Answered step by step

Verified Expert Solution

Question

1 Approved Answer

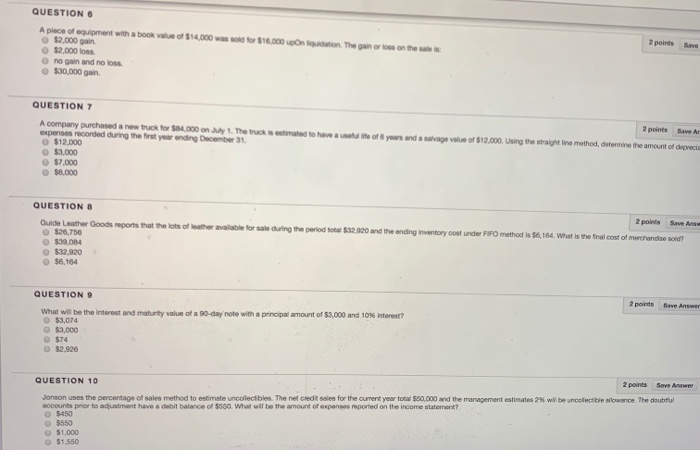

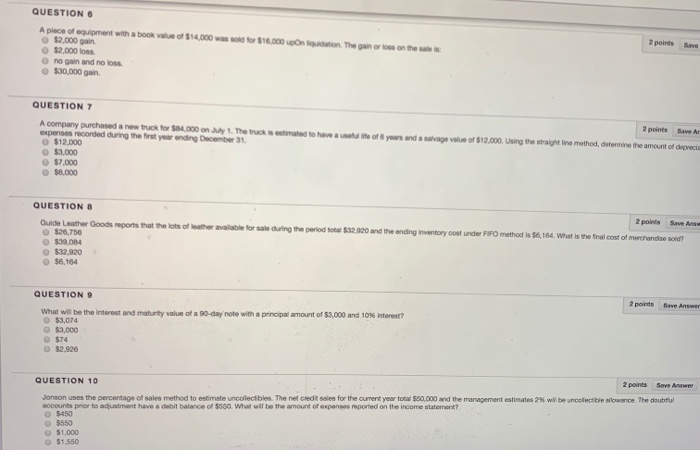

help please!!! QUESTIONS A piece of equipment with a book value of $14.000 sold for $18.000 ton. The ganar on the $2,000 gain $2,000 loss

help please!!!

QUESTIONS A piece of equipment with a book value of $14.000 sold for $18.000 ton. The ganar on the $2,000 gain $2,000 loss no gain and no loss. $30,000 gain 2 points 2 points Save Ar QUESTION 7 A company purchased a new truck for $4,000. The metted to have a ne of years and a welvage value of $12,000. Using the tragire method, determine the amount of deprecia expenses recorded during the first year ending December 31 $12.000 $9,000 $7.000 50,000 2 points Save As QUESTIONS Guide Leather Goods reports that the lots of leather available for sale during the period total $32,920 and the ending inventory cout under FIFO method is $0,164. What is the final cost of merchandise told? $20,750 $39,084 $32,920 $6,164 2 points Save Aner QUESTION 9 What will be the interest and maturity value of a 90-day note with a principal amount of $3,000 and 10% interest? $3,074 $3,000 $74 $2,926 QUESTION 10 2 points Save Answer Jonson uses the percentage of sales method to estimate uncollectibles. The net credit sales for the current year total $50,000 and the management estimates will be collectiblesowance. The doubt accounts prior to adjustment have a debit balance of $550 What will be the amount of expenses reported on the income statement? $450 $550 $1,000 51.550

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started