Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP PLEASE! Thank you in advance ! The firm has total assets of $2,9 million and net plant and equipment equals $2.5 million. It has

HELP PLEASE! Thank you in advance !

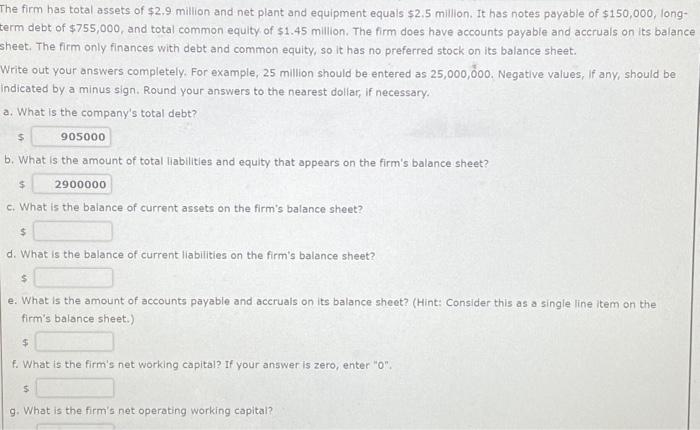

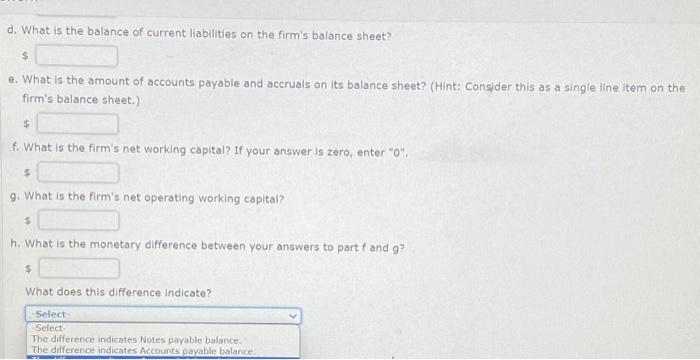

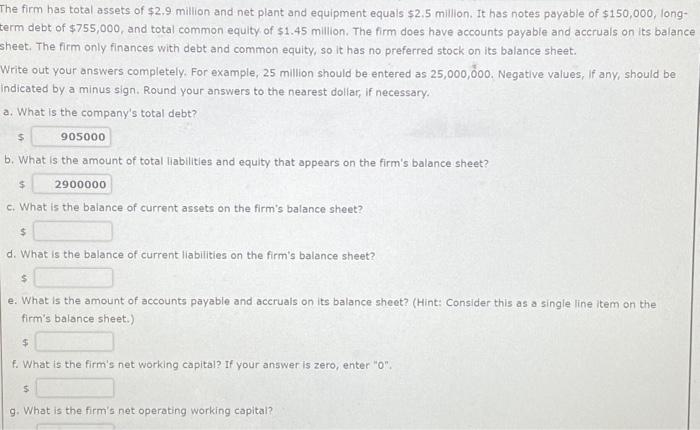

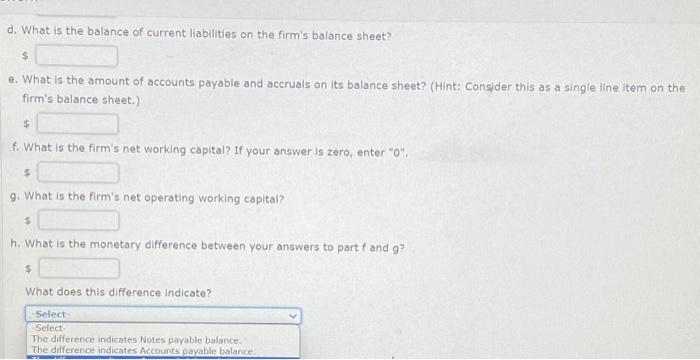

The firm has total assets of $2,9 million and net plant and equipment equals $2.5 million. It has notes payable of $150,000, longserm debt of $755,000, and total common equity of $1.45 milition. The firm does have accounts payable and accruals on its balane sheet. The firm only finances with debt and common equity, so it has no preferred stock on its balance sheet. Write out your answers completely. For example, 25 million should be entered as 25,000,000. Negative values, If any, should be indicated by a minus sign. Round your answers to the nearest dollar, if necessary. a. What is the company's total debt? $ b. What is the amount of total liabilities and equity that appears on the firm's balance sheet? s c. What is the balance of current assets on the firm's balance sheet? $ d. What is the balance of current liabilities on the firm's balance sheet? $ e. What is the amount of accounts payable and accruals on its balance sheet? (Hint: Consider this as a single line item on the firm's balance sheet.) $ f. What is the firm's net working capital? If your answer is zero, enter " 0 ". 5 g. What is the firm's net operating working capital? d. What is the balance of current liabilities on the firm's balance sheet? $ e. What is the amount of accounts payable and accruals on its balance sheet? (Hint: Consjder this as a single line item on the firm's balance sheet.) f. What is the firm's net working capital? If your answer is zero, enter "O", 9. What is the firm's net operating working capital? h. What is the monetary difference between your answers to part f and g ? What does this difference indicate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started