Answered step by step

Verified Expert Solution

Question

1 Approved Answer

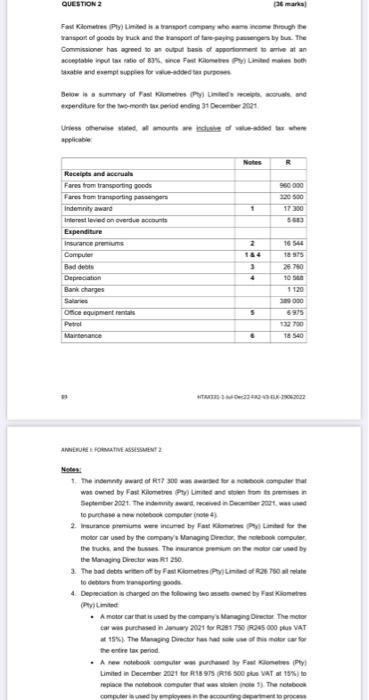

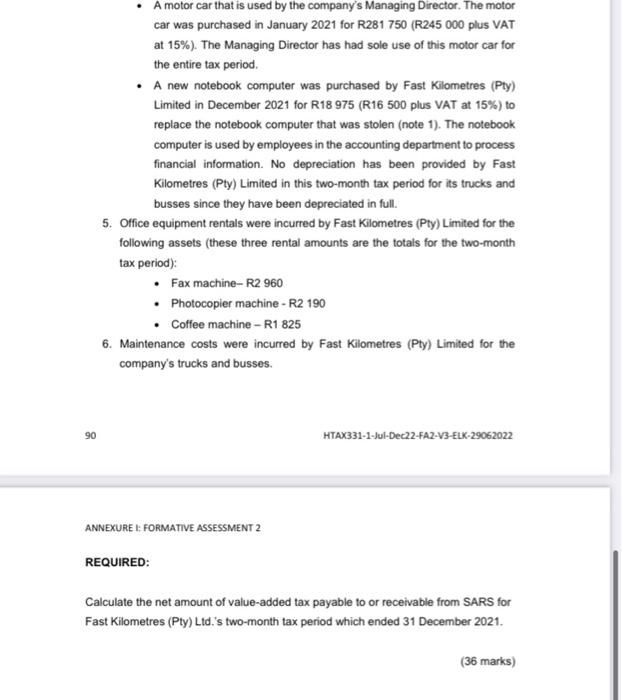

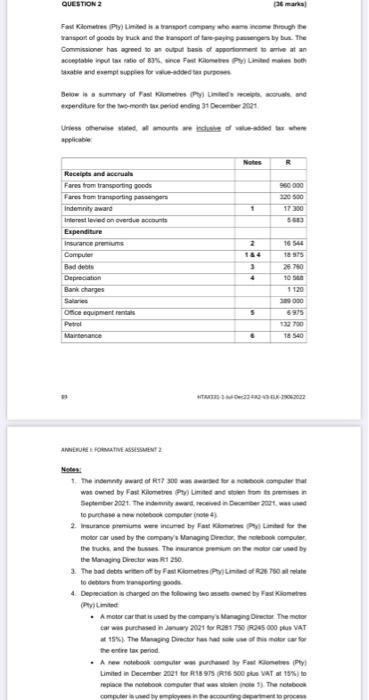

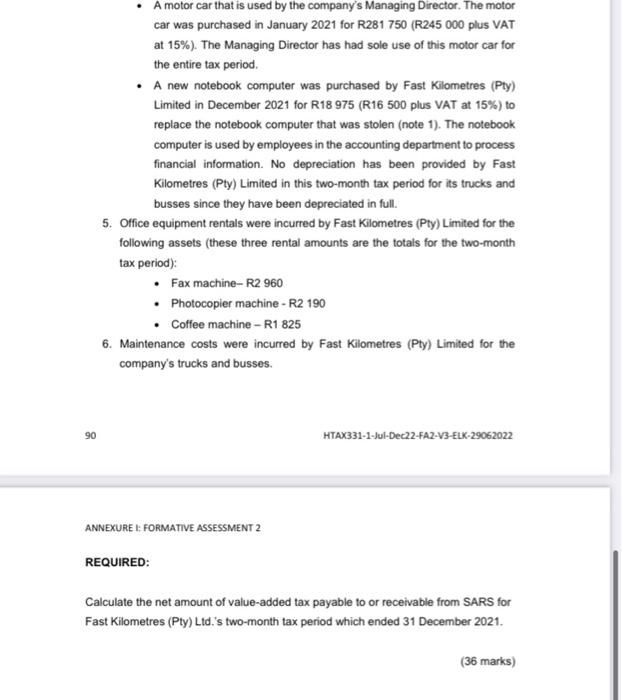

help please ranspor of goced ty truck and the kanspor of taie gaping saaserpta by bun. The Commissione has agreed to an output tass of

help please

ranspor of goced ty truck and the kanspor of taie gaping saaserpta by bun. The Commissione has agreed to an output tass of apportionmern to amter at an exserditare for the Mw-merch lex geriod anding 34 Cust eer 2rit apcivabie B] Mraten mohor car used by the concosy' 1 fanaging Dredor, the notebook ocreuser. the Manajrey Develw was Rit 250 . to debtses frum transparting goots. - A mater car that is ised by the comeary a dirargng Direchar The metor the ertre tax period. Limited in Decembe 2nd1 for RAg 915 (Pid 400 gha WNT at 15\%) to car was purchased in January 2021 for R281 750 (R245 000 plus VAT at 15% ). The Managing Director has had sole use of this motor car for the entire tax period. - A new notebook computer was purchased by Fast Kilometres (Pty) Limited in December 2021 for R18 975 (R16 500 plus VAT at 15\%) to replace the notebook computer that was stolen (note 1). The notebook computer is used by employees in the accounting department to process financial information. No depreciation has been provided by Fast Kilometres (Pty) Limited in this two-month tax period for its trucks and busses since they have been depreciated in full. 5. Office equipment rentals were incurred by Fast Kilometres (Pty) Limited for the following assets (these three rental amounts are the totals for the two-month tax period): - Fax machine- R2 960 - Photocopier machine - R2 190 - Coffee machine - R1 825 6. Maintenance costs were incurred by Fast Kilometres (Pty) Limited for the company's trucks and busses. 90 HTAX331-1-Jul-Dec22-FA2-V3-ELK-29062022 ANNEXURE I: FORMATIVE ASSESSMENT 2 REQUIRED: Calculate the net amount of value-added tax payable to or receivable from SARS for Fast Kilometres (Pty) Ltd.'s two-month tax period which ended 31 December 2021. ranspor of goced ty truck and the kanspor of taie gaping saaserpta by bun. The Commissione has agreed to an output tass of apportionmern to amter at an exserditare for the Mw-merch lex geriod anding 34 Cust eer 2rit apcivabie B] Mraten mohor car used by the concosy' 1 fanaging Dredor, the notebook ocreuser. the Manajrey Develw was Rit 250 . to debtses frum transparting goots. - A mater car that is ised by the comeary a dirargng Direchar The metor the ertre tax period. Limited in Decembe 2nd1 for RAg 915 (Pid 400 gha WNT at 15\%) to car was purchased in January 2021 for R281 750 (R245 000 plus VAT at 15% ). The Managing Director has had sole use of this motor car for the entire tax period. - A new notebook computer was purchased by Fast Kilometres (Pty) Limited in December 2021 for R18 975 (R16 500 plus VAT at 15\%) to replace the notebook computer that was stolen (note 1). The notebook computer is used by employees in the accounting department to process financial information. No depreciation has been provided by Fast Kilometres (Pty) Limited in this two-month tax period for its trucks and busses since they have been depreciated in full. 5. Office equipment rentals were incurred by Fast Kilometres (Pty) Limited for the following assets (these three rental amounts are the totals for the two-month tax period): - Fax machine- R2 960 - Photocopier machine - R2 190 - Coffee machine - R1 825 6. Maintenance costs were incurred by Fast Kilometres (Pty) Limited for the company's trucks and busses. 90 HTAX331-1-Jul-Dec22-FA2-V3-ELK-29062022 ANNEXURE I: FORMATIVE ASSESSMENT 2 REQUIRED: Calculate the net amount of value-added tax payable to or receivable from SARS for Fast Kilometres (Pty) Ltd.'s two-month tax period which ended 31 December 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started