Answered step by step

Verified Expert Solution

Question

1 Approved Answer

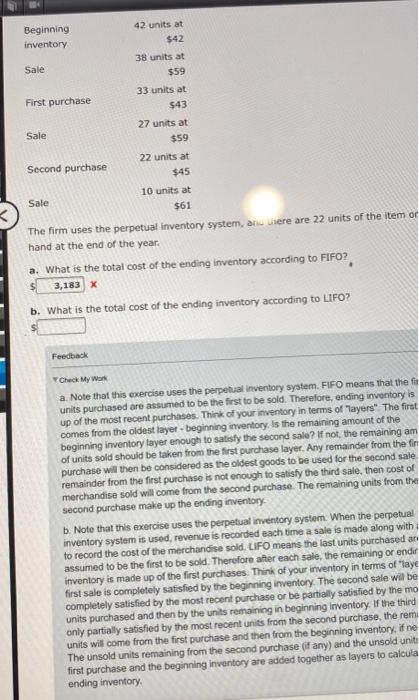

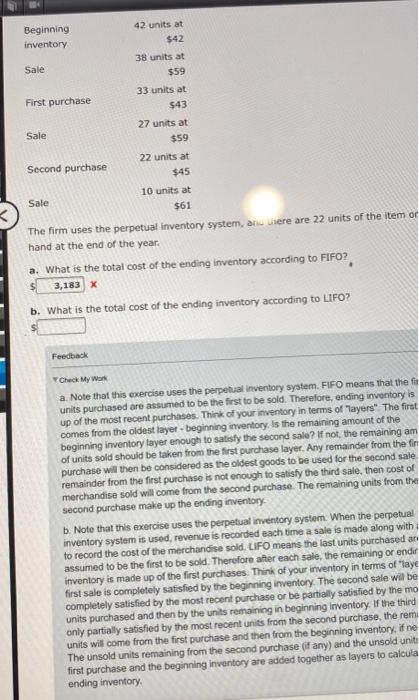

help please The firm uses the perpetual inventory system, aris were are 22 units of the item of hand at the end of the year.

help please

The firm uses the perpetual inventory system, aris were are 22 units of the item of hand at the end of the year. a. What is the total cost of the ending inventory according to FIFO? x b. What is the totai cost of the ending inventory according to LIFO? 4 Feedback TCheck My Wow a. Note that this exercise uses the perpetual inventory system. FIFO means that the fii units purchased are assumed to be the frst to be sold. Therefore, ending inventory is up of the most recent purchases. Think of your inventory in terms of "layers". The first comes from the oldest layer-beginning imvertory is the remaining amount of the beginning inwentory layer enough to satsify the second sale? If not, the remaining am of units soid should be taken from the first purchase layer. Any remainder from the fin purchase will then be considered as the oldest goods to be used for the second sale. remainder from the first purchase is not enough to satisfy the third sale, then cost of merchandise sold will come from the second purchase. The remaining units from the second purchase make up the ending inventory. b. Note that this exercise uses the perpetual inventory system. When the perpetual inventory system is used, revenue is recorded each time a sale is made along with + to record the cost of the merchandise sold. LIFO means the last units purchased an assumed to be the first to be sold. Therefore after each sale, the remaining or endir inventory is made up of the first purchases. Thinik of your inventory in terms of "laye first sale is completely safified by the beginning inventory. The second sale will be completely satisfied by the most recent purchase or be partially satisfied by the mo units purchased and then by the units remaining in beginning inventory. If the third only partially satisfied by the most recent units from the second purchase, the remi units will come from the first purchase and then from the beginning inventory, if ne The unsold units remaining from the second purchase (if any) and the unsold units first purchase and the beginning inventory are added together as layers to calcula ending inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started