Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please QUESTION 13 David is looking to buy a home for $1,000,000. The bank is offering him a 15 year fixed ratefully amortizing mortgage

help please

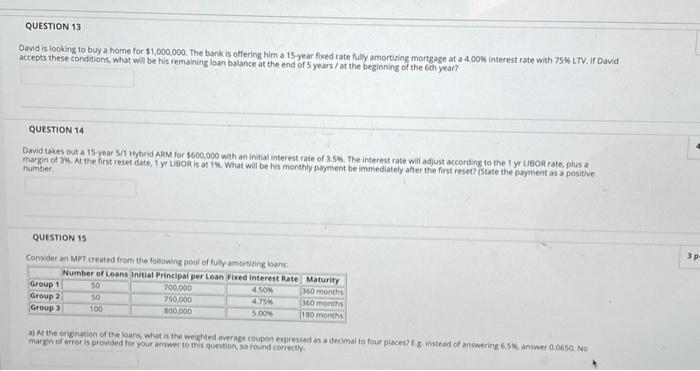

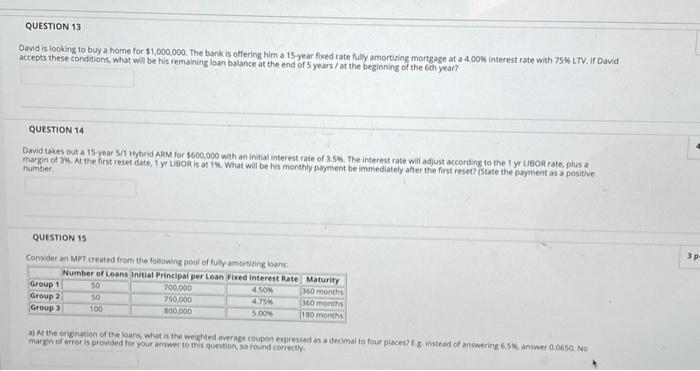

QUESTION 13 David is looking to buy a home for $1,000,000. The bank is offering him a 15 year fixed ratefully amortizing mortgage at a 4.004 interest rate with 75% LTV. If David accepts these conditions, what will be his remaining loan balance at the end of 5 years at the beginning of the 6th year? QUESTION 14 David takes out a 15-year 5/1 Hybrid ARM for $600,000 with an initial interest rate of 35%. The interest rate will adjust according to the 1 y LIBOR rate, plus a margin of 3. At the first reset date, 1 yr USOR is at 1%. What will be his monthly payment be immediately after the first reset(State the payment as a positive number QUESTION 15 3p Consider an MPT created from the following pool of fully amortizing loans Number of Loans initial Principal per Loan Fixed Interest Rate Maturity Group 1 50 700.000 450W 360 months Group 2 50 750,000 360 months Group 100 300.000 180 months 4.75 500 At the origination of the loans, what is the weighted average coupon expressed as a decimal to four places instead of answering 65 answer 0.0650. NO margin of error is provided for your answer to this question, so round correctly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started