Answered step by step

Verified Expert Solution

Question

1 Approved Answer

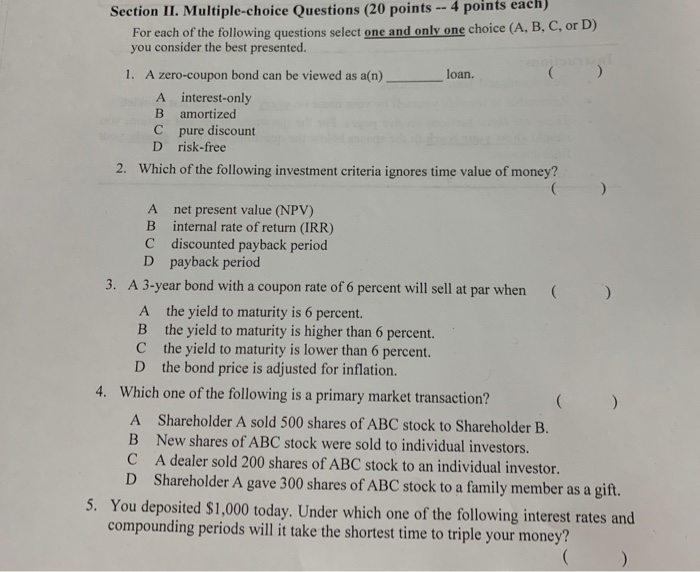

help please ! Section II. Multiple-choice Questions (20 points -- 4 points each) For each of the following questions select one and only one choice

help please !

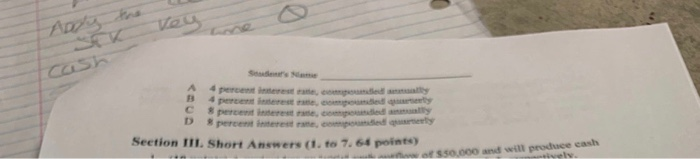

Section II. Multiple-choice Questions (20 points -- 4 points each) For each of the following questions select one and only one choice (A, B, C, or D) you consider the best presented. loan. 1. A zero-coupon bond can be viewed as a(n) A interest-only B amortized pure discount D risk-free Which of the following investment criteria ignores time value of money? 2. net present value (NPV) B internal rate of return (IRR) C discounted payback period D payback period A 3-year bond with a coupon rate of 6 percent will sell at par when 3. A the yield to maturity is 6 percent. B the yield to maturity is higher than 6 percent. C the yield to maturity is lower than 6 percent. D the bond price is adjusted for inflation. 4. Which one of the following is a primary market transaction? A Shareholder A sold 500 shares of ABC stock to Shareholder B. B New shares of ABC stock were sold to individual investors. C A dealer sold 200 shares of ABC stock to an individual investor. D Shareholder A gave 300 shares of ABC stock to a family member as a gift. 5. You deposited $1,000 today. Under which one of the following interest rates and compounding periods will it take the shortest time to triple your money? Anpy the Vey cash Sudent's Name 4 percent interest eate, eomgodied aally 4 percenn innerest ate, compounded quarterly 8 percent interest rane, comnponded anaally percent interest rane, eompouded qterly Section III. Short Answers (1. to 7. 64 points) wof $50.000 and will produce cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started