Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please Littlefield's supplier moved to a different city and now once an inventory replenishment order is placed, it takes exactly 7 days for the

help please

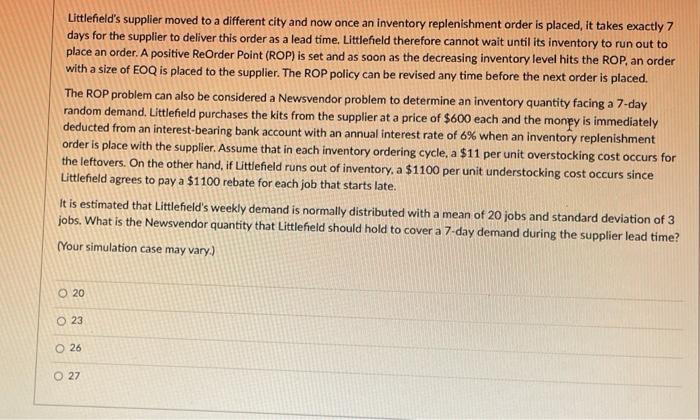

Littlefield's supplier moved to a different city and now once an inventory replenishment order is placed, it takes exactly 7 days for the supplier to deliver this order as a lead time. Littlefield therefore cannot wait until its inventory to run out to place an order. A positive ReOrder Point (ROP) is set and as soon as the decreasing inventory level hits the ROP, an order with a size of EOQ is placed to the supplier. The ROP policy can be revised any time before the next order is placed. The ROP problem can also be considered a Newsvendor problem to determine an inventory quantity facing a 7-day random demand, Littlefield purchases the kits from the supplier at a price of $600 each and the money is immediately deducted from an interest-bearing bank account with an annual interest rate of 6% when an inventory replenishment order is place with the supplier. Assume that in each inventory ordering cycle, a $11 per unit overstocking cost occurs for the leftovers. On the other hand, if Littlefield runs out of inventory, a $1100 per unit understocking cost occurs since Littlefield agrees to pay a $1100 rebate for each job that starts late. What is the Critical Ratio in the Newsvendor model to help Littlefield decide how many units to hold to cover a 7-day demand during the supplier lead time? (The Critical Ratio is, in essence, the optimal service level to run.) (Your simulation case may vary.) O-11/1100 O-1100/(1100+11) O-11/(1100+11) O-11/(1100-11) Littlefield's supplier moved to a different city and now once an inventory replenishment order is placed, it takes exactly 7 days for the supplier to deliver this order as a lead time. Littlefield therefore cannot wait until its inventory to run out to place an order. A positive ReOrder Point (ROP) is set and as soon as the decreasing inventory level hits the ROP, an order with a size of EOQ is placed to the supplier. The ROP policy can be revised any time before the next order is placed. The ROP problem can also be considered a Newsvendor problem to determine an inventory quantity facing a 7-day random demand. Littlefield purchases the kits from the supplier at a price of $600 each and the money is immediately deducted from an interest-bearing bank account with an annual interest rate of 6% when an inventory replenishment order is place with the supplier. Assume that in each inventory ordering cycle, a $11 per unit overstocking cost occurs for the leftovers. On the other hand, if Littlefield runs out of inventory, a $1100 per unit understocking cost occurs since Littlefield agrees to pay a $1100 rebate for each job that starts late. It is estimated that Littlefield's weekly demand is normally distributed with a mean of 20 jobs and standard deviation of 3 jobs. What is the Newsvendor quantity that Littlefield should hold to cover a 7-day demand during the supplier lead time? (Your simulation case may vary.) O 20 O 23 O 26 O 27 Littlefield's supplier moved to a different city and now once an inventory replenishment order is placed, it takes exactly 7 days for the supplier to deliver this order as a lead time. Littlefield therefore cannot wait until its inventory to run out to place an order. A positive ReOrder Point (ROP) is set and as soon as the decreasing inventory level hits the ROP, an order with a size of EOQ is placed to the supplier. The ROP policy can be revised any time before the next order is placed. The ROP problem can also be considered a Newsvendor problem to determine an inventory quantity facing a 7-day random demand, Littlefield purchases the kits from the supplier at a price of $600 each and the money is immediately deducted from an interest-bearing bank account with an annual interest rate of 6% when an inventory replenishment order is place with the supplier. Assume that in each inventory ordering cycle, a $11 per unit overstocking cost occurs for the leftovers. On the other hand, if Littlefield runs out of inventory, a $1100 per unit understocking cost occurs since Littlefield agrees to pay a $1100 rebate for each job that starts late. What is the Critical Ratio in the Newsvendor model to help Littlefield decide how many units to hold to cover a 7-day demand during the supplier lead time? (The Critical Ratio is, in essence, the optimal service level to run.) (Your simulation case may vary.) O-11/1100 O-1100/(1100+11) O-11/(1100+11) O-11/(1100-11) Littlefield's supplier moved to a different city and now once an inventory replenishment order is placed, it takes exactly 7 days for the supplier to deliver this order as a lead time. Littlefield therefore cannot wait until its inventory to run out to place an order. A positive ReOrder Point (ROP) is set and as soon as the decreasing inventory level hits the ROP, an order with a size of EOQ is placed to the supplier. The ROP policy can be revised any time before the next order is placed. The ROP problem can also be considered a Newsvendor problem to determine an inventory quantity facing a 7-day random demand. Littlefield purchases the kits from the supplier at a price of $600 each and the money is immediately deducted from an interest-bearing bank account with an annual interest rate of 6% when an inventory replenishment order is place with the supplier. Assume that in each inventory ordering cycle, a $11 per unit overstocking cost occurs for the leftovers. On the other hand, if Littlefield runs out of inventory, a $1100 per unit understocking cost occurs since Littlefield agrees to pay a $1100 rebate for each job that starts late. It is estimated that Littlefield's weekly demand is normally distributed with a mean of 20 jobs and standard deviation of 3 jobs. What is the Newsvendor quantity that Littlefield should hold to cover a 7-day demand during the supplier lead time? (Your simulation case may vary.) O 20 O 23 O 26 O 27

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started