HELP PLEASE!! OMG

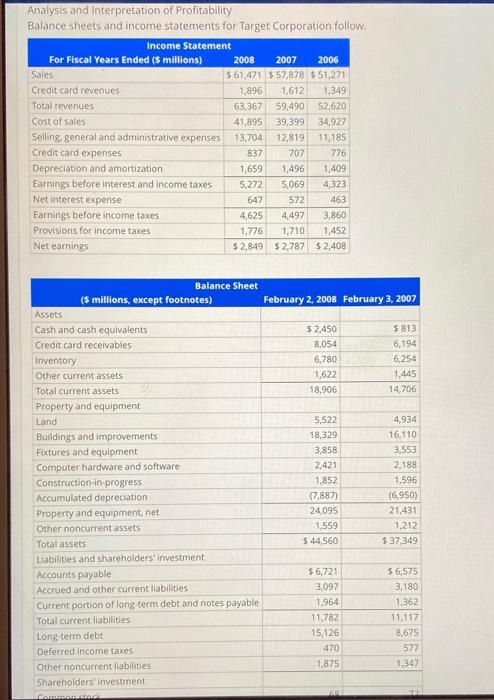

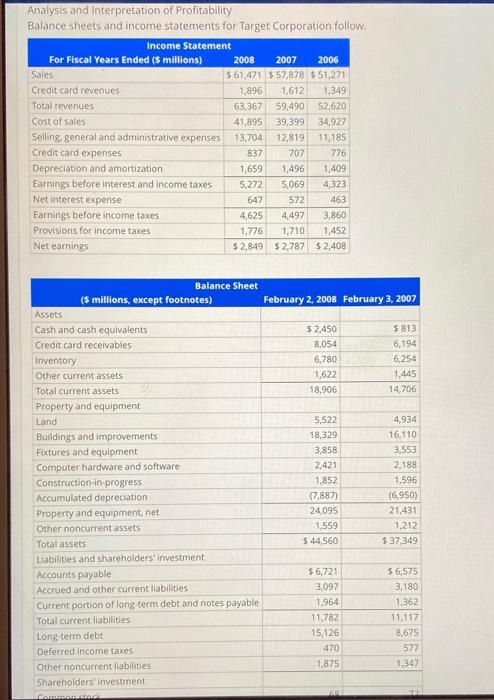

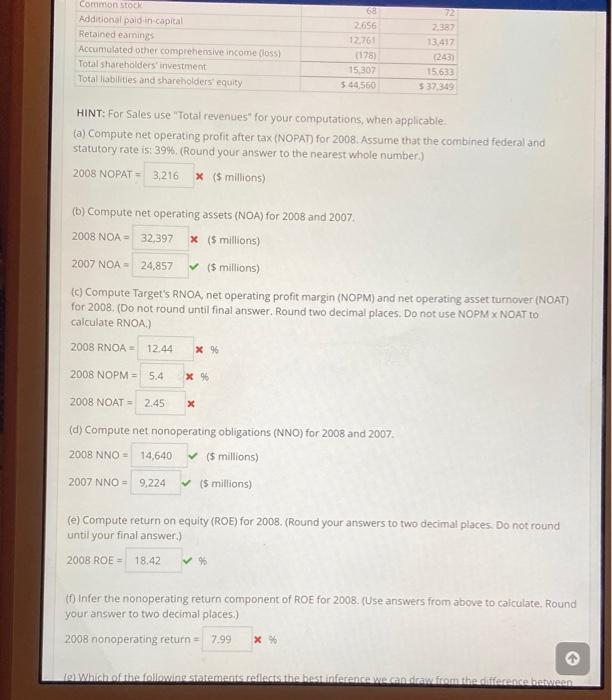

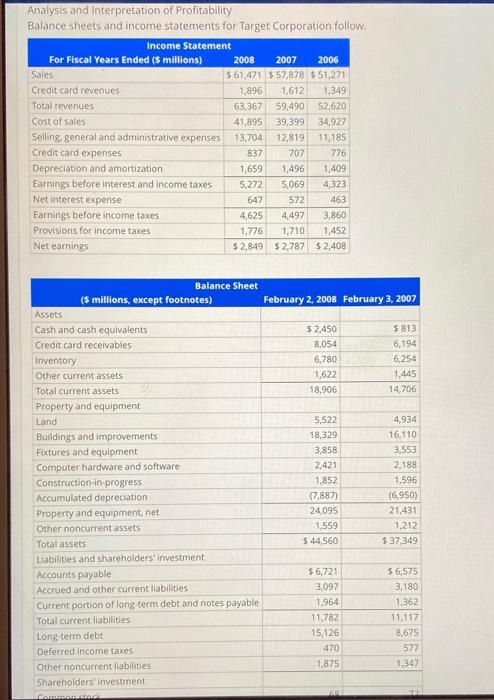

Analysis and Interpretation of Profitability Balance sheets and income statements for Target Corporation follow Income Statement For Fiscal Years Ended (5 millions) 2008 2007 2006 Sales 561,471 $57,878 $ 51,271 Credit card revenues 1.896 1,612 1,349 Total revenues 63,367 59,490 52,620 Cost of sales 41,895 39,399 34,927 Selling general and administrative expenses 13,704 12,819 11,185 Credit card expenses 837 707 776 Depreciation and amortization 1,659 1,496 1,409 Earnings before interest and income taxes 5,272 5,069 4,323 Net interest expense 647 572 463 Earnings before income taxes 4,625 4,497 3,860 Provisions for income taxes 1.776 1.710 1,452 Net earnings $ 2,849 $ 2,787 $ 2,408 February 2, 2008 February 3, 2007 $ 2,450 8,054 6,780 1,622 18,906 $ 813 6,194 6,254 1,445 14,706 Balance Sheet (5 millions, except footnotes) Assets Cash and cash equivalents Credit card receivables Inventory Other current assets Total current assets Property and equipment Land Buildings and improvements Fixtures and equipment Computer hardware and software Construction-in-progress Accumulated depreciation Property and equipment, net Other noncurrent assets Total assets Llabilities and shareholders' investment Accounts payable Accrued and other current liabilities Current portion of long-term debt and notes payable Total current liabilities Long-term debt Deferred income taxes Other noncurrent liabilities Shareholders investment ORD 5,522 18,329 3,858 2,421 1.852 (7.887) 24,095 1,559 $ 44,560 4,934 16,110 3.553 2,188 1,596 (6,950) 21,431 1,212 $ 37,349 $ 6,721 3,097 1.964 11.782 15.126 470 1,875 $6,575 3,180 1,362 11.117 8,675 577 1,347 Common Stock Additional paid in capital Retained earnings Accumulated other comprehensive income (los) Total shareholders investment Total liabilities and shareholders' equity 6a 2656 12.76 (178) 15 307 5.44,560 2.387 13.417 243 15633 537.349 HINT: For Sales use "Total revenues" for your computations, when applicable. (a) Compute net operating profit after tax (NOPAT) for 2008. Assume that the combined federal and statutory rate is: 39%, (Round your answer to the nearest whole number) 2008 NOPAT 3216 X (5 millions) (b) Compute net operating assets (NOA) for 2008 and 2007 2008 NOA 32,397 * (5 millions) 2007 NOA = 24.857 (5 millions) (c) Compute Target's RNOA, net operating profit margin (NOPM) and net operating asset turnover (NOAT) for 2008. (Do not round until final answer. Round two decimal places. Do not use NOPMX NOAT O calculate RNOA) 2008 RNOA 12.44 x 96 2008 NOPM = 5.4 X 96 2008 NOAT = 2.45 (d) Compute net nonoperating obligations (NNO) for 2008 and 2007 2008 NNO 14,640 (5 millions) 2007 NNO = 9,224 (5 millions) (e) Compute return on equity (ROE) for 2008. (Round your answers to two decimal places. Do not round until your final answer.) 2008 ROE - 18.42 % th Infer the nonoperating return component of ROE for 2008. (Use answers from above to calculate. Round your answer to two decimal places.) 2008 nonoperating return= 7.99 To which of the following statements.cafilesitheasternrewanawaom the difference hawan