Help Please????

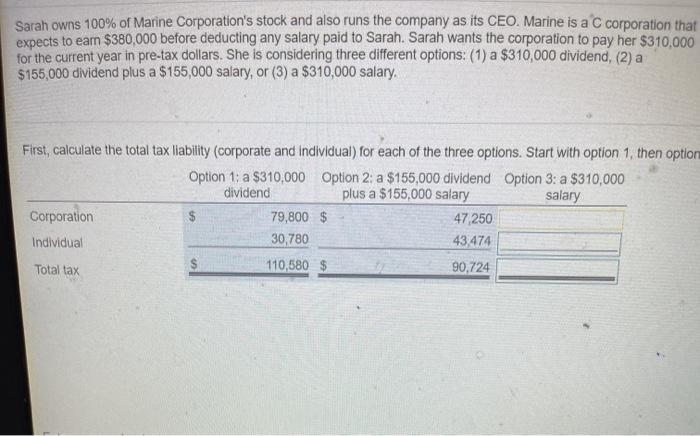

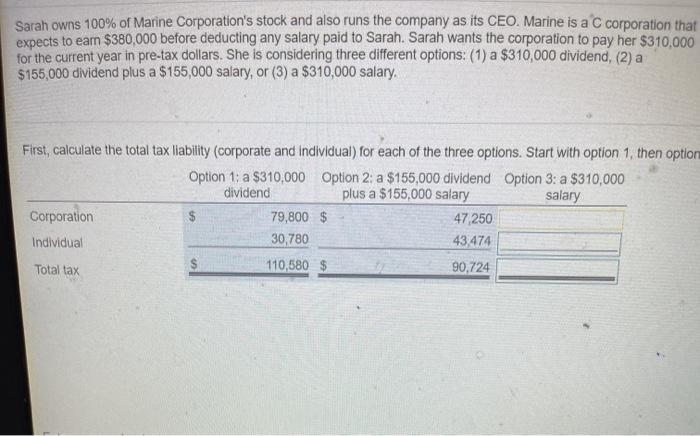

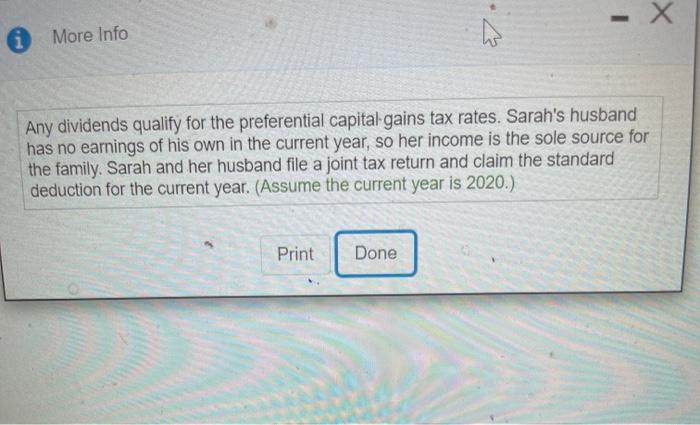

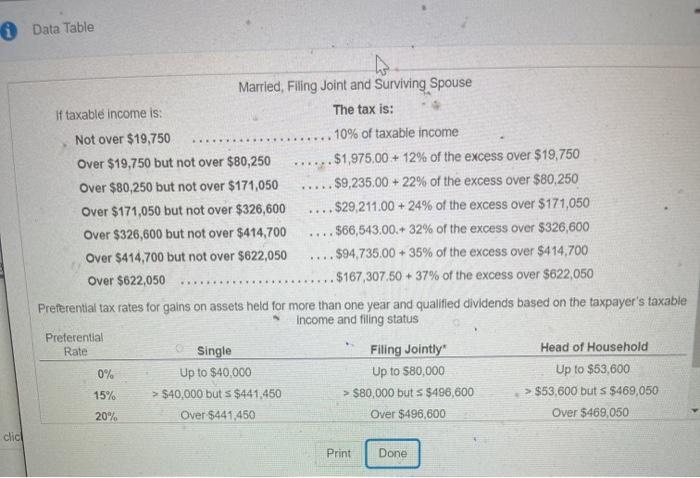

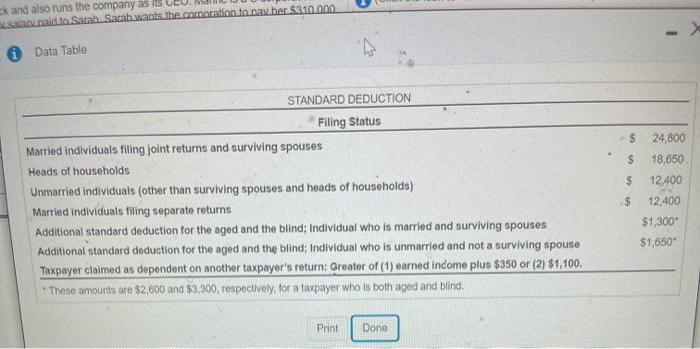

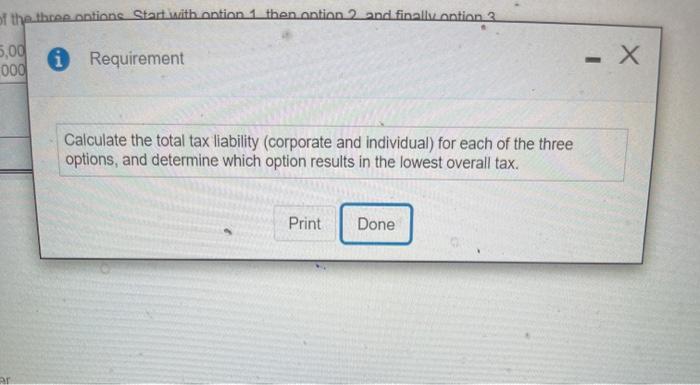

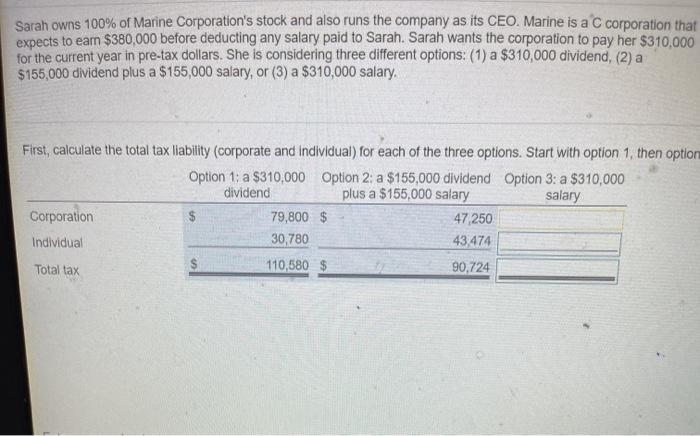

Sarah owns 100% of Marine Corporation's stock and also runs the company as its CEO. Marine is a C corporation that expects to earn $380,000 before deducting any salary paid to Sarah. Sarah wants the corporation to pay her $310,000 for the current year in pre-tax dollars. She is considering three different options: (1) a $310,000 dividend, (2) a $155,000 dividend plus a $155,000 salary, or (3) a $310,000 salary First, calculate the total tax liability (corporate and individual) for each of the three options. Start with option 1, then option Option 1: a $310,000 Option 2: a $155,000 dividend Option 3: a $310,000 dividend plus a $155,000 salary salary Corporation 79,800 $ 47,250 Individual 30,780 43,474 Total tax 110,580 $ 90,724 More Info Any dividends qualify for the preferential capital gains tax rates. Sarah's husband has no earnings of his own in the current year, so her income is the sole source for the family. Sarah and her husband file a joint tax return and claim the standard deduction for the current year. (Assume the current year is 2020.) Print Done i Data Table ... ws Married, Filing Joint and Surviving Spouse If taxable income is: The tax is: Not over $19,750 . 10% of taxable income Over $19,750 but not over $80,250 . $1,975,00 + 12% of the excess over $19,750 Over $80,250 but not over $171,050 ..... $9,235.00 + 22% of the excess over $80,250 Over $171,050 but not over $326,600 .... $29,211.00 + 24% of the excess over $171,050 Over $326,600 but not over $414,700 .... $66,543.00.+ 32% of the excess over $326,600 Over $414,700 but not over $622,050 .... $94,735,00 + 35% of the excess over $414,700 Over $622,050 $167,307,50 + 37% of the excess over $622,050 Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable Income and filing status Preferential Rate Filing Jointly* Head of Household 0% Up to $40,000 Up to $80,000 Up to $53,600 15% > $40,000 but s $441,450 > $80,000 but s $496,600 > $53,600 but s $469,050 20% Over $441,450 Over $496,600 Over $469,050 Single clic Print Done sk and also runs the company as its salan naido Sarah Sarah wants the.com oration to nav her $210.000 Data Table STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard doduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,100, These amounts are $2,600 and $3,300, respectively, for a taxpayer who is both aged and blind, $ 24.800 S 18,650 $ 12,400 $ 12,400 $1,300 $1,650 Paint Done of the three antions Start with antion 1 then antion 2 and finally antion 3 5,00 Requirement 000 - X Calculate the total tax liability (corporate and individual) for each of the three options, and determine which option results in the lowest overall tax. Print Done ar Sarah owns 100% of Marine Corporation's stock and also runs the company as its CEO. Marine is a C corporation that expects to earn $380,000 before deducting any salary paid to Sarah. Sarah wants the corporation to pay her $310,000 for the current year in pre-tax dollars. She is considering three different options: (1) a $310,000 dividend, (2) a $155,000 dividend plus a $155,000 salary, or (3) a $310,000 salary First, calculate the total tax liability (corporate and individual) for each of the three options. Start with option 1, then option Option 1: a $310,000 Option 2: a $155,000 dividend Option 3: a $310,000 dividend plus a $155,000 salary salary Corporation 79,800 $ 47,250 Individual 30,780 43,474 Total tax 110,580 $ 90,724 More Info Any dividends qualify for the preferential capital gains tax rates. Sarah's husband has no earnings of his own in the current year, so her income is the sole source for the family. Sarah and her husband file a joint tax return and claim the standard deduction for the current year. (Assume the current year is 2020.) Print Done i Data Table ... ws Married, Filing Joint and Surviving Spouse If taxable income is: The tax is: Not over $19,750 . 10% of taxable income Over $19,750 but not over $80,250 . $1,975,00 + 12% of the excess over $19,750 Over $80,250 but not over $171,050 ..... $9,235.00 + 22% of the excess over $80,250 Over $171,050 but not over $326,600 .... $29,211.00 + 24% of the excess over $171,050 Over $326,600 but not over $414,700 .... $66,543.00.+ 32% of the excess over $326,600 Over $414,700 but not over $622,050 .... $94,735,00 + 35% of the excess over $414,700 Over $622,050 $167,307,50 + 37% of the excess over $622,050 Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable Income and filing status Preferential Rate Filing Jointly* Head of Household 0% Up to $40,000 Up to $80,000 Up to $53,600 15% > $40,000 but s $441,450 > $80,000 but s $496,600 > $53,600 but s $469,050 20% Over $441,450 Over $496,600 Over $469,050 Single clic Print Done sk and also runs the company as its salan naido Sarah Sarah wants the.com oration to nav her $210.000 Data Table STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard doduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,100, These amounts are $2,600 and $3,300, respectively, for a taxpayer who is both aged and blind, $ 24.800 S 18,650 $ 12,400 $ 12,400 $1,300 $1,650 Paint Done of the three antions Start with antion 1 then antion 2 and finally antion 3 5,00 Requirement 000 - X Calculate the total tax liability (corporate and individual) for each of the three options, and determine which option results in the lowest overall tax. Print Done ar