Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help please. Journalizing Departmental Sales, Sales Returns and Allowances, and Cash Receipts Ellis Paint sells paint and paint supplies. Many customers purchase merchandise from both

Help please.

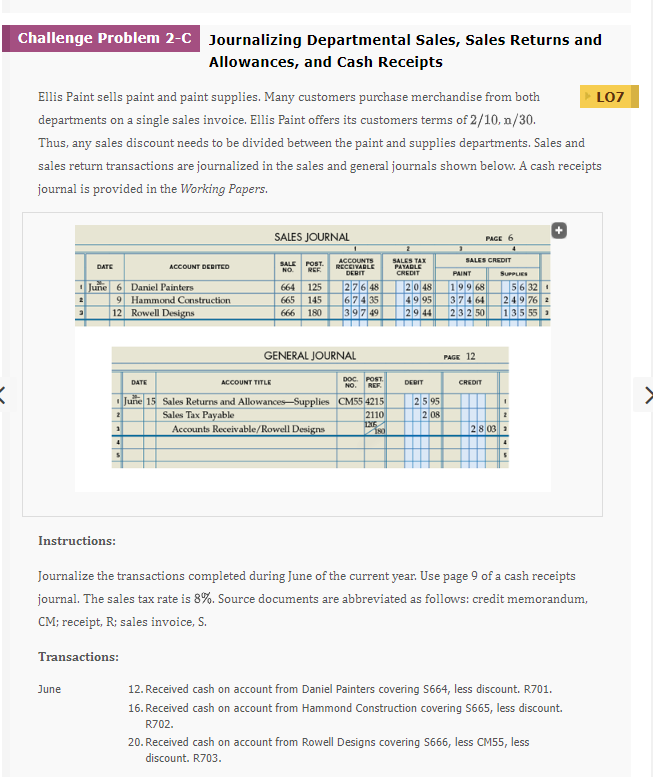

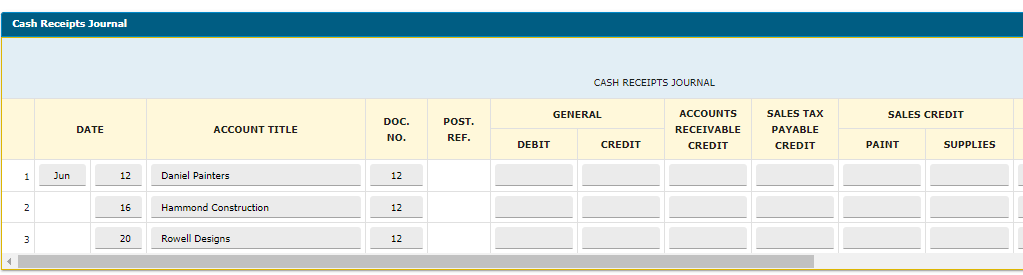

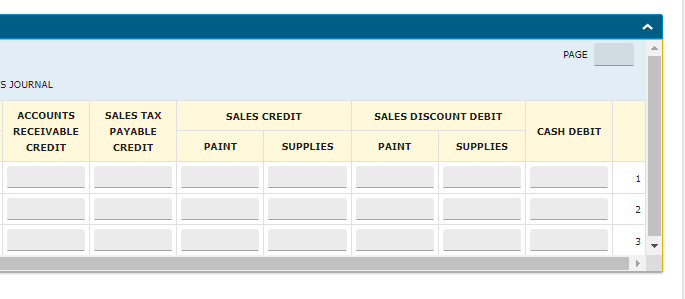

Journalizing Departmental Sales, Sales Returns and Allowances, and Cash Receipts Ellis Paint sells paint and paint supplies. Many customers purchase merchandise from both departments on a single sales invoice. Ellis Paint offers its customers terms of 2/10,n/30. Thus, any sales discount needs to be divided between the paint and supplies departments. Sales and sales return transactions are journalized in the sales and general journals shown below. A cash receipts journal is provided in the Working Papers. Instructions: Journalize the transactions completed during June of the current year. Use page 9 of a cash receipts journal. The sales tax rate is 8%. Source documents are abbreviated as follows: credit memorandum, CM; receipt, R; sales invoice, S. Transactions: June 12. Received cash on account from Daniel Painters covering S664, less discount. R701. 16. Received cash on account from Hammond Construction covering S665, less discount. R702. 20. Received cash on account from Rowell Designs covering S666, less CM55, less discount. R703. Cash Receipts Journal Journalizing Departmental Sales, Sales Returns and Allowances, and Cash Receipts Ellis Paint sells paint and paint supplies. Many customers purchase merchandise from both departments on a single sales invoice. Ellis Paint offers its customers terms of 2/10,n/30. Thus, any sales discount needs to be divided between the paint and supplies departments. Sales and sales return transactions are journalized in the sales and general journals shown below. A cash receipts journal is provided in the Working Papers. Instructions: Journalize the transactions completed during June of the current year. Use page 9 of a cash receipts journal. The sales tax rate is 8%. Source documents are abbreviated as follows: credit memorandum, CM; receipt, R; sales invoice, S. Transactions: June 12. Received cash on account from Daniel Painters covering S664, less discount. R701. 16. Received cash on account from Hammond Construction covering S665, less discount. R702. 20. Received cash on account from Rowell Designs covering S666, less CM55, less discount. R703. Cash Receipts JournalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started