Answered step by step

Verified Expert Solution

Question

1 Approved Answer

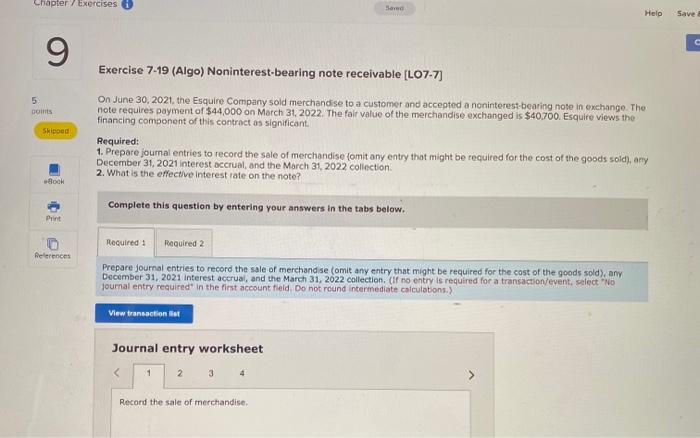

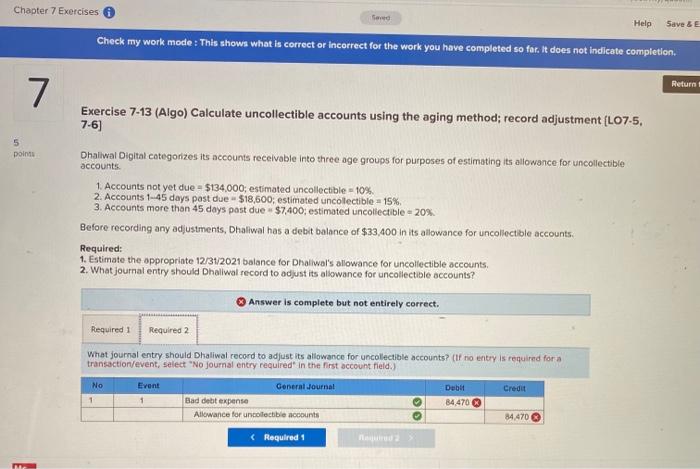

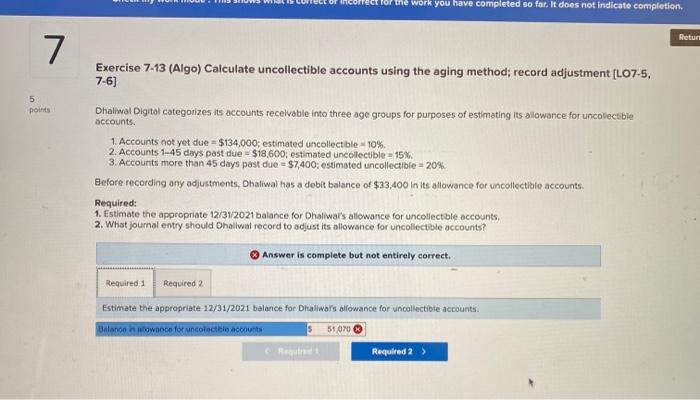

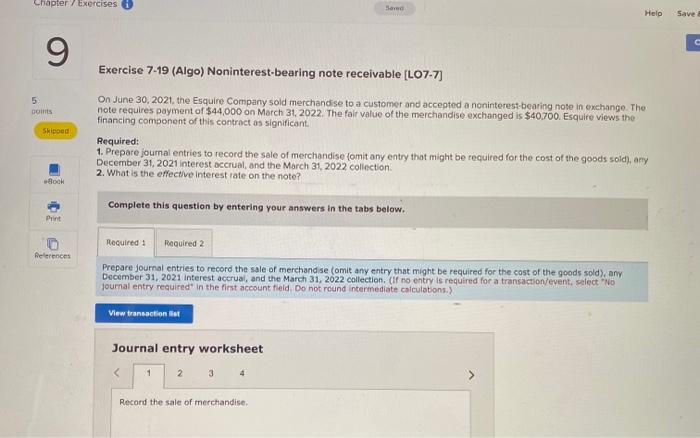

Help please!! please answer all and type answers clearly!! Thank you so much!! Chapter / Exercises Sore Help Save C 9 Exercise 7-19 (Algo) Noninterest-bearing

Help please!!

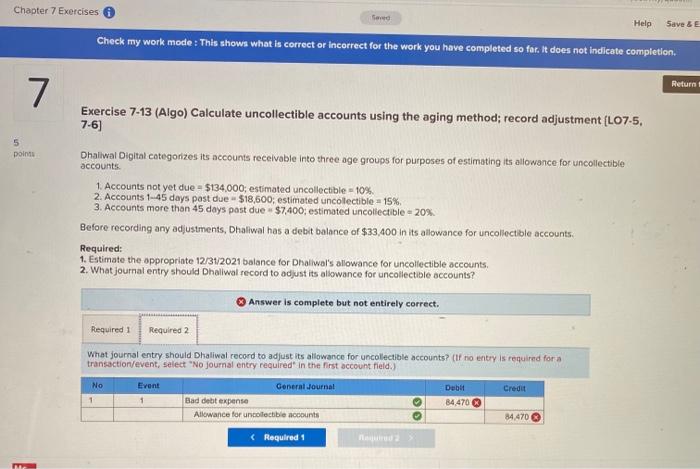

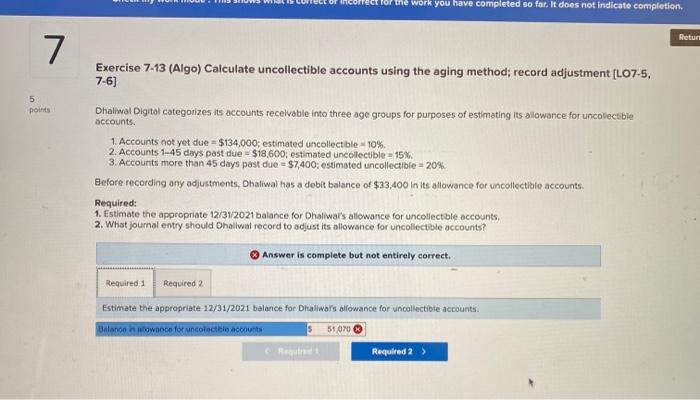

Chapter / Exercises Sore Help Save C 9 Exercise 7-19 (Algo) Noninterest-bearing note receivable [LO7-7) 5 DO Skised On June 30, 2021. the Esquire Company sold merchandise to a customer and accepted a noninterest-bearing note in exchange. The note requires payment of $44.000 on March 31, 2022. The fair value of the merchandise exchanged is $40.700. Esquire views the financing component of this contract as significant Required: 1. Prepare journal entries to record the sale of merchandise (omit any entry that might be required for the cost of the goods sold), any December 31, 2021 interest accrual, and the Morch 31, 2022 collection 2. What is the effective interest rate on the note? Complete this question by entering your answers in the tabs below. Print Required: Required 2 References Prepare journal entries to record the sale of merchandise comit any entry that might be required for the cost of the goods sold), any December 31, 2021 Interest accrual, and the March 31, 2022 collection. (If no entry is required for a transaction/event, select "No Journal entry required in the first account field. Do not round Intermediate calculations.) View transaction lit Journal entry worksheet 3 1 2 4 Record the sale of merchandise, Chapter 7 Exercises Swed Help Save E Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion Return 7 Exercise 7-13 (Algo) Calculate uncollectible accounts using the aging method; record adjustment (L07-5, 7-6) 5 points Dhaliwal Digital categorizes its accounts receivable into three age groups for purposes of estimating its allowance for uncollectible accounts 1. Accounts not yet due = $134,000; estimated uncollectible - 10% 2. Accounts 1-45 days past due - $18,600; estimated uncollectible = 15% 3. Accounts more than 45 days past due $7,400; estimated uncollectible -20% Before recording any adjustments, Dhaliwal has a debit balance of $33,400 In its allowance for uncollectible accounts. Required: 1. Estimate the appropriate 12/312021 balance for Dhaliwal's allowance for uncollectible accounts. 2. What journal entry should Dhaliwal record to adjust its allowance for uncollectible accounts? Answer is complete but not entirely correct. Required 1 Required 2 What journal entry should Dhaliwal record to adjust its allowance for uncollectible accounts? (no entry is required for a transaction/event, select "No journal entry required in the first account field. No General Journal Dublt Credit 1 Bad debt expense 84.470 Allowance for uncollectible accounts 84.470 please answer all and type answers clearly!! Thank you so much!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started