Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HELP PLEASE this assignment is due today. I need answers to them all. please round to 2 decimal places !! thank you so much 3.

HELP PLEASE this assignment is due today. I need answers to them all. please round to 2 decimal places !! thank you so much

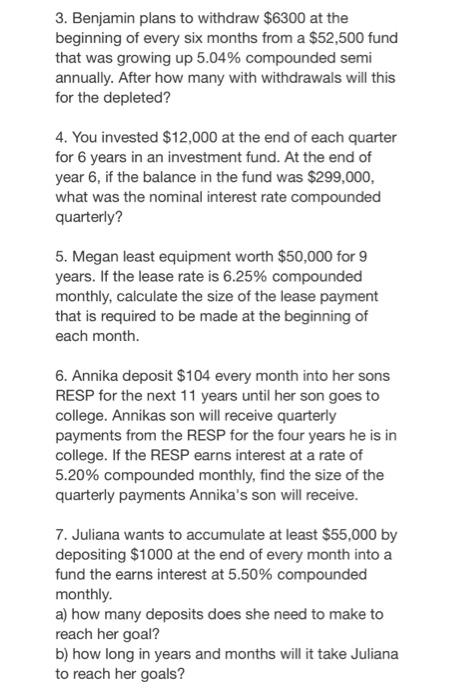

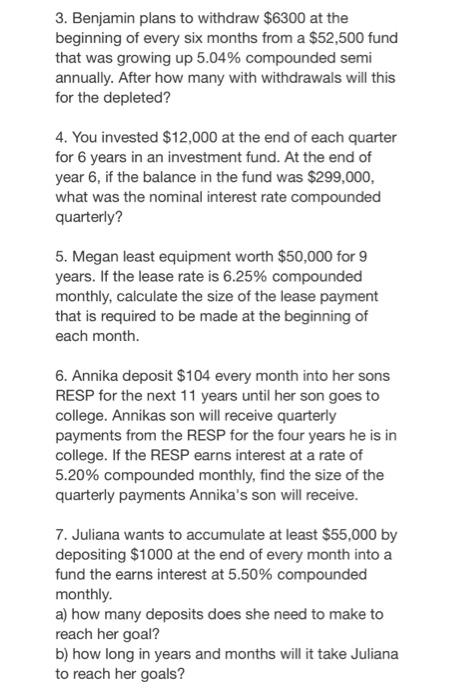

3. Benjamin plans to withdraw $6300 at the beginning of every six months from a $52,500 fund that was growing up 5.04% compounded semi annually. After how many with withdrawals will this for the depleted? 4. You invested $12,000 at the end of each quarter for 6 years in an investment fund. At the end of year 6, if the balance in the fund was $299,000, what was the nominal interest rate compounded quarterly? 5. Megan least equipment worth $50,000 for 9 years. If the lease rate is 6.25% compounded monthly, calculate the size of the lease payment that is required to be made at the beginning of each month. 6. Annika deposit $104 every month into her sons RESP for the next 11 years until her son goes to college. Annikas son will receive quarterly payments from the RESP for the four years he is in college. If the RESP earns interest at a rate of 5.20% compounded monthly, find the size of the quarterly payments Annika's son will receive. 7. Juliana wants to accumulate at least $55,000 by depositing $1000 at the end of every month into a fund the earns interest at 5.50% compounded monthly. a) how many deposits does she need to make to reach her goal? b) how long in years and months will it take Juliana to reach her goals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started