Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help. Please show work. Thank you in advance. Part Four-Journalizing Transactions for Plant Assets Davis Carpet uses the following asset accounts: Land, Buildings, Delivery Equipment,

Help. Please show work. Thank you in advance.

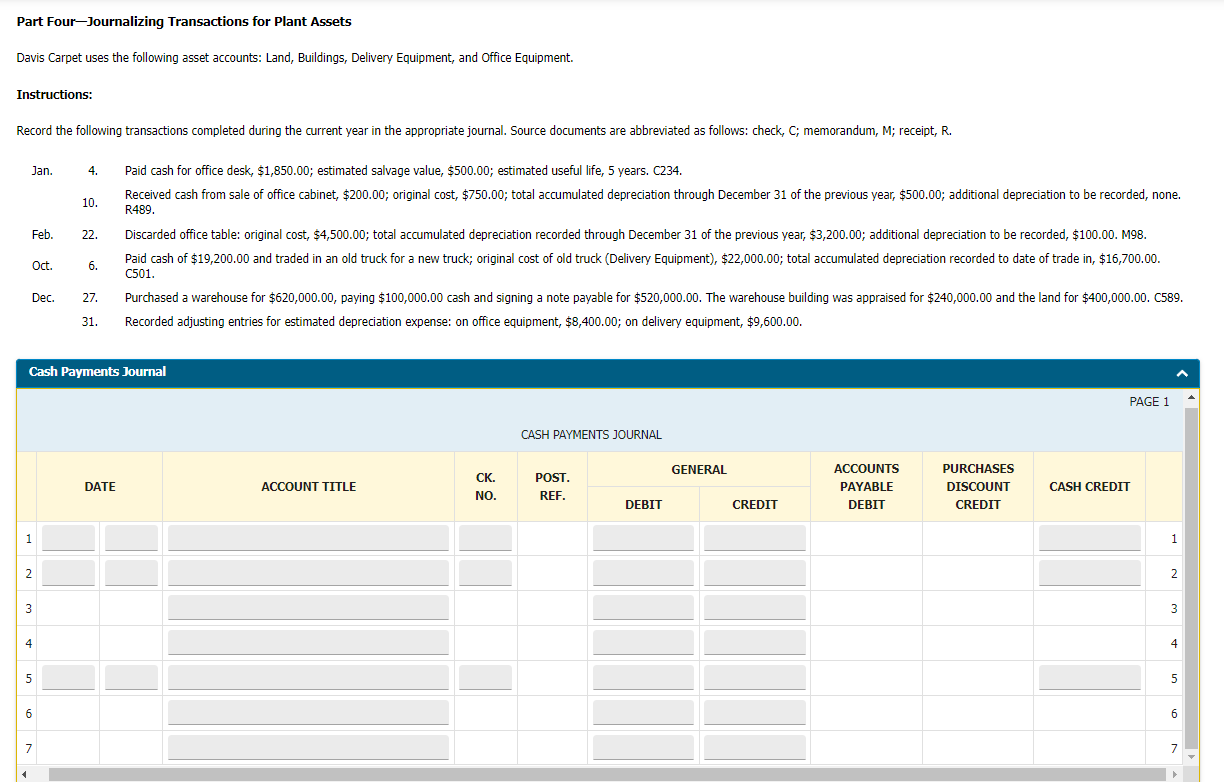

Part Four-Journalizing Transactions for Plant Assets Davis Carpet uses the following asset accounts: Land, Buildings, Delivery Equipment, and Office Equipment. Instructions: Record the following transactions completed during the current year in the appropriate journal. Source documents are abbreviated as follows: check, C; memorandum, M; receipt, R. Jan. 4. Paid cash for office desk, $1,850.00; estimated salvage value, $500.00; estimated useful life, 5 years. C234. 10. Received cash from sale of office cabinet, $200.00; original cost, $750.00; total accumulated depreciation through December 31 of the previous year, $500.00; additional depreciation to be recorded, none. 10. Received Feb. 22. Discarded office table: original cost, $4,500.00; total accumulated depreciation recorded through December 31 of the previous year, $3,200.00; additional depreciation to be recorded, $100.00. M98. Oct. 6. Paid cash of $19,200.00 and traded in an old truck for a new truck; original cost of old truck (Delivery Equipment), $22,000.00; total accumulated depreciation recorded to date of trade in, $16,700.00. Dec. 27. Purchased a warehouse for $620,000.00, paying $100,000.00 cash and signing a note payable for $520,000.00. The warehouse building was appraised for $240,000.00 and the land for $400,000.00. C589. 31. Recorded adjusting entries for estimated depreciation expense: on office equipment, $8,400.00; on delivery equipment, $9,600.00. Part Four-Journalizing Transactions for Plant Assets Davis Carpet uses the following asset accounts: Land, Buildings, Delivery Equipment, and Office Equipment. Instructions: Record the following transactions completed during the current year in the appropriate journal. Source documents are abbreviated as follows: check, C; memorandum, M; receipt, R. Jan. 4. Paid cash for office desk, $1,850.00; estimated salvage value, $500.00; estimated useful life, 5 years. C234. 10. Received cash from sale of office cabinet, $200.00; original cost, $750.00; total accumulated depreciation through December 31 of the previous year, $500.00; additional depreciation to be recorded, none. 10. Received Feb. 22. Discarded office table: original cost, $4,500.00; total accumulated depreciation recorded through December 31 of the previous year, $3,200.00; additional depreciation to be recorded, $100.00. M98. Oct. 6. Paid cash of $19,200.00 and traded in an old truck for a new truck; original cost of old truck (Delivery Equipment), $22,000.00; total accumulated depreciation recorded to date of trade in, $16,700.00. Dec. 27. Purchased a warehouse for $620,000.00, paying $100,000.00 cash and signing a note payable for $520,000.00. The warehouse building was appraised for $240,000.00 and the land for $400,000.00. C589. 31. Recorded adjusting entries for estimated depreciation expense: on office equipment, $8,400.00; on delivery equipment, $9,600.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started