Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help please Jim again. In 205 the benefit formula was changed so that at the end of each year during retirement Jim will receive 4%

Help please

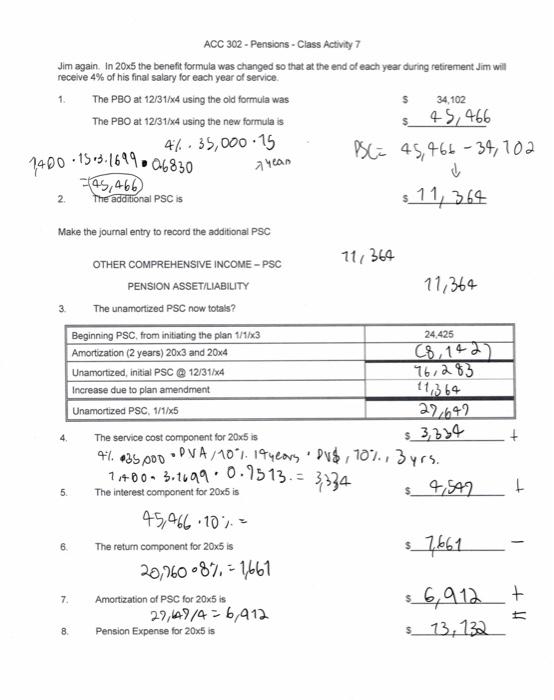

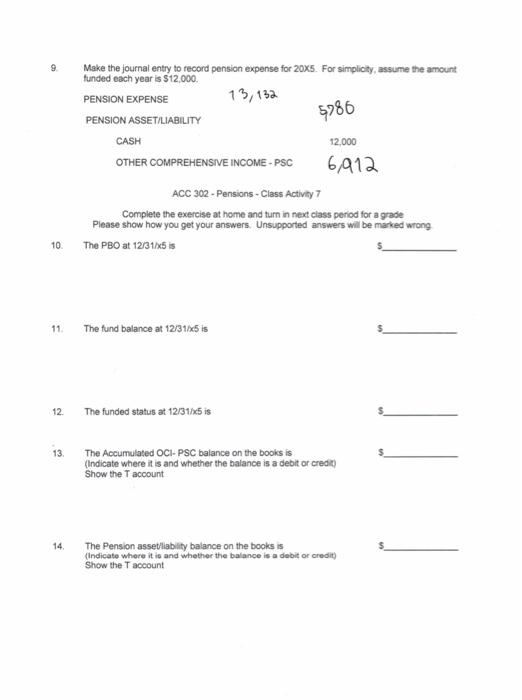

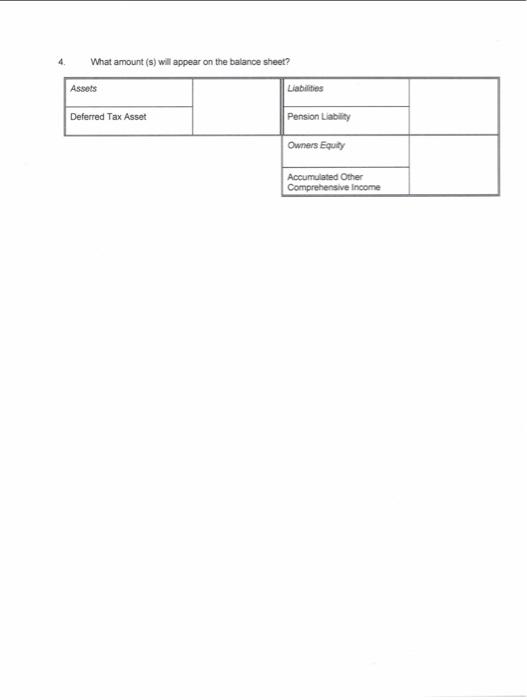

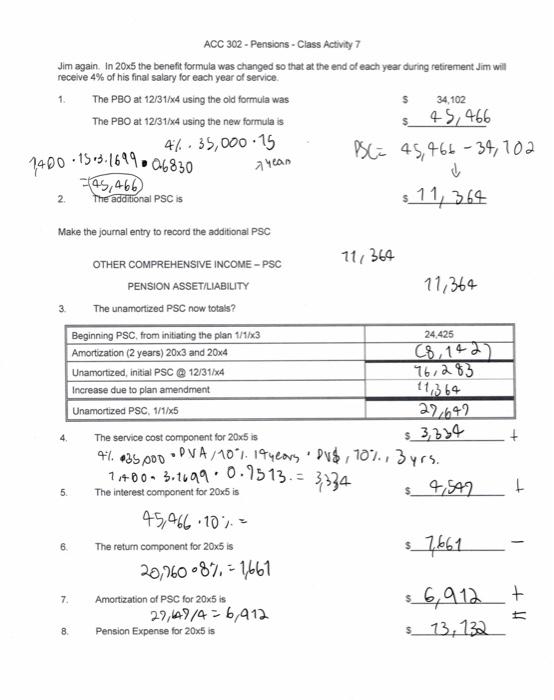

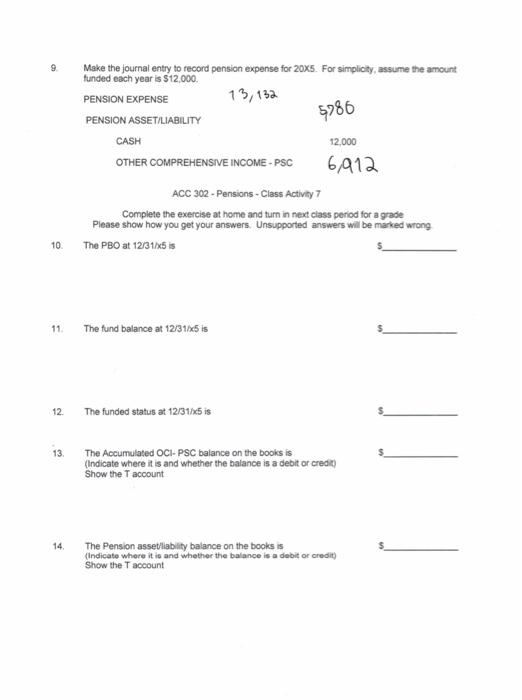

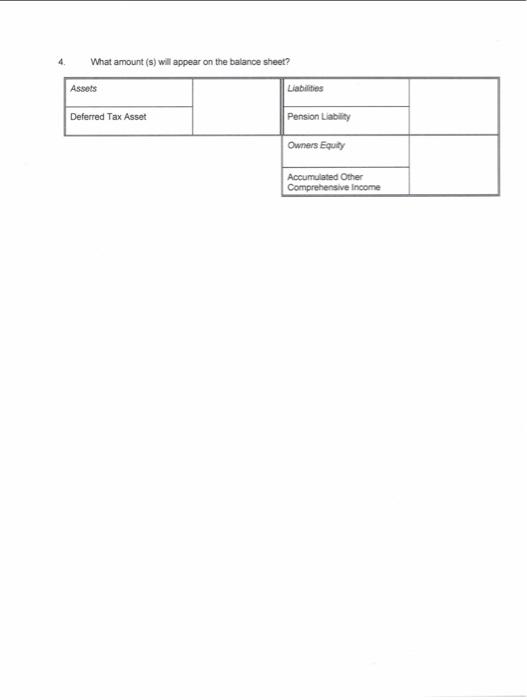

Jim again. In 205 the benefit formula was changed so that at the end of each year during retirement Jim will receive 4% of his final salary for each year of service. 1. The PBO at 12/31/4 using the old formula was The PBO at 12/31/x4 using the new formula is 534,102 4%35,00015 +00153.16990.68304 ean PSC =45,46634,10 =45,466 2. The additional PSC is 511,364 Make the joumal entry to record the additional PSC OTHER COMPREHENSIVE INCOME - PSC 71,364 PENSION ASSETLIABILTY 11,364 3. The unamortized PSC now totals? 4. The service cost component for 205 is 53,334 4%. 35000 . PVA /10%,19 years. DV $,10%,3 y rs. 1,400=3.16990.945,96610%= 6. The return component for 205 is 20,7608%=1,661 7. Amortization of PSC for 205 is 27,49/4=6,912 3. 7,661 =6,912+ 9. Make the journal entry to record pension expense for 20X5. For simplicty, assume the amount funded each year is $12,000. ACC 302 - Pensions - Class Activity 7 Complete the exercise at home and turn in next class period for a grade Please show how you get your answers. Unsupported answers wil be marked wrong 10. The PBO at 12/31/5 is 5 11. The fund balance at 12/31/x5 is s 12. The funded status at 12/31/5 is s. 13. The Accumulated OCI- PSC balance on the books is (Indicate where it is and whether the balance is a debit or crecit) s. Show the T account 14. The Pension assetliablity balance on the books is s (Indicate whore it is and whether the balance is a debit or oredit) Show the T account What amount (s) will appear on the balance sheet? Jim again. In 205 the benefit formula was changed so that at the end of each year during retirement Jim will receive 4% of his final salary for each year of service. 1. The PBO at 12/31/4 using the old formula was The PBO at 12/31/x4 using the new formula is 534,102 4%35,00015 +00153.16990.68304 ean PSC =45,46634,10 =45,466 2. The additional PSC is 511,364 Make the joumal entry to record the additional PSC OTHER COMPREHENSIVE INCOME - PSC 71,364 PENSION ASSETLIABILTY 11,364 3. The unamortized PSC now totals? 4. The service cost component for 205 is 53,334 4%. 35000 . PVA /10%,19 years. DV $,10%,3 y rs. 1,400=3.16990.945,96610%= 6. The return component for 205 is 20,7608%=1,661 7. Amortization of PSC for 205 is 27,49/4=6,912 3. 7,661 =6,912+ 9. Make the journal entry to record pension expense for 20X5. For simplicty, assume the amount funded each year is $12,000. ACC 302 - Pensions - Class Activity 7 Complete the exercise at home and turn in next class period for a grade Please show how you get your answers. Unsupported answers wil be marked wrong 10. The PBO at 12/31/5 is 5 11. The fund balance at 12/31/x5 is s 12. The funded status at 12/31/5 is s. 13. The Accumulated OCI- PSC balance on the books is (Indicate where it is and whether the balance is a debit or crecit) s. Show the T account 14. The Pension assetliablity balance on the books is s (Indicate whore it is and whether the balance is a debit or oredit) Show the T account What amount (s) will appear on the balance sheet

Jim again. In 205 the benefit formula was changed so that at the end of each year during retirement Jim will receive 4% of his final salary for each year of service. 1. The PBO at 12/31/4 using the old formula was The PBO at 12/31/x4 using the new formula is 534,102 4%35,00015 +00153.16990.68304 ean PSC =45,46634,10 =45,466 2. The additional PSC is 511,364 Make the joumal entry to record the additional PSC OTHER COMPREHENSIVE INCOME - PSC 71,364 PENSION ASSETLIABILTY 11,364 3. The unamortized PSC now totals? 4. The service cost component for 205 is 53,334 4%. 35000 . PVA /10%,19 years. DV $,10%,3 y rs. 1,400=3.16990.945,96610%= 6. The return component for 205 is 20,7608%=1,661 7. Amortization of PSC for 205 is 27,49/4=6,912 3. 7,661 =6,912+ 9. Make the journal entry to record pension expense for 20X5. For simplicty, assume the amount funded each year is $12,000. ACC 302 - Pensions - Class Activity 7 Complete the exercise at home and turn in next class period for a grade Please show how you get your answers. Unsupported answers wil be marked wrong 10. The PBO at 12/31/5 is 5 11. The fund balance at 12/31/x5 is s 12. The funded status at 12/31/5 is s. 13. The Accumulated OCI- PSC balance on the books is (Indicate where it is and whether the balance is a debit or crecit) s. Show the T account 14. The Pension assetliablity balance on the books is s (Indicate whore it is and whether the balance is a debit or oredit) Show the T account What amount (s) will appear on the balance sheet? Jim again. In 205 the benefit formula was changed so that at the end of each year during retirement Jim will receive 4% of his final salary for each year of service. 1. The PBO at 12/31/4 using the old formula was The PBO at 12/31/x4 using the new formula is 534,102 4%35,00015 +00153.16990.68304 ean PSC =45,46634,10 =45,466 2. The additional PSC is 511,364 Make the joumal entry to record the additional PSC OTHER COMPREHENSIVE INCOME - PSC 71,364 PENSION ASSETLIABILTY 11,364 3. The unamortized PSC now totals? 4. The service cost component for 205 is 53,334 4%. 35000 . PVA /10%,19 years. DV $,10%,3 y rs. 1,400=3.16990.945,96610%= 6. The return component for 205 is 20,7608%=1,661 7. Amortization of PSC for 205 is 27,49/4=6,912 3. 7,661 =6,912+ 9. Make the journal entry to record pension expense for 20X5. For simplicty, assume the amount funded each year is $12,000. ACC 302 - Pensions - Class Activity 7 Complete the exercise at home and turn in next class period for a grade Please show how you get your answers. Unsupported answers wil be marked wrong 10. The PBO at 12/31/5 is 5 11. The fund balance at 12/31/x5 is s 12. The funded status at 12/31/5 is s. 13. The Accumulated OCI- PSC balance on the books is (Indicate where it is and whether the balance is a debit or crecit) s. Show the T account 14. The Pension assetliablity balance on the books is s (Indicate whore it is and whether the balance is a debit or oredit) Show the T account What amount (s) will appear on the balance sheet

Help please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started