Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP PLEASE!!!!! Question 10 (1.5 points) Over the past 7 years the dividends of Sunshine Mining have grown from $0.24 to the current level of

HELP PLEASE!!!!!

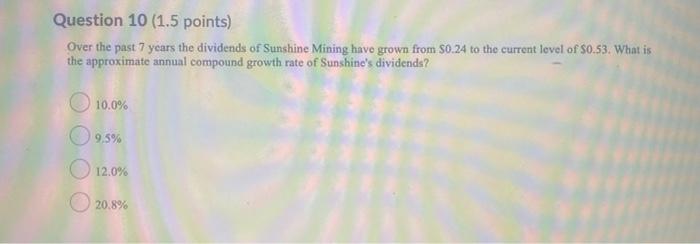

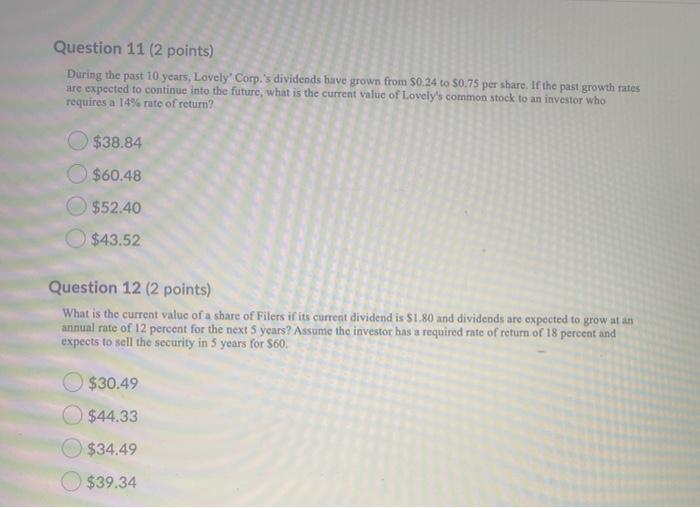

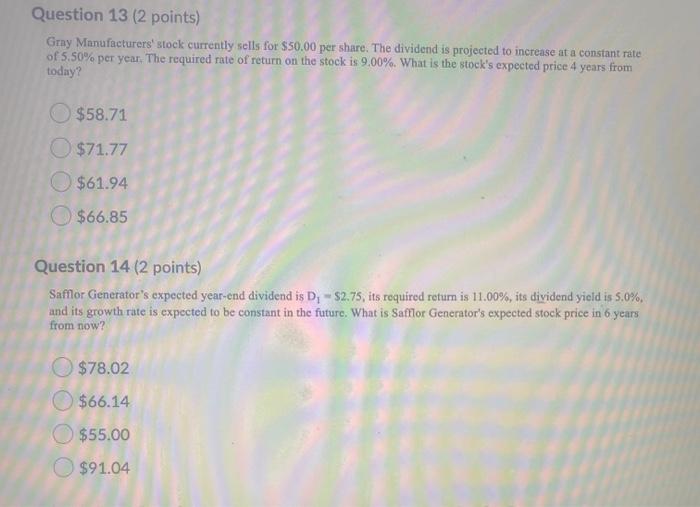

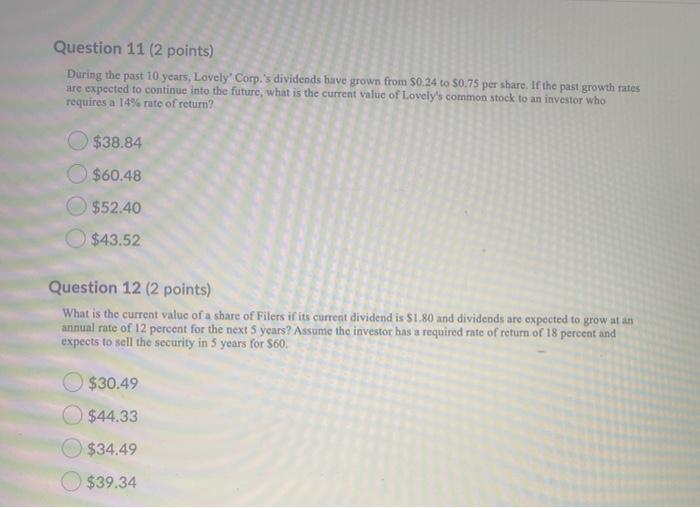

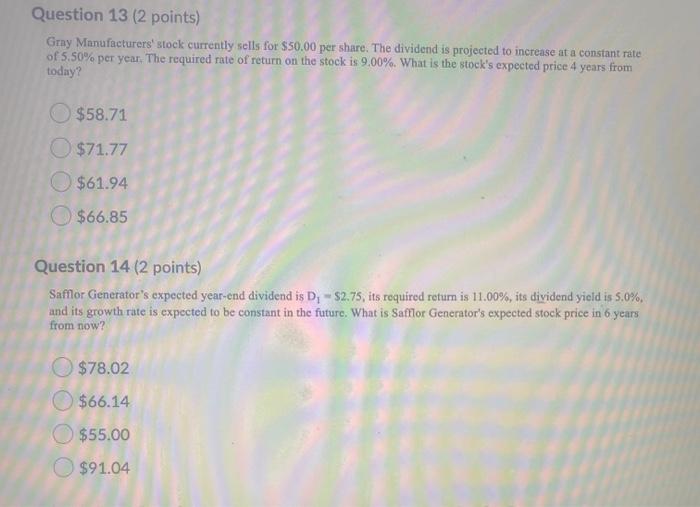

Question 10 (1.5 points) Over the past 7 years the dividends of Sunshine Mining have grown from $0.24 to the current level of $0.53. What is the approximate annual compound growth rate of Sunshine's dividends? 10.0% 9,5% 12.0% 20.8% Question 11 (2 points) During the past 10 years, Lovely Corp.'s dividends have grown from $0.24 to $0.75 per share. If the past growth rates are expected to continue into the future, what is the current value of Lovely's common stock to an investor who requires a 14% rate of return? $38.84 $60.48 $52.40 $43.52 Question 12 (2 points) What is the current value of a share of Filers if its current dividend is $1.80 and dividends are expected to grow at an annual rate of 12 percent for the next 5 years? Assume the investor has a required rate of return of 18 percent and expects to sell the security in 5 years for 560 $30.49 $44.33 $34.49 $39.34 Question 13 (2 points) Gry Manufacturers' stock currently sells for $50.00 per share. The dividend is projected to increase at a constant rate of 5.50% per year. The required rate of return on the stock is 9.00%. What is the stock's expected price 4 years from today? $58.71 $71.77 $61.94 $66.85 Question 14 (2 points) Safflor Generator's expected year-end dividend is D. - $2.75, its required return is 11.00%, its dividend yield is 5.0%. and its growth rate is expected to be constant in the future. What is Safflor Generator's expected stock price in 6 years from now? $78.02 $66.14 $55.00 $91.04

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started