help please

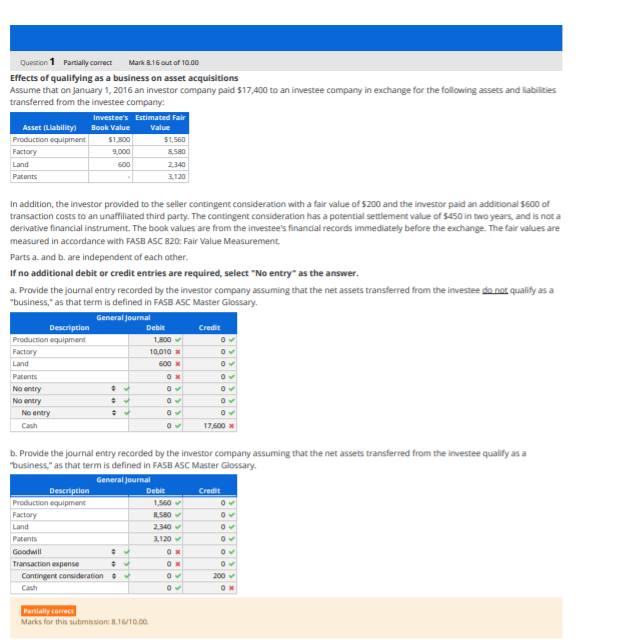

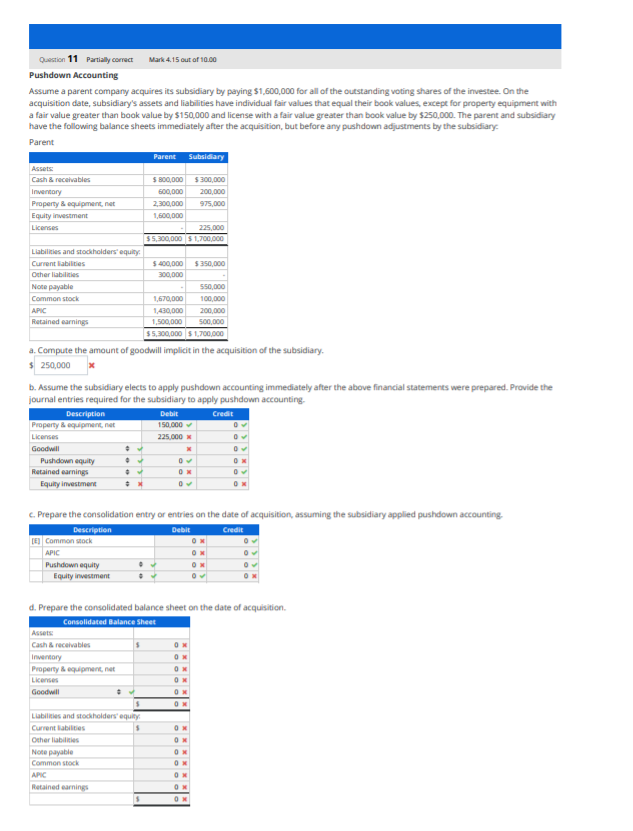

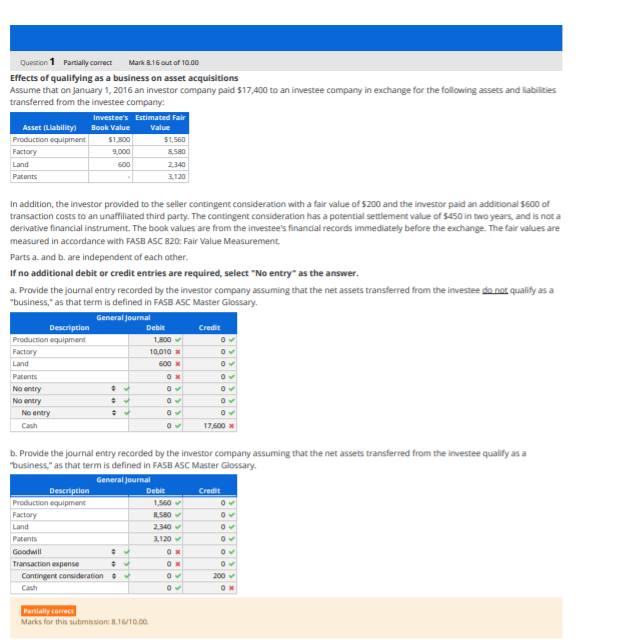

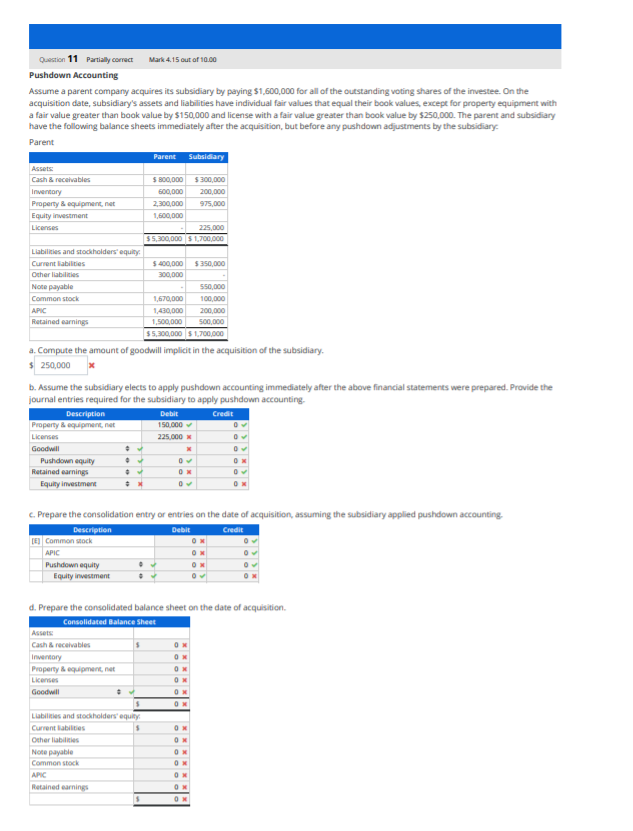

Question 1 Partially correct Mark 8.16 out of 10.00 Effects of qualifying as a business on asset acquisitions Assume that on January 1, 2016 an investor company paid $17.400 to an investee company in exchange for the following assets and liabilities transferred from the investee company: Investee's Estimated Fair Asset (Liability Book Value Production equipment $1,800 $1,560 Factory 8.580 Land 500 2.340 Patents 3.120 Value In addition, the investor provided to the seller contingent consideration with a fair value of $200 and the investor paid an additional $600 of transaction costs to an unaffiliated third party. The contingent consideration has a potential settlement value of $450 in two years, and is not a derivative financial instrument. The book values are from the investee's financial records immediately before the exchange. The fair values are measured in accordance with FASE ASC 820: Fair Value Measurement Parts a. and b. are independent of each other. If no additional debit or credit entries are required, select "No entry" as the answer. a. Provide the joumal entry recorded by the investor company assuming that the net assets transferred from the investee de not qualify as a "business," as that term is defined in FASB ASC Master Glossary General Journal Description Credit Production equipment 1.800 10,010 X Debit Factory Land Patents 600 No entry No entry No entry 0 3 Cash 17600 x b. Provide the journal entry recorded by the investor company assuming that the net assets transferred from the investee qualify as a business," as that term is defined in FASB ASC Master Glossary. General Journal Description Debit Credit Production equipment 1.560 0 Factory Land 2.340 Patents 3,120 Goodwill Transaction expense Contingent consideration Cash OX Partially correct Marks for this submission 8.16/10.00 Question 11 Partially correct Mark 4.15 out of 10.00 Pushdown Accounting Assume a parent company acquires its subsidiary by paying $1,600,000 for all of the outstanding voting shares of the investee. On the acquisition date, subsidiary's assets and liabilities have individual fair values that equal their book values, except for property equipment with a fair value greater than book value by $150,000 and license with a fair value greater than book value by $250,000. The parent and subsidiary have the following balance sheets immediately after the acquisition, but before any pushdown adjustments by the subsidiary Parent Parent Subsidiary Assets Cash & receivables $ 800,000 $ 300,000 Inventory 600,000 200,000 Property & equipment, net 2.300,000 975,000 Equity investment 1.600.000 Licenses 225,000 $5,300,000 $1,700,000 Llabilities and stockholders' equity Current liabilities $400,000 $ 350,000 Other abilities 300,000 Notepayable 550,000 Common stock 1,670,000 100,000 APIC 1.430,000 200,000 Retained earnings 1,500,000 500,000 $5,300,000 $1,700,000 a. Compute the amount of goodwill implicit in the acquisition of the subsidiary. $ 250,000 b. Assume the subsidiary elects to apply pushdown accounting immediately after the above financial statements were prepared. Provide the journal entries required for the subsidiary to apply pushdown accounting Description Debit Credit Property & equipment, net 150.000 License 225.000 Goodwill Pushdown quity Retained earnings Equity investment OM O Debit Credit C. Prepare the consolidation entry or entries on the date of acquisition, assuming the subsidiary applied pushdown accounting Description DE) Common stock APIC Pushdown equity Equity investment OX d. Prepare the consolidated balance sheet on the date of acquisition Consolidated Balance Sheet Assets Cash & receivables $ OX Inventory OX Property & equipment, net OX Lenses OX Goodwill OX 5 OX Labilities and stockholders' equity Current abilities 5 OX Other abilities OX Notepayable OM Common stock ON APIC OX Retained earnings ON O