Answered step by step

Verified Expert Solution

Question

1 Approved Answer

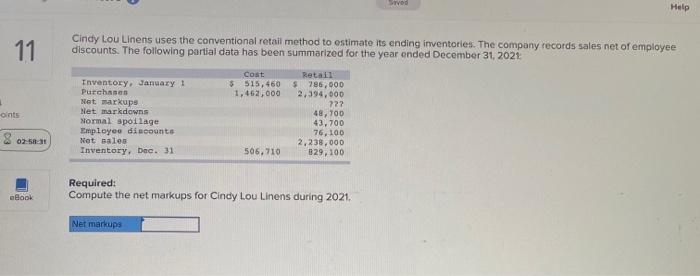

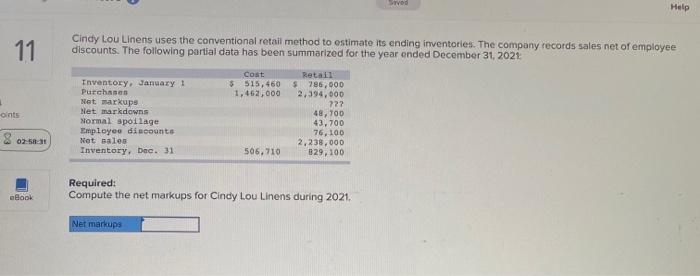

HELP PLEASE od Help 11 Cindy Lou Linens uses the conventional retail method to estimato its ending inventories. The company records sales net of employee

HELP PLEASE

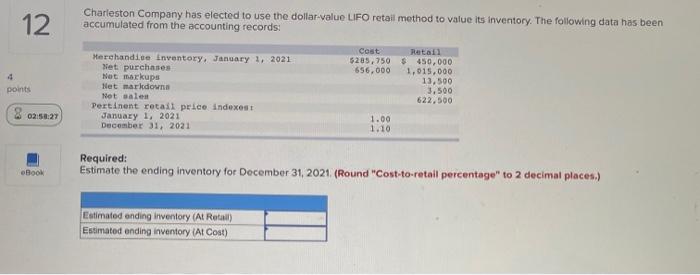

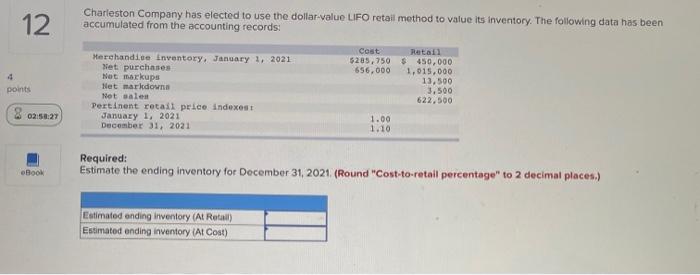

od Help 11 Cindy Lou Linens uses the conventional retail method to estimato its ending inventories. The company records sales net of employee discounts. The following partial data has been summarized for the year ended December 31, 2021 Cost $S15,460 1,462,000 . oints Inventory. January ! Purchase Net markups Net markdowns Normal spoilage Employeu discounts Not bales Inventory. Dec. 31 Retail $ 786,000 2,394,000 722 48,700 43,700 76,100 2,238.000 B29, 100 02-580 506,710 Required: Compute the net markups for Cindy Lou Linens during 2021. Book Net markups 12 Charleston Company has elected to use the dollar-value LIFO retail method to value its inventory. The following data has been accumulated from the accounting records 4 points Merchandise Inventory, January 1, 2021 Net purchases Not markups Net markdown Not sale Pertinent retail price indexes January 1, 2021 December 31, 2021 Cost Retail 5285,750 $450,000 656.000 1.015.000 13,500 3.500 622,500 02:58:22 1.00 1.10 Required: Estimate the ending inventory for December 31, 2021. (Round "Cost-to-retail percentage" to 2 decimal places.) Book Estimated ending inventory (At Retail) Estimated ending inventory (Al Cost)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started