Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help please. Thank you in advance ! Today is December 31,2022 . The following information applies to Sky airlines: - After-tax operating income [EBIT(1-T)] for

Help please. Thank you in advance !

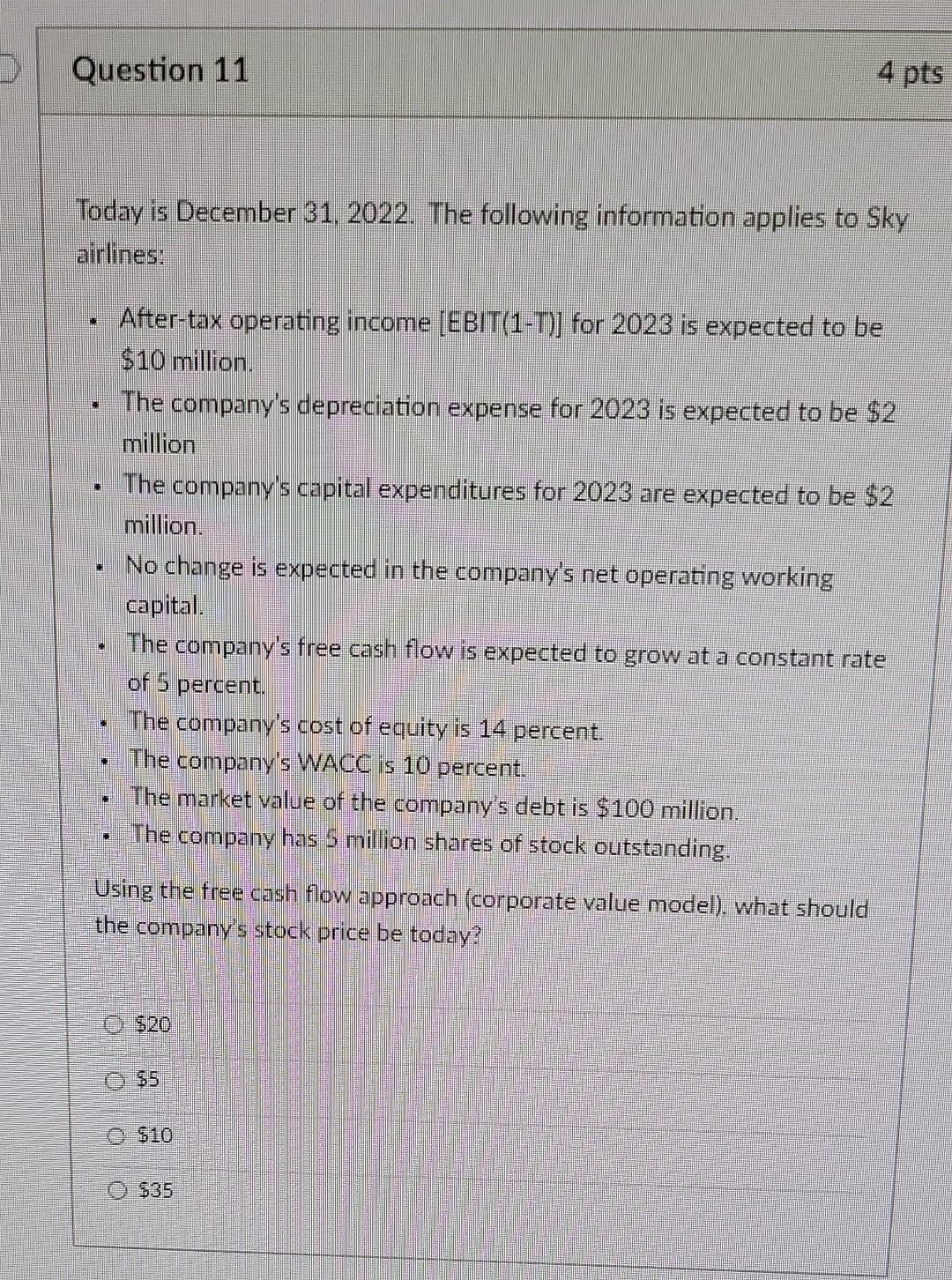

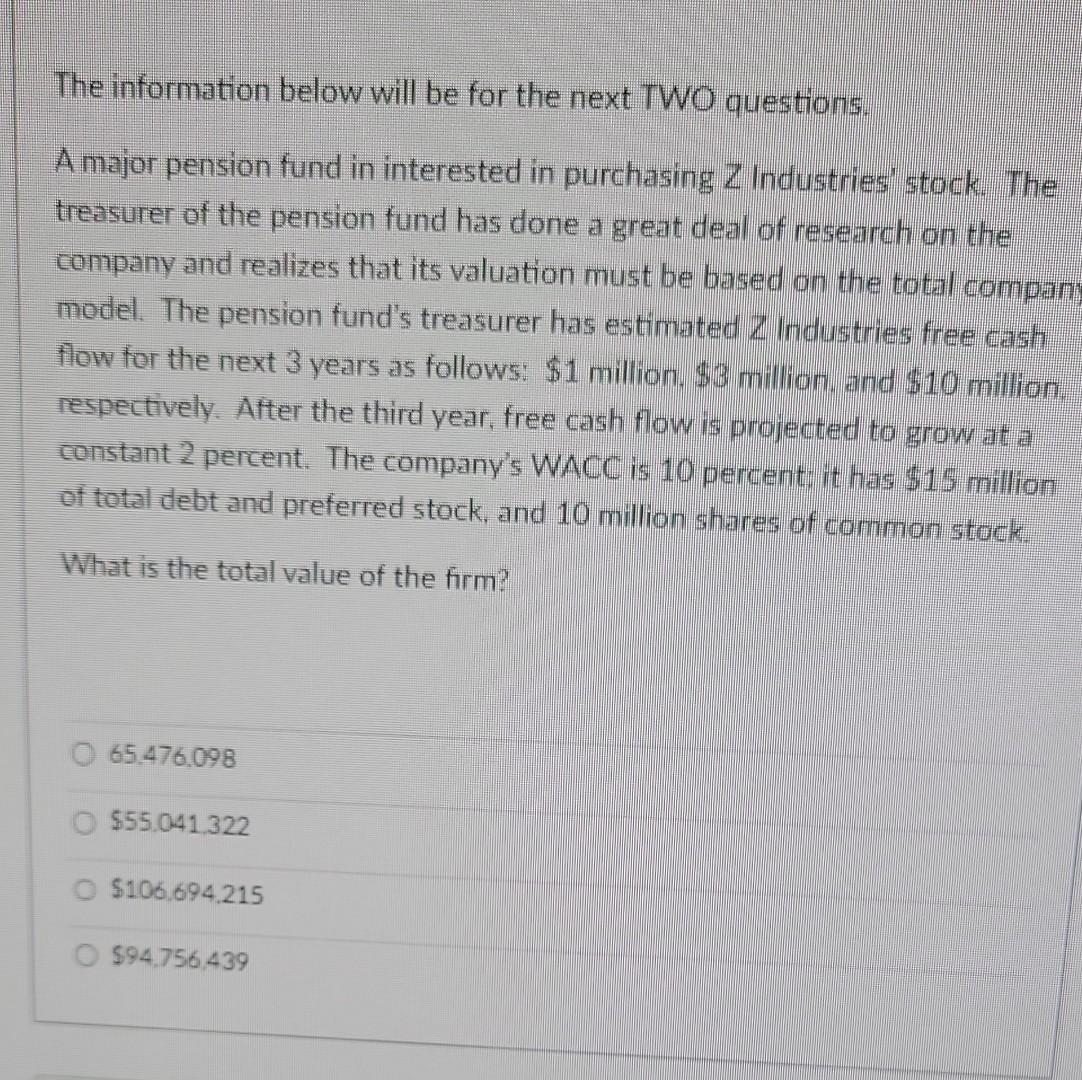

Today is December 31,2022 . The following information applies to Sky airlines: - After-tax operating income [EBIT(1-T)] for 2023 is expected to be $10 million. - The company's depreciation expense for 2023 is expected to be $2 million - The company's capital expenditures for 2023 are expected to be $2 million. - No change is expected in the company's net operating working capital. - The company's free cash flow is expected to grow at a constant rate of 5 percent. - The company's cost of equity is 14 percent. - The company's WACC is 10 percent. - The market value of the company's debt is $100 million. - The company has 5 million shares of stock outstanding. Using the free cash flow approach (corporate value model). what should the company's stock price be today? $20 $5 $10 $35 The information below will be for the next TWO questions. A major pension fund in interested in purchasing Z industries' stock. The treasurer of the pension fund has done a great deal of research on the company and realizes that its valuation must be based on the total compan model. The pension fund's treasurer has estimated Z industries free cash flow for the next 3 years as follows: $1 million, $3 million, and $10 million. respectively. After the third year, free cash flow is projected to grow at a constant 2 percent. The company's WACC is 10 percent: it has $15 million of total debt and preferred stock, and 10 million shares of common stock. What is the total value of the firm? 65.476.098$55.041.322$106.694.215$94.756.439Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started