Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please on the last part! Tasteful Pizza bought a used Ford delivery van on January 2,2021 , for $23,000. The van was expected to

help please on the last part!

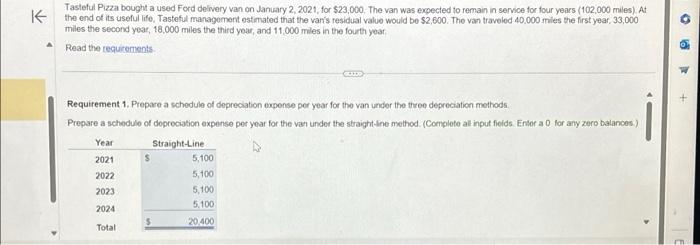

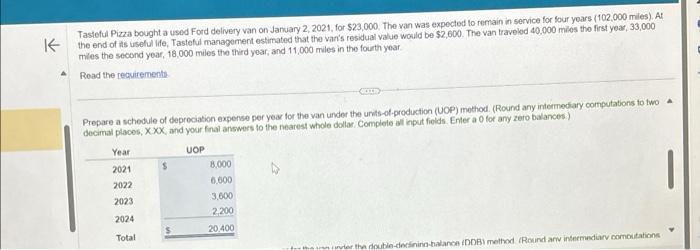

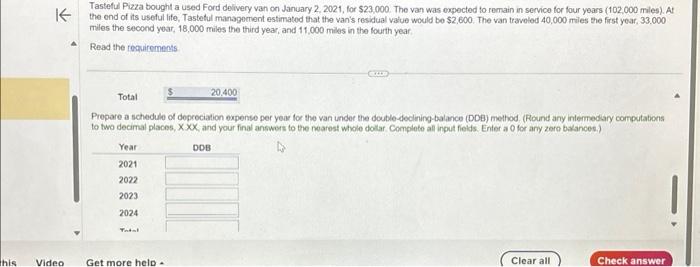

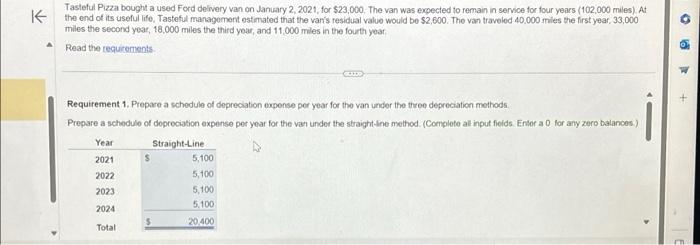

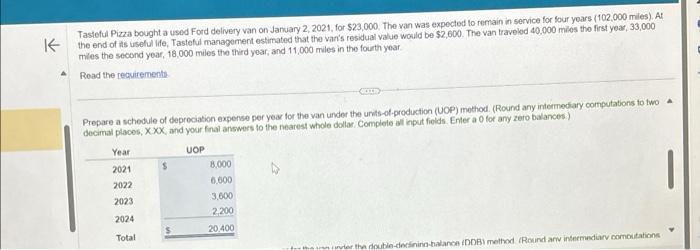

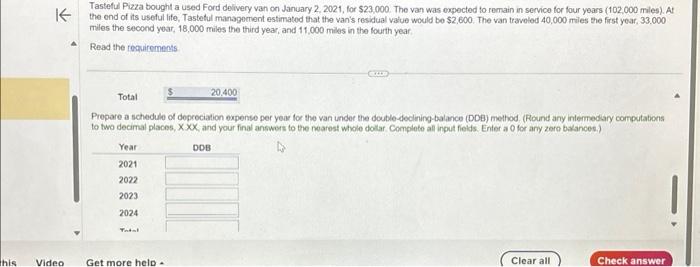

Tasteful Pizza bought a used Ford delivery van on January 2,2021 , for $23,000. The van was expected to remain in service for four yoars (102,000 miles). At the end of its useful tife. Tasteful manegoment estimated that the var's residual value would be $2,600. The van traveled 40,000 miles the first yeas, 33,000 miles the second year, 18,000 miles the third yoar, and 11,000 miles in the fourth yoar. Road the reavirements Prepare a schedule of depreciation expense per yea tor the van under the unts-ot-production (UOP) method. (Round any intermediary computations to two Tasteful Pizza bought a used Ford delivery van on January 2, 2021, for $23,000. The van was oxpected to remain in service for four years (102,000 miles). the end of its uselul life, Tasteful manaporvent estimated that the van's residual value would be $2,600, The van travolod 40,000 miles Ehe first year, 33,000 miles the second yoar, 18,000 miles the third year, and 11,000 miles in the fourth year. Read the reouirements Prepare a schedule of deprociation expense per year for the van under the double-declining-balance (DDE) method. (Round any intemediary computatons to two decirnal places, XX, and your final answors to the nearest whole dollar. Completo all input fields. Enter a 0 for ary zero baxances.) Tasteful Pizza bought a used Ford delvery van on January 2, 2021, for $23,000. The van was expected to remain in service for tour years ( 102,000 miles). At the end of its useful life. Tasteful management estimated that the varf's residual valuo would bo $2,600. Tho van travelod 40,000 miles the first year, 33,000 miles the second year, 18,000 miles the third yoar, and 11,000 miles in the fourth your. Read the requirements Requirement 1. Prepare a schedule of depreciation expense per year for the van under the theo depreciation methods. Prepare a schedule of depreciation expense per year for the van under the straight fine method. (Cornplete all input fieids. Enter a 0 for any zero balancess)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started