Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP PLEASE Required information [The following information applies to the questions displayed below] Marc and Mikkel are married and earned salaries this year of $64,000

HELP PLEASE

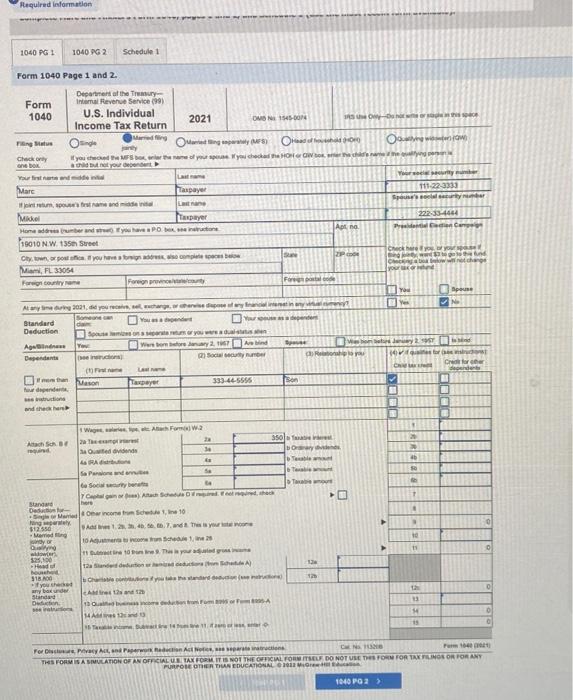

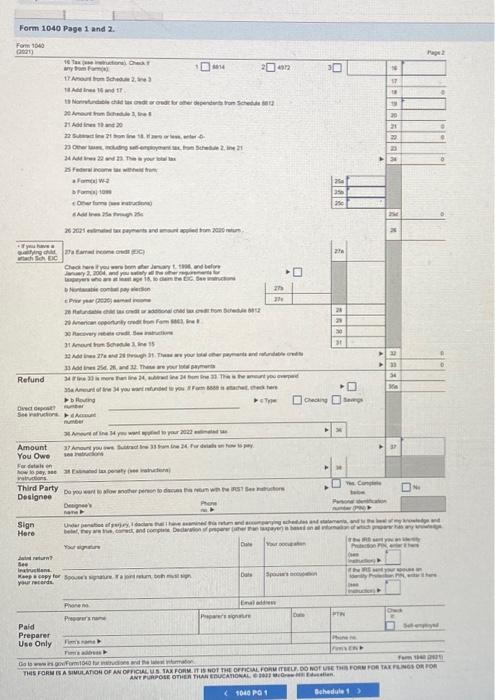

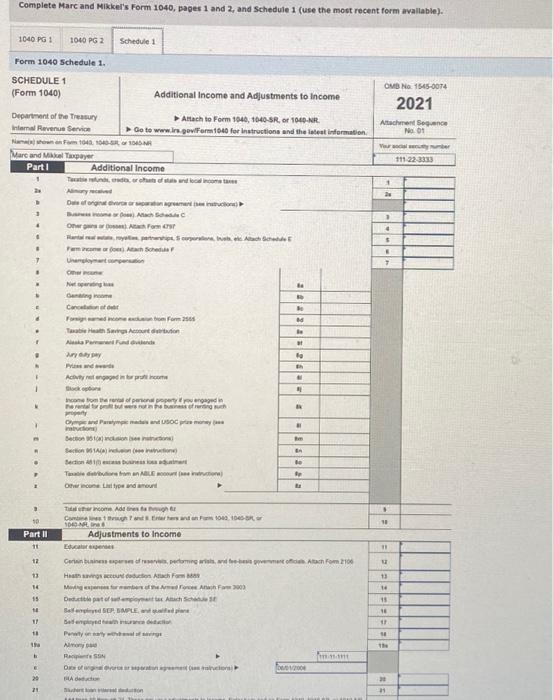

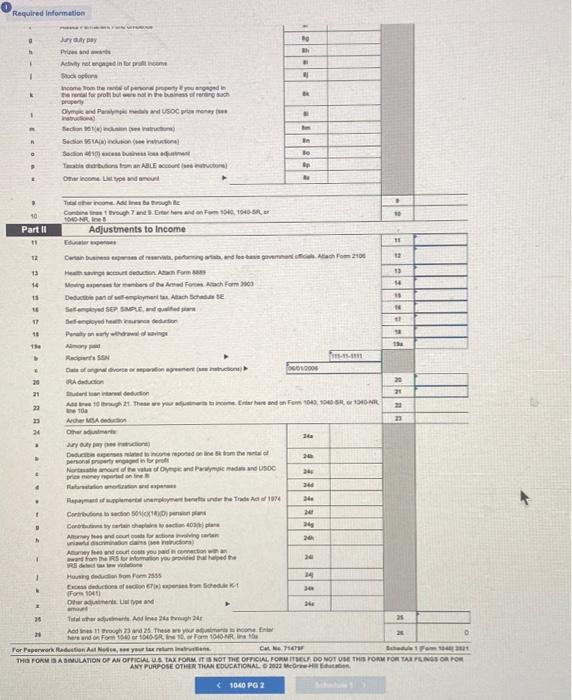

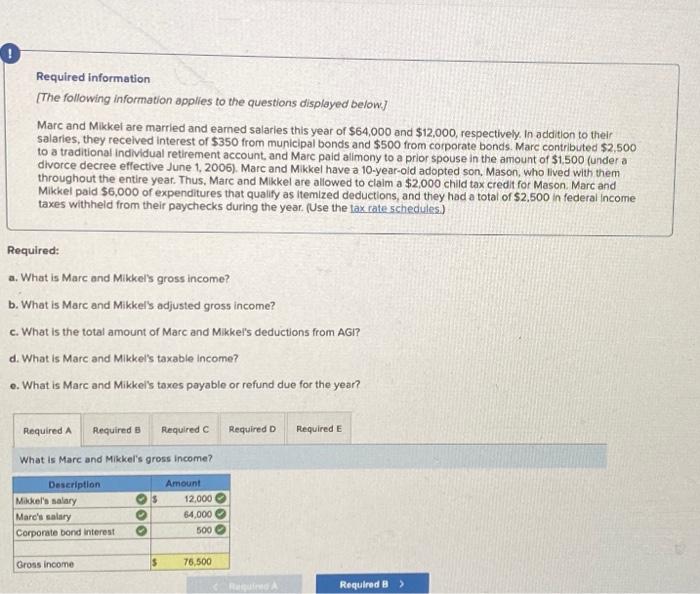

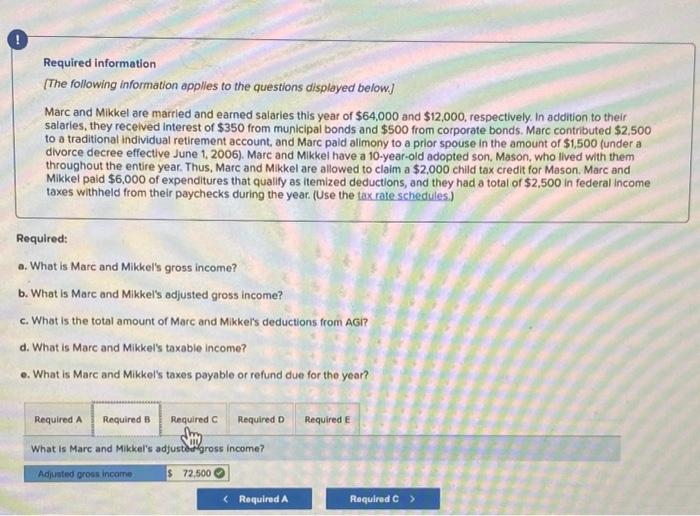

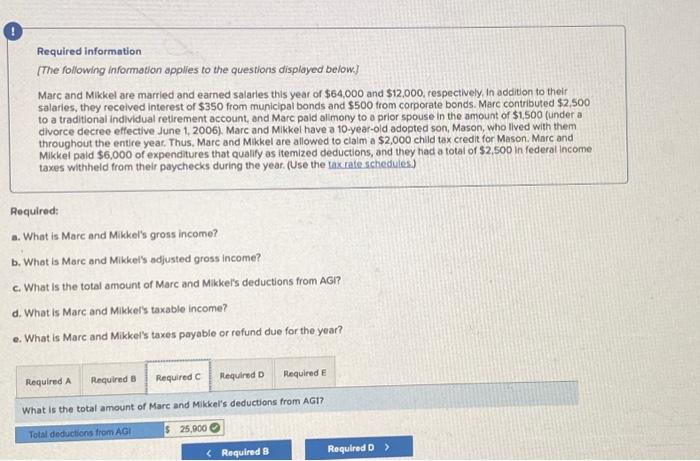

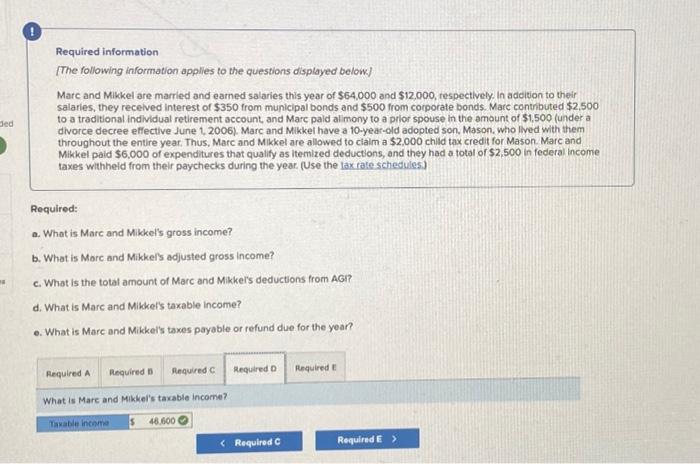

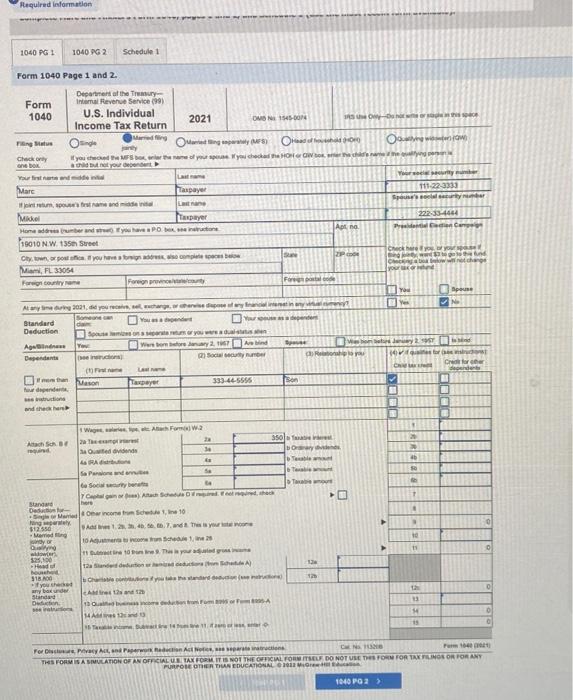

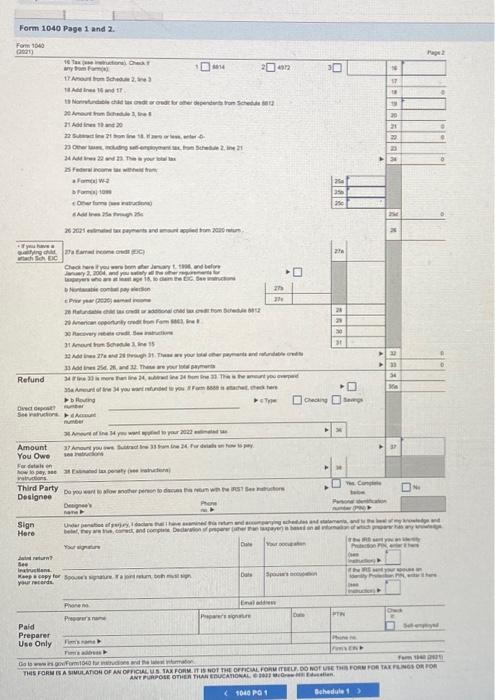

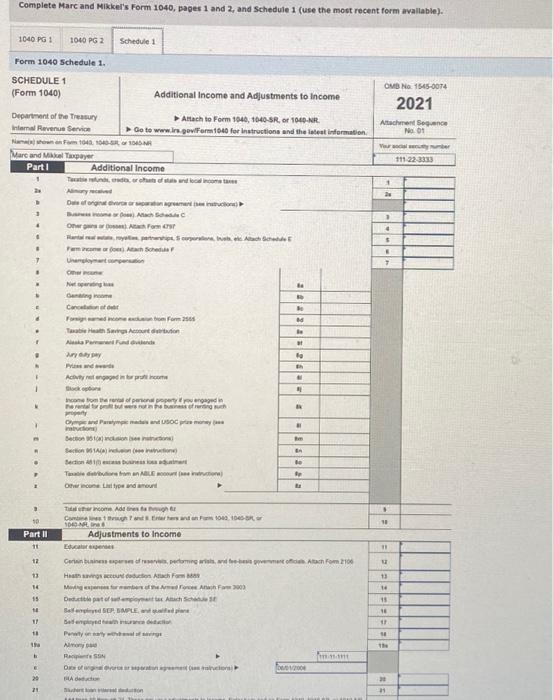

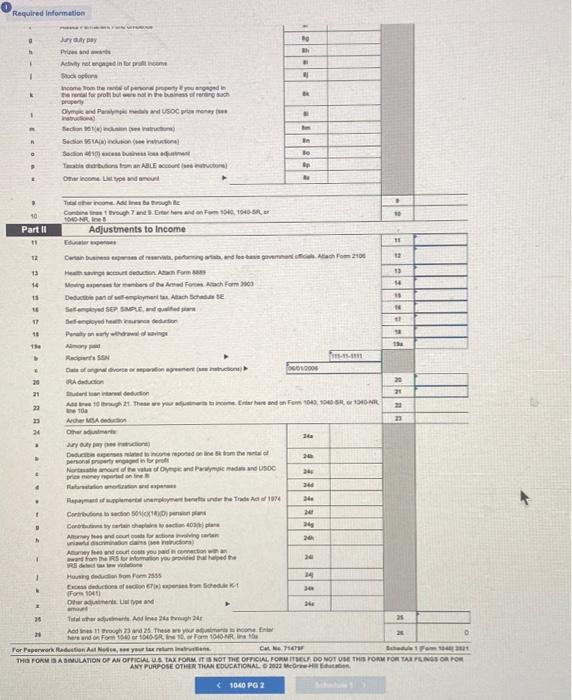

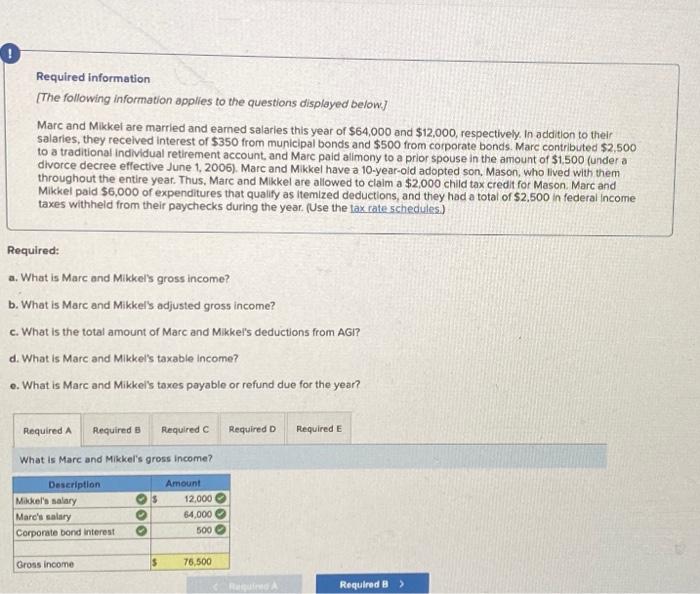

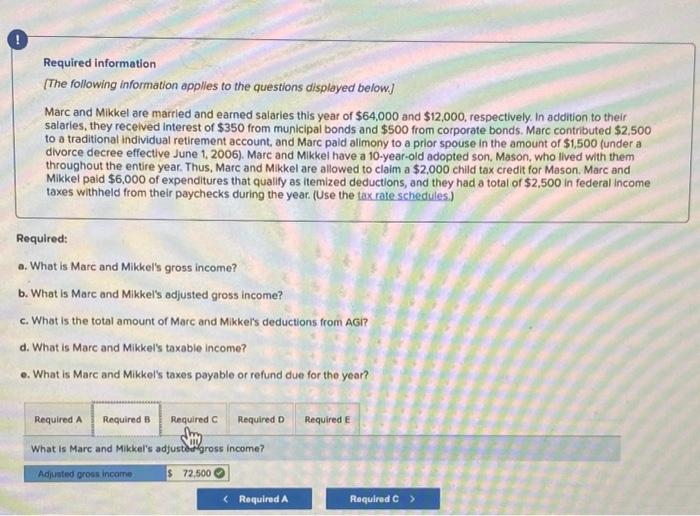

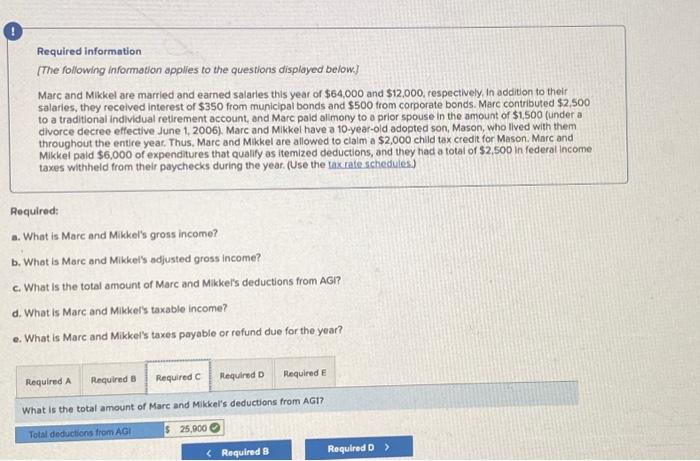

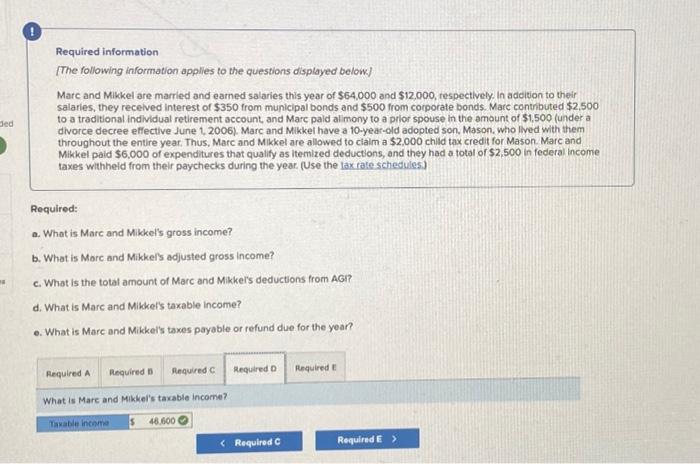

Required information [The following information applies to the questions displayed below] Marc and Mikkel are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they recelved interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2006), Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $6,000 of expenditures that qualify as itemized deductions, and they had a total of $2,500 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules) Complete Marc and Mikkel's Form Y40, pages 1 and 2 , and Schedule 1 (use the most recent forms available). Marc and Mikkel's address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: Marc Taxpayer: 111-22-3333 Mikkel Taxpayer: 222-33-4444 Mason Taxpayer: 333-44-5555 Prior Spouse 111-11-1111 (Input all the values as positive numbers. Enter any non-financial information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear in any given information or Problem Statement. Do not skip rows, while entering in Deductions section of Form 1040 PG1. Use 2022 tax laws and 2021 tax form.) Neither Marc nor Michelle wish to contribute to the Presidential Election Campaign fund or had any virtual currency transactions or interests. Complete Marc and Mikkel's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent form avaliable). Form 1040 Page 1 and 2 . Aequlred informution 1040 PG 1 10 104092 sthedule 1 Form 1040 Page 1 and 2. 149 pg23 Form 1040 Page 1 and 2. form 1040 (2061) 19. Aned Inet 19 in th b b iruing tesert cegrand raptet You Owo Fer tatais in Third Party Designee Here Ania roturn? teter inatrutisns Yeur agrins 3[ Nest Rest 2 Thes roky E A suUL Complete Marc and Mikkel's Form 1040, papes 1 and 2 , and Schedule 1 (use the most recent form avallable). Form 1040 schedule 1. (1) Required informatien Jarrater Bay Friset and baith Abbly not eranpet in for prial inam Asen optine hcone lan the reved of perand propety I raveresond in. prupent Ayence and Premplis miths whe Usoc prus menry ioet inethesina? fechin bay jeckinm taet ratrestre: Secbon is (N) inoution (uee inthationt) c. Oen inceme Lat epes and anovil \begin{tabular}{|c|c|} \hline me & \\ \hline min \\ \hline in \\ \hline A \\ \hline me \\ \hline ne \\ \hline Bn \\ \hline Be \\ \hline Bn \\ \hline An \\ \hline \end{tabular} Part II Adjustments to income 11 12. 13. 14 11. if. 17. it 13 . b Relearth sis as Dei difincer 23 Nolaridensish 24 3. Mry buey pary ines inatichort? Ahwert lies end court coter you pad in copertiol we as nes delest bas iew wilisone Hevsey dediction bom Fonn asss (Forn 1947) Oeler atistiturie Lei ine ave Oetiras 34 Glith at ar adebbeite. Ads inke 34 ts twioh zer Sibedule 1 Fom timen ant 1040Pa2 Required information [The following information applies to the questions displayed below] Marc and Mikkel are married and eamed salarles this year of $64,000 and $12,000, respectively. In addition to their. salaries, they recelved interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to a traditional individual retirement account, and Marc paid alimony to a prior $pouse in the amount of $1,500 (under a divorce decree effective June 1, 2006). Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them throughout the entire year. Thus. Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $6,000 of expenditures that qualify as itemized deductions, and they had a total of $2,500 in federal income taxes withheid from their paychecks during the year. (Use the lax rate schedules). Required: a. What is Marc and Mikkel's gross income? b. What is Marc and Mikkel's adjusted gross income? c. What is the total amount of Marc and Mikiel's deductions from AGI? d. What is Marc and Mikkel's taxable income? e. What is Mare and Mikkel's toxes payable or refund due for the year? What is Mare and Mikkel's gross income? Required information [The following information applles to the questions displayed below] Marc and Mikkel are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they recelved interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2006), Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $6,000 of expenditures that qualify as itemized deductions, and they had a total of $2,500 in federal income taxes withheld from their paychecks during the year. (Use the tax rateschedules.) Required: a. What is Mare and Mikkel's gross income? b. What is Marc and Mikkel's adjusted gross income? c. What is the total amount of Marc and Mikkers deductions from AGi? d. What is Marc and Mikkel's taxable income? e. What is Marc and Mikkel's taxes payable or refund due for the year? What is Mare and Mikkei's adjusterfgross income? Required information [The following information applies to the questions displayed below.] Marc and Mikkel are married and earned salaries this year of $64,000 and $12,000, respectively, In addition to their salaries, they recelved interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2006) Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them throughout the entire yeac. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $6,000 of expenditures that qualify as itemized deductions, and they had a total of $2,500 in federal income taxes withheid from their paychecks during the year. (Use the tax rate schedules) Required: a. What is Marc and Mikkel's gross income? b. What is Marc and Mikkel's adjusted gross income? c. What is the total amount of Marc and Mikkei's deductions from AGI? d. What is Marc and Mikkel's taxable income? e. What is Marc and Mikkel's taxes payable or refund due for the year? What is the total amount of Marc and Mikkel's deductions from AGI? Required information [The following information applies to the questions displayed below] Marc and Mikkel are married and earned salaries this year of $64,000 and $12.000, respectively. In adeition to their salaries, they recelved interest of $350 from municipal bonds and $500 from corporate bonds. Marc contrbuted $2,500 to a traditional indlividual retirement account, and Mare pald alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2006). Marc and Mikkel have a 10-year-old adopted son. Mason, who Ived with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $6,000 of expenditures that qualify as itemized deductions, and they had a totol or $2,500 in federal income taxes withheid from their paychecks during the year. (Use the lax rate schedules) Required: a. What is Mare and Mikkel's gross income? b. What is Marc and Mikker's adjusted gross income? c. What is the total amount of Marc and Mikkers deductions from AGI? d. What is Marc and Mikkel's taxable income? e. What is Marc and Mikkei's taxes payable or refund due for the year? What is Mare and Mikkel's taxable incorne? Required information [The following information applies to the questions displayed belowJ Marc and Mikkel are married and earned salaries this year of $64,000 and $12,000, respectively, In addition to their salarles, they recelved interest of $350 from municipal bonds and $500 from corporate bonds, Marc contributed $2,500 to a traditional indlvidual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2006). Marc and Mikkel have a 10-year-old adopted son, Mason, who llved with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 chid tax credit for Mason. Marc and Mikkel paid $6,000 of expenditures that qualify as itemized deductions, and they had a total of $2,500 in federal income taxes withheid from their paychecks during the year. (Use the tax rateschedules) Required: a. What is Mare and Mikkel's gross income? b. What is Marc and Mikkel's adjusted gross income? c. What is the total amount of Marc and Mikkel's deductions from AGI? d. What is Marc and Mikkel's taxable income? e. What is Marc and Mikkels taxes payable or refund due for the year? What is Marc and Mikkel's taxes payabile or refund due for the year? Required information [The following information applies to the questions displayed below] Marc and Mikkel are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they recelved interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2006), Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $6,000 of expenditures that qualify as itemized deductions, and they had a total of $2,500 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules) Complete Marc and Mikkel's Form Y40, pages 1 and 2 , and Schedule 1 (use the most recent forms available). Marc and Mikkel's address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: Marc Taxpayer: 111-22-3333 Mikkel Taxpayer: 222-33-4444 Mason Taxpayer: 333-44-5555 Prior Spouse 111-11-1111 (Input all the values as positive numbers. Enter any non-financial information, (e.g. Names, Addresses, social security numbers) EXACTLY as they appear in any given information or Problem Statement. Do not skip rows, while entering in Deductions section of Form 1040 PG1. Use 2022 tax laws and 2021 tax form.) Neither Marc nor Michelle wish to contribute to the Presidential Election Campaign fund or had any virtual currency transactions or interests. Complete Marc and Mikkel's Form 1040, pages 1 and 2, and Schedule 1 (use the most recent form avaliable). Form 1040 Page 1 and 2 . Aequlred informution 1040 PG 1 10 104092 sthedule 1 Form 1040 Page 1 and 2. 149 pg23 Form 1040 Page 1 and 2. form 1040 (2061) 19. Aned Inet 19 in th b b iruing tesert cegrand raptet You Owo Fer tatais in Third Party Designee Here Ania roturn? teter inatrutisns Yeur agrins 3[ Nest Rest 2 Thes roky E A suUL Complete Marc and Mikkel's Form 1040, papes 1 and 2 , and Schedule 1 (use the most recent form avallable). Form 1040 schedule 1. (1) Required informatien Jarrater Bay Friset and baith Abbly not eranpet in for prial inam Asen optine hcone lan the reved of perand propety I raveresond in. prupent Ayence and Premplis miths whe Usoc prus menry ioet inethesina? fechin bay jeckinm taet ratrestre: Secbon is (N) inoution (uee inthationt) c. Oen inceme Lat epes and anovil \begin{tabular}{|c|c|} \hline me & \\ \hline min \\ \hline in \\ \hline A \\ \hline me \\ \hline ne \\ \hline Bn \\ \hline Be \\ \hline Bn \\ \hline An \\ \hline \end{tabular} Part II Adjustments to income 11 12. 13. 14 11. if. 17. it 13 . b Relearth sis as Dei difincer 23 Nolaridensish 24 3. Mry buey pary ines inatichort? Ahwert lies end court coter you pad in copertiol we as nes delest bas iew wilisone Hevsey dediction bom Fonn asss (Forn 1947) Oeler atistiturie Lei ine ave Oetiras 34 Glith at ar adebbeite. Ads inke 34 ts twioh zer Sibedule 1 Fom timen ant 1040Pa2 Required information [The following information applies to the questions displayed below] Marc and Mikkel are married and eamed salarles this year of $64,000 and $12,000, respectively. In addition to their. salaries, they recelved interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to a traditional individual retirement account, and Marc paid alimony to a prior $pouse in the amount of $1,500 (under a divorce decree effective June 1, 2006). Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them throughout the entire year. Thus. Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $6,000 of expenditures that qualify as itemized deductions, and they had a total of $2,500 in federal income taxes withheid from their paychecks during the year. (Use the lax rate schedules). Required: a. What is Marc and Mikkel's gross income? b. What is Marc and Mikkel's adjusted gross income? c. What is the total amount of Marc and Mikiel's deductions from AGI? d. What is Marc and Mikkel's taxable income? e. What is Mare and Mikkel's toxes payable or refund due for the year? What is Mare and Mikkel's gross income? Required information [The following information applles to the questions displayed below] Marc and Mikkel are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they recelved interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2006), Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $6,000 of expenditures that qualify as itemized deductions, and they had a total of $2,500 in federal income taxes withheld from their paychecks during the year. (Use the tax rateschedules.) Required: a. What is Mare and Mikkel's gross income? b. What is Marc and Mikkel's adjusted gross income? c. What is the total amount of Marc and Mikkers deductions from AGi? d. What is Marc and Mikkel's taxable income? e. What is Marc and Mikkel's taxes payable or refund due for the year? What is Mare and Mikkei's adjusterfgross income? Required information [The following information applies to the questions displayed below.] Marc and Mikkel are married and earned salaries this year of $64,000 and $12,000, respectively, In addition to their salaries, they recelved interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2006) Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them throughout the entire yeac. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $6,000 of expenditures that qualify as itemized deductions, and they had a total of $2,500 in federal income taxes withheid from their paychecks during the year. (Use the tax rate schedules) Required: a. What is Marc and Mikkel's gross income? b. What is Marc and Mikkel's adjusted gross income? c. What is the total amount of Marc and Mikkei's deductions from AGI? d. What is Marc and Mikkel's taxable income? e. What is Marc and Mikkel's taxes payable or refund due for the year? What is the total amount of Marc and Mikkel's deductions from AGI? Required information [The following information applies to the questions displayed below] Marc and Mikkel are married and earned salaries this year of $64,000 and $12.000, respectively. In adeition to their salaries, they recelved interest of $350 from municipal bonds and $500 from corporate bonds. Marc contrbuted $2,500 to a traditional indlividual retirement account, and Mare pald alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2006). Marc and Mikkel have a 10-year-old adopted son. Mason, who Ived with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $6,000 of expenditures that qualify as itemized deductions, and they had a totol or $2,500 in federal income taxes withheid from their paychecks during the year. (Use the lax rate schedules) Required: a. What is Mare and Mikkel's gross income? b. What is Marc and Mikker's adjusted gross income? c. What is the total amount of Marc and Mikkers deductions from AGI? d. What is Marc and Mikkel's taxable income? e. What is Marc and Mikkei's taxes payable or refund due for the year? What is Mare and Mikkel's taxable incorne? Required information [The following information applies to the questions displayed belowJ Marc and Mikkel are married and earned salaries this year of $64,000 and $12,000, respectively, In addition to their salarles, they recelved interest of $350 from municipal bonds and $500 from corporate bonds, Marc contributed $2,500 to a traditional indlvidual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2006). Marc and Mikkel have a 10-year-old adopted son, Mason, who llved with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 chid tax credit for Mason. Marc and Mikkel paid $6,000 of expenditures that qualify as itemized deductions, and they had a total of $2,500 in federal income taxes withheid from their paychecks during the year. (Use the tax rateschedules) Required: a. What is Mare and Mikkel's gross income? b. What is Marc and Mikkel's adjusted gross income? c. What is the total amount of Marc and Mikkel's deductions from AGI? d. What is Marc and Mikkel's taxable income? e. What is Marc and Mikkels taxes payable or refund due for the year? What is Marc and Mikkel's taxes payabile or refund due for the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started