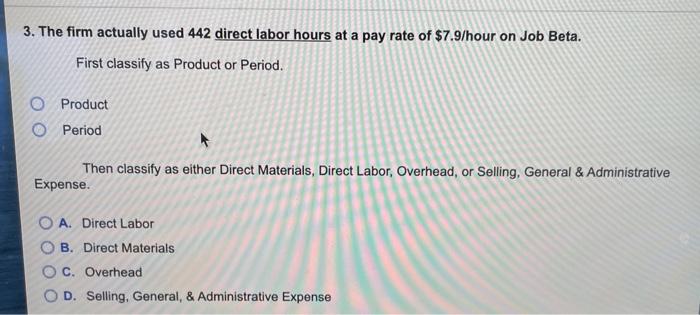

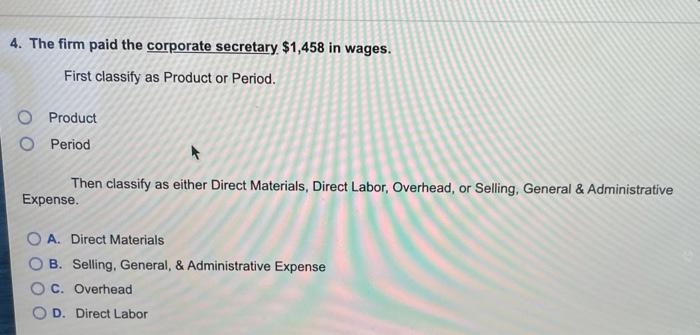

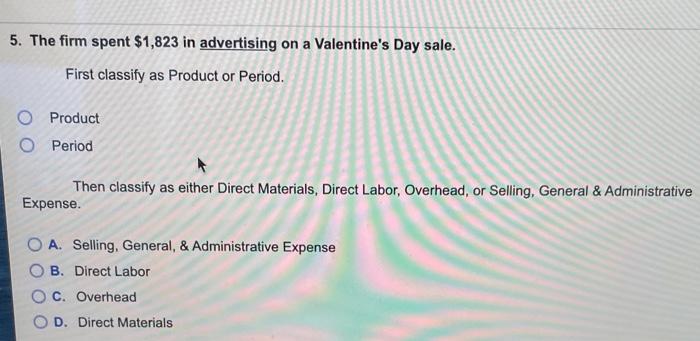

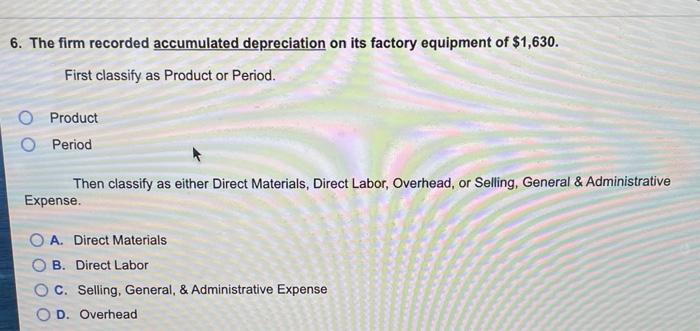

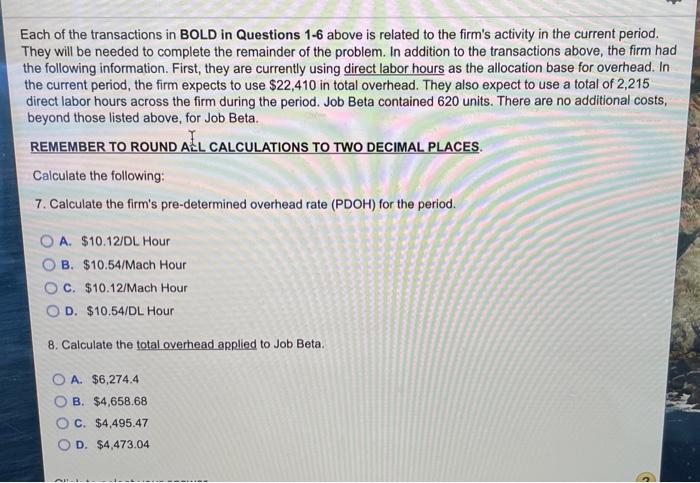

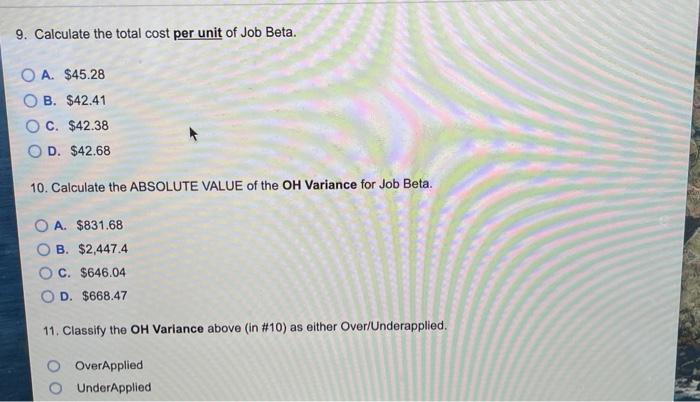

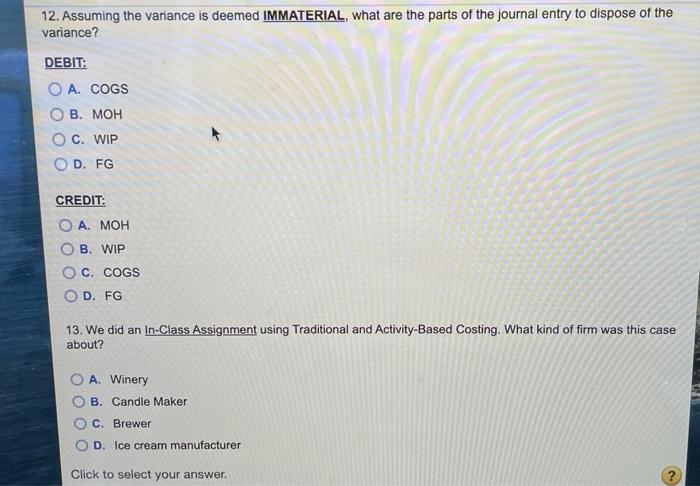

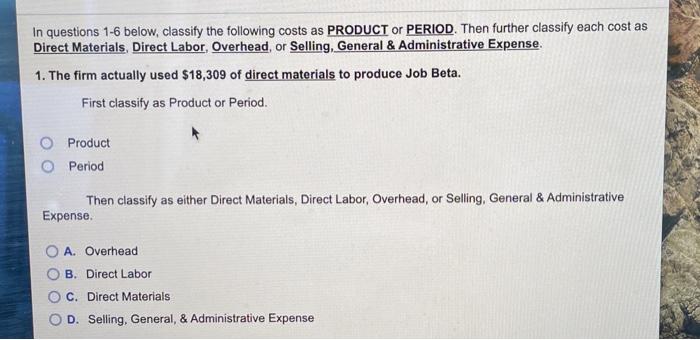

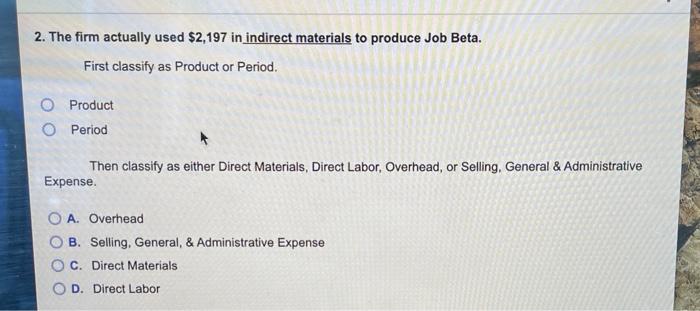

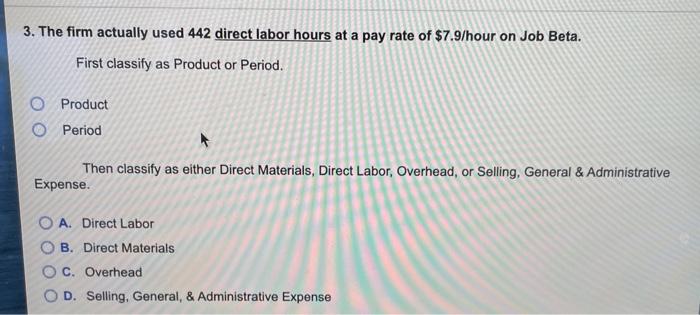

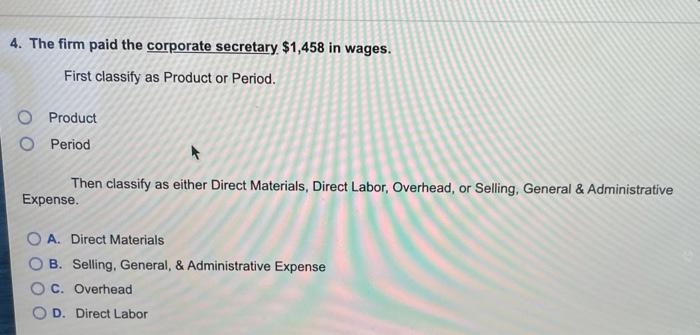

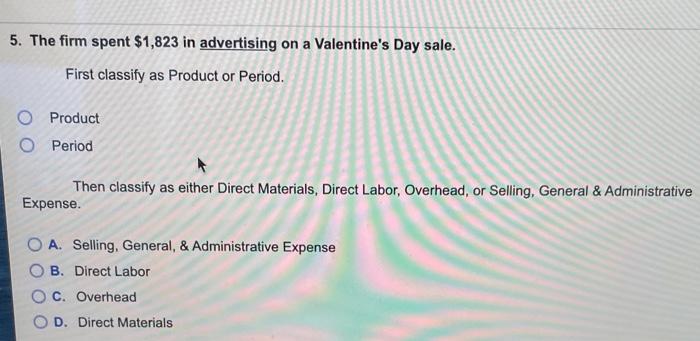

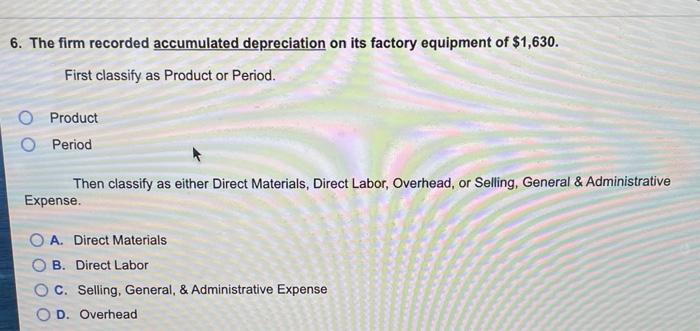

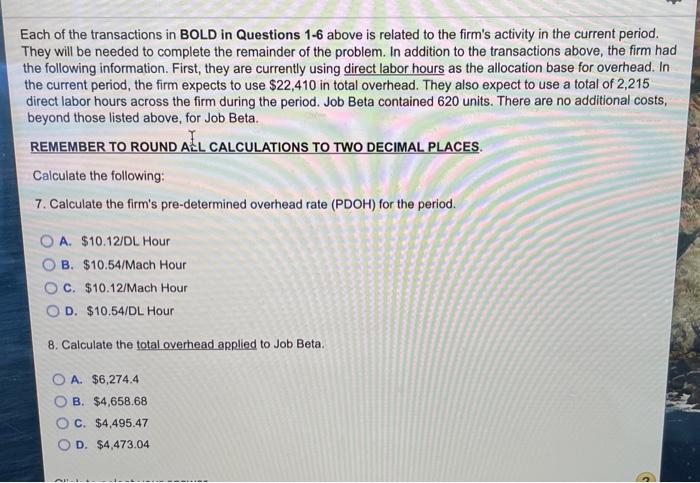

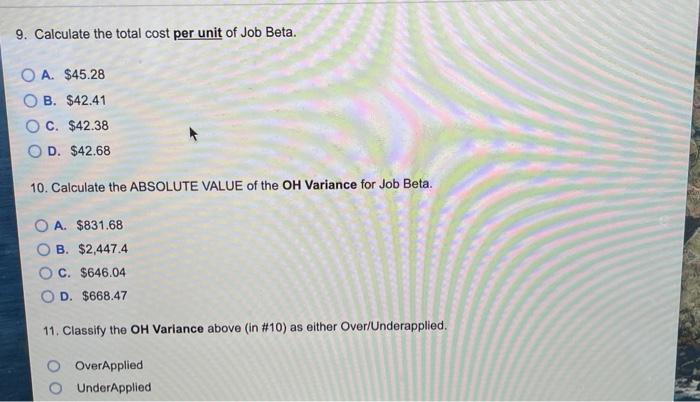

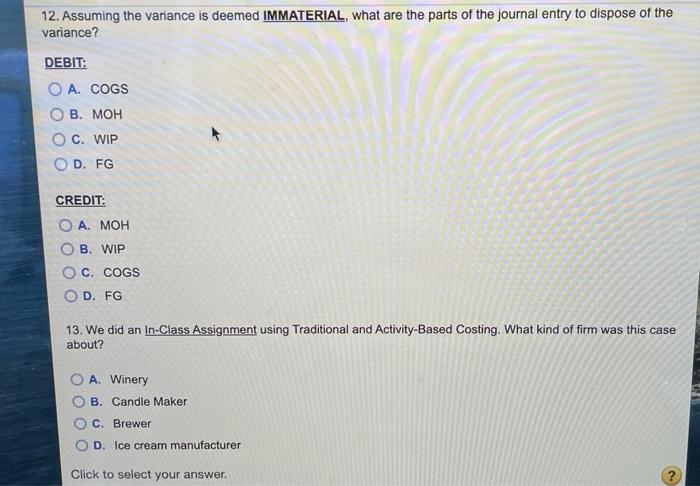

In questions 1-6 below, classify the following costs as PRODUCT or PERIOD. Then further classify each cost as Direct Materials, Direct Labor, Overhead, or Selling, General & Administrative Expense. 1. The firm actually used $18,309 of direct materials to produce Job Beta. First classify as Product or Period. O Product Period Then classify as either Direct Materials, Direct Labor, Overhead, or Selling, General & Administrative Expense. A. Overhead B. Direct Labor C. Direct Materials D. Selling, General, & Administrative Expense 2. The firm actually used $2,197 in indirect materials to produce Job Beta. First classify as Product or Period. O Product O Period Then classify as either Direct Materials, Direct Labor, Overhead, or Selling, General & Administrative Expense. O A. Overhead OB. Selling, General, & Administrative Expense OC. Direct Materials D. Direct Labor 3. The firm actually used 442 direct labor hours at a pay rate of $7./hour on Job Beta. First classify as Product or Period. Product O Period Then classify as either Direct Materials, Direct Labor, Overhead, or Selling, General & Administrative Expense. O A. Direct Labor O B. Direct Materials O c. Overhead D. Selling, General, & Administrative Expense 4. The firm paid the corporate secretary $1,458 in wages. First classify as Product or Period. Product Period Then classify as either Direct Materials, Direct Labor, Overhead, or Selling, General & Administrative Expense. O A. Direct Materials B. Selling, General, & Administrative Expense C. Overhead D. Direct Labor 5. The firm spent $1,823 in advertising on a Valentine's Day sale. First classify as Product or Period. O Product O Period Then classify as either Direct Materials, Direct Labor, Overhead, or Selling, General & Administrative Expense. O A. Selling, General, & Administrative Expense B. Direct Labor OC. Overhead D. Direct Materials 6. The firm recorded accumulated depreciation on its factory equipment of $1,630. First classify as Product or Period. Product Period Then classify as either Direct Materials, Direct Labor, Overhead, or Selling, General & Administrative Expense. A. Direct Materials O B. Direct Labor O C. Selling, General, & Administrative Expense D. Overhead Each of the transactions in BOLD in Questions 1-6 above is related to the firm's activity in the current period. They will be needed to complete the remainder of the problem. In addition to the transactions above, the firm had the following information. First, they are currently using direct labor hours as the allocation base for overhead. In the current period, the firm expects to use $22,410 in total overhead. They also expect to use a total of 2,215 direct labor hours across the firm during the period. Job Beta contained 620 units. There are no additional costs, beyond those listed above, for Job Beta. I REMEMBER TO ROUND ALL CALCULATIONS TO TWO DECIMAL PLACES Calculate the following: 7. Calculate the firm's pre-determined overhead rate (PDOH) for the period. O A. $10.12/DL Hour OB. $10.54/Mach Hour OC. $10.12/Mach Hour D. $10.54/DL Hour 8. Calculate the total overhead applied to Job Beta. O A. $6,274.4 B. $4,658.68 C. $4,495.47 D. $4,473.04 9. Calculate the total cost per unit of Job Beta. O A. $45.28 OB. $42.41 OC. $42.38 OD. $42.68 10. Calculate the ABSOLUTE VALUE of the OH Variance for Job Beta. A. $831.68 B. $2,447.4 C. $646.04 OD. $668.47 11. Classify the OH Variance above (in #10) as either Over/Underapplied. OverApplied UnderApplied 12. Assuming the variance is deemed IMMATERIAL, what are the parts of the journal entry to dispose of the variance? DEBIT: O A. COGS OB. MOH OC. WIP OD. FG CREDIT: O A. MOH OB. WIP C. COGS OD. FG 13. We did an in-Class Assignment using Traditional and Activity-Based Costing. What kind of firm was this case about? A. Winery B. Candle Maker C. Brewer D. Ice cream manufacturer Click to select your

In questions 1-6 below, classify the following costs as PRODUCT or PERIOD. Then further classify each cost as Direct Materials, Direct Labor, Overhead, or Selling, General & Administrative Expense. 1. The firm actually used $18,309 of direct materials to produce Job Beta. First classify as Product or Period. O Product Period Then classify as either Direct Materials, Direct Labor, Overhead, or Selling, General & Administrative Expense. A. Overhead B. Direct Labor C. Direct Materials D. Selling, General, & Administrative Expense 2. The firm actually used $2,197 in indirect materials to produce Job Beta. First classify as Product or Period. O Product O Period Then classify as either Direct Materials, Direct Labor, Overhead, or Selling, General & Administrative Expense. O A. Overhead OB. Selling, General, & Administrative Expense OC. Direct Materials D. Direct Labor 3. The firm actually used 442 direct labor hours at a pay rate of $7./hour on Job Beta. First classify as Product or Period. Product O Period Then classify as either Direct Materials, Direct Labor, Overhead, or Selling, General & Administrative Expense. O A. Direct Labor O B. Direct Materials O c. Overhead D. Selling, General, & Administrative Expense 4. The firm paid the corporate secretary $1,458 in wages. First classify as Product or Period. Product Period Then classify as either Direct Materials, Direct Labor, Overhead, or Selling, General & Administrative Expense. O A. Direct Materials B. Selling, General, & Administrative Expense C. Overhead D. Direct Labor 5. The firm spent $1,823 in advertising on a Valentine's Day sale. First classify as Product or Period. O Product O Period Then classify as either Direct Materials, Direct Labor, Overhead, or Selling, General & Administrative Expense. O A. Selling, General, & Administrative Expense B. Direct Labor OC. Overhead D. Direct Materials 6. The firm recorded accumulated depreciation on its factory equipment of $1,630. First classify as Product or Period. Product Period Then classify as either Direct Materials, Direct Labor, Overhead, or Selling, General & Administrative Expense. A. Direct Materials O B. Direct Labor O C. Selling, General, & Administrative Expense D. Overhead Each of the transactions in BOLD in Questions 1-6 above is related to the firm's activity in the current period. They will be needed to complete the remainder of the problem. In addition to the transactions above, the firm had the following information. First, they are currently using direct labor hours as the allocation base for overhead. In the current period, the firm expects to use $22,410 in total overhead. They also expect to use a total of 2,215 direct labor hours across the firm during the period. Job Beta contained 620 units. There are no additional costs, beyond those listed above, for Job Beta. I REMEMBER TO ROUND ALL CALCULATIONS TO TWO DECIMAL PLACES Calculate the following: 7. Calculate the firm's pre-determined overhead rate (PDOH) for the period. O A. $10.12/DL Hour OB. $10.54/Mach Hour OC. $10.12/Mach Hour D. $10.54/DL Hour 8. Calculate the total overhead applied to Job Beta. O A. $6,274.4 B. $4,658.68 C. $4,495.47 D. $4,473.04 9. Calculate the total cost per unit of Job Beta. O A. $45.28 OB. $42.41 OC. $42.38 OD. $42.68 10. Calculate the ABSOLUTE VALUE of the OH Variance for Job Beta. A. $831.68 B. $2,447.4 C. $646.04 OD. $668.47 11. Classify the OH Variance above (in #10) as either Over/Underapplied. OverApplied UnderApplied 12. Assuming the variance is deemed IMMATERIAL, what are the parts of the journal entry to dispose of the variance? DEBIT: O A. COGS OB. MOH OC. WIP OD. FG CREDIT: O A. MOH OB. WIP C. COGS OD. FG 13. We did an in-Class Assignment using Traditional and Activity-Based Costing. What kind of firm was this case about? A. Winery B. Candle Maker C. Brewer D. Ice cream manufacturer Click to select your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started