Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please? Please select the correct answer choice. Question 3 4 pts Which of the following investments has the highest effective annual return (EAR)? (Assume

help please?

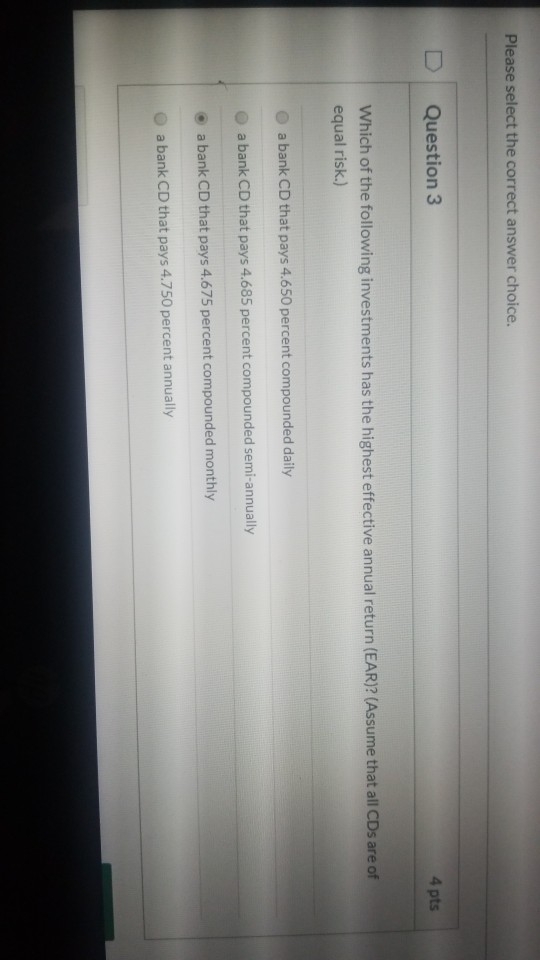

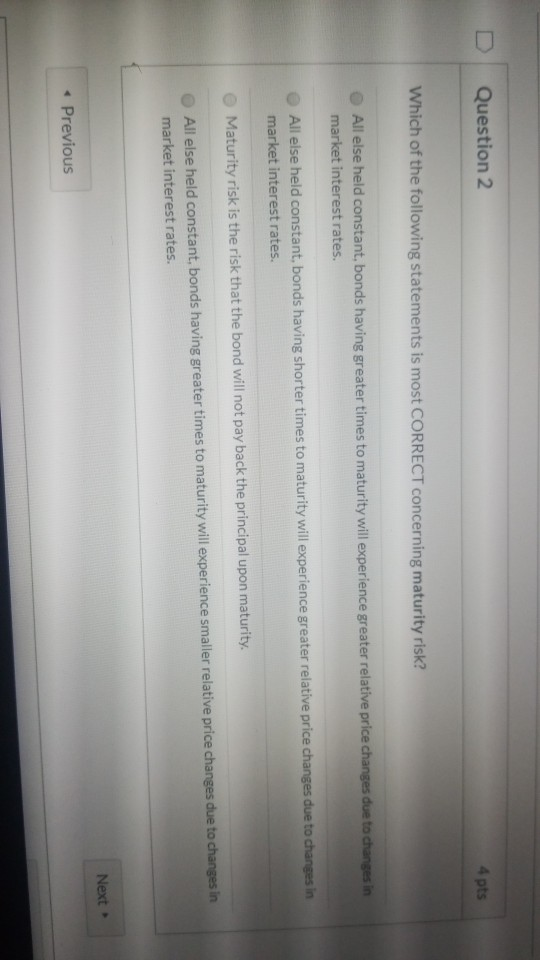

Please select the correct answer choice. Question 3 4 pts Which of the following investments has the highest effective annual return (EAR)? (Assume that all CDs are of equal risk.) a bank CD that pays 4.650 percent compounded daily a bank CD that pays 4.685 percent compounded semi-annually a bank CD that pays 4.675 percent compounded monthly a bank CD that pays 4.750 percent annually Question 2 4 pts Which of the following statements is most CORRECT concerning maturity risk? All else held constant, bonds having greater times to maturity will experience greater relative price changes due to changes in market interest rates. All else held constant, bonds having shorter times to maturity will experience greater relative price changes due to changes in market interest rates. Maturity risk is the risk that the bond will not pay back the principal upon maturity. All else held constant, bonds having greater times to maturity will experience smaller relative price changes due to changes in market interest rates. Next * PreviousStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started