Question

HELP PLEASE Sum of Walmart INC: 354 Measure Names Name Avg. Cash Balance Measure Values Operating Cash Flows WALMART INC 7,558.75 26,557.4 Investing Cash Flows

HELP PLEASE

Sum of Walmart INC: 354

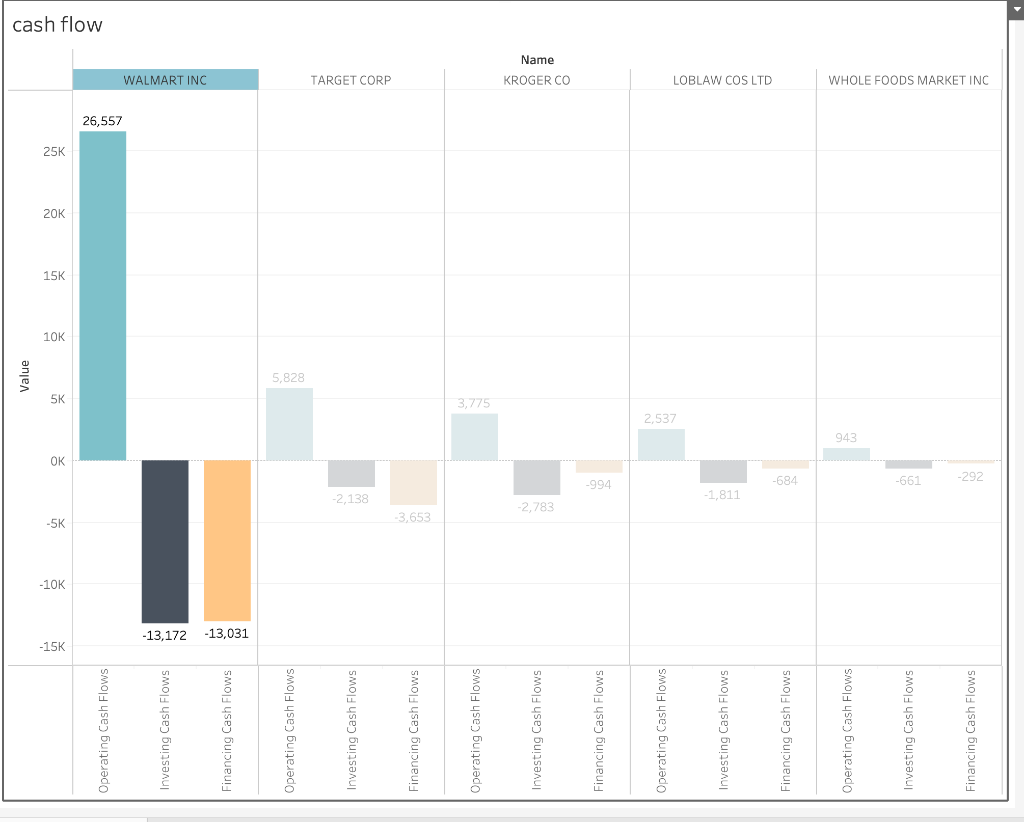

Measure Names Name Avg. Cash Balance Measure Values Operating Cash Flows WALMART INC 7,558.75 26,557.4 Investing Cash Flows WALMART INC 7,558.75 -13,172.2 Financing Cash Flows WALMART INC 7,558.75 -13,030.8

Sum of Target CORP: 38

Measure Names Name Avg. Cash Balance Measure Values Operating Cash Flows TARGET CORP 1,952.9 5,828.2 Investing Cash Flows TARGET CORP 1,952.9 -2,137.6 Financing Cash Flows TARGET CORP 1,952.9 -3,653.1

Sum of Kroger CO: -3

Measure Names Name Avg. Cash Balance Measure Values Operating Cash Flows KROGER CO 369.4 3,774.6 Investing Cash Flows KROGER CO 369.4 -2,783.2 Financing Cash Flows KROGER CO 369.4 -993.9

Sum of Loblaw COS LTD: 42

Name Avg. Cash Balance Measure Values Operating Cash Flows LOBLAW COS LTD 1,256.4 2,537.3 Investing Cash Flows LOBLAW COS LTD 1,256.4 -1,811 Financing Cash Flows LOBLAW COS LTD 1,256.4 -684.4

Sum of WHOLE FOOD Market INC: -11

Measure Names Name Avg. Cash Balance Measure Values Operating Cash Flows WHOLE FOODS MARKET INC 214.430857143 943.120714286 Investing Cash Flows WHOLE FOODS MARKET INC 214.430857143 -661.497 Financing Cash Flows WHOLE FOODS MARKET INC 214.430857143 -292.184857143

1.Which company has the largest operating cash inflows?

a.Whole Foods Market

b.Target

c.Walmart

d.Kroger

2.Target seems to have a higher financing cash outflows relative to operating cash flows compared to other companies. Which of the following may be a reason for financing cash outflows?

a.Increase in Inventory

b.Payment of Cash Dividends

c.Depreciation Expense

d.Purchase of Building

3.Based on the information in the visualization, which companies have an average net cash outflow in the past ten years?

a.Target and Walmart

b.Loblaw and Walmart

c.Whole Foods Market and Kroger

d.Kroger and Target

Value -15K -10K -5K OK 5K 10K 15K 20K 25K cash flow Operating Cash Flows 26,557 Investing Cash Flows -13,172 WALMART INC Financing Cash Flows -13,031 Operating Cash Flows 5,828 Investing Cash Flows -2,138 TARGET CORP Financing Cash Flows -3,653 Operating Cash Flows 3,775 Investing Cash Flows -2,783 KROGER CO Name Financing Cash Flows -994 Operating Cash Flows 2,537 Investing Cash Flows -1,811 LOBLAW COS LTD Financing Cash Flows -684 Operating Cash Flows 943 Investing Cash Flows 199- WHOLE FOODS MARKET INC Financing Cash Flows -292

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started