Help please!!

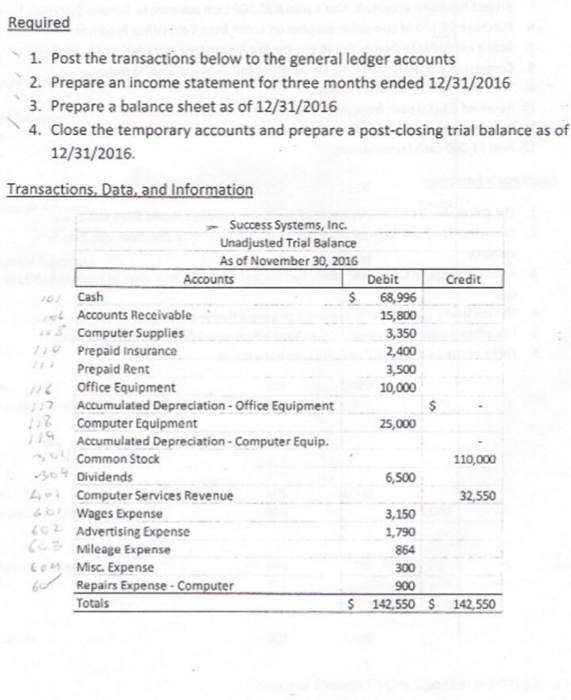

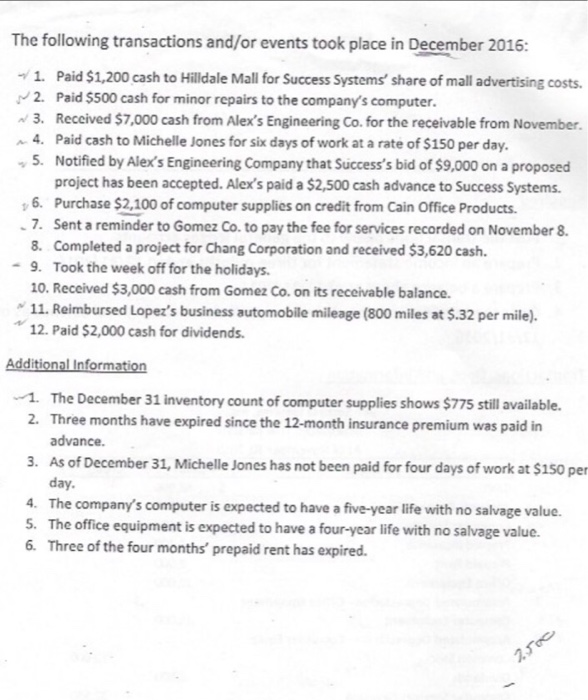

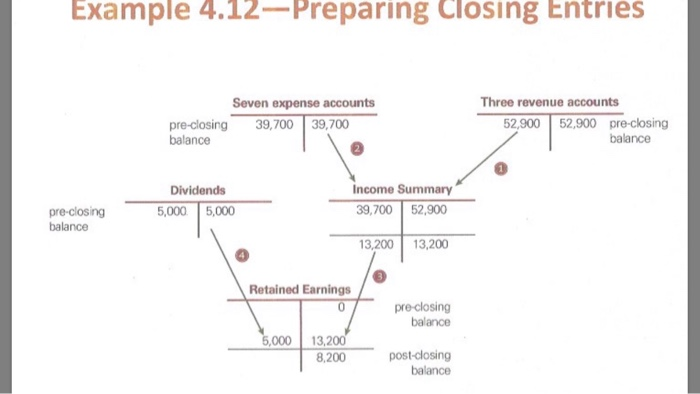

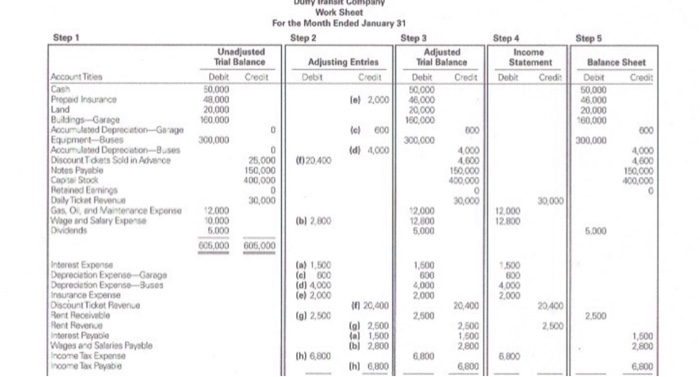

This included, the Accounting Cycle, preparing a work sheet and closing entries. The PDF has the Success System problem, an example of a work sheet and a diagram of how the closing entries flow. A couple of comments: The 30 November Balance sheet becomes your beginning balance sheet 1 December. Entries 1- 12 are cash transactions for December and the additional information are your adjusting entries for the month. Once you have posted entries 1- 12 you'll have the unadjusted trial balance for 31 December. From here prepare your worksheet, financials and close the temporary accounts and prepare a post-closing trial balance (hint: should be the same as the 31 December balance sheet) Required 1. Post the transactions below to the general ledger accounts 2. Prepare an income statement for three months ended 12/31/2016 3. Prepare a balance sheet as of 12/31/2016 4. Close the temporary accounts and prepare a post-closing trial balance as of 12/31/2016. Success Systems, Inc. Unadjusted Trial Balance As of November 30, 2016 Debit Credit $ 68,996 15,800 3,350 2,400 07 Accounts Receivable Computer Supplies Prepaid Insurance Prepaid Rent Office Equipment Accumulated Depreciation-Office Equipment Computer Equipment Accumulated Depreciation-Computer Equip. Common Stock Dividends Computer Services Revenue Wages Expense Advertising Expense Mileage Expense Misc. Expense Repairs Expense-Computer Totals , 10,000 25,000 110,000 32,550 3,150 1,790 I o ", 142,550 $ 142,550 The following transactions and/or events took place in December 2016 1. Paid $1,200 cash to Hilldale Mall for Success Systems' share of mall advertising costs. 2. Paid $500 cash for minor repairs to the company's computer. 3. Reccived $7,000 cash from Alex's Engineering Co. for the receivable from November 4. Paid cash to Michelle Jones for six days of work at a rate of $150 per day. 5. Notified by Alex's Engineering Company that Success's bid of $9,000 on a proposed project has been accepted. Alex's paid a $2,500 cash advance to Success Systems. 6. Purchase $2,100 of computer supplies on credit from Cain Office Products 7. Sent a reminder to Gomez Co. to pay the fee for services recorded on November 8. 8. Completed a project for Chang Corporation and received $3,620 cash. Took the week off for the holidays. 10. Received $3,000 cash from Gomez Co. on its receivable balance. 11. Reimbursed Lopez's business automobile mileage (800 miles at $.32 per mile). 12. Paid $2,000 cash for dividends -9. ddi 1. The December 31 inventory count of computer supplies shows $775 still available. 2. Three months have expired since the 12-month insurance premium was paid in advance As of December 31, Michelle Jones has not been paid for four days of work at $150 per day 3. 4. The company's computer is expected to have a five-year life with no salvage value. 5. The office equipment is expected to have a four-year life with no salvage value 6. Three of the four months' prepaid rent has expired. Example 4.12-Preparing Closing Entries Seven expense accounts Three revenue accounts 52,900 52,900 pre-closing pre-closing 39,700 39,700 balance balance 0 Income Summary 39,700 52,900 Dividends 5,000 5,000 pre-closing balance 3,200 13,200 Retained Earnings 0 pre-closing balance 000 13,2 8.200 post-closing balance Work Sheet For the Month Ended January 31 Step 2 Step 3 Step 4 Step 5 Unadjusted Trial Balance Debit Crecit Adjusting Entries Debt Statement DebitCredt DebitCredDebitCredit Trial Balance Balance Sheet Account Tities Preped Insurance lel 2,000 46000 180,000 Accumulated Deprecation-Bus Discount T dkes Sold in Adhence Notes Payable apal Stock Retained Eenings Daily Ticket Peven.a Gas O, and Vainterance Expens age and Salary Expse () 4,000 4000 4,600 150,000 400,000 25,000 20400 4,600 150,000 400,000 2000 30000 12.800 30,000 30,000 2000 b) 2,800 12,800 06,000 605,000 nterest Expense Depreciation Expense-Garage opreciation Expense-Buses nsurance Expense Dscount Tickot even ent Receiveble Rent Revenue nterest Payacie Wages and Saleries Payeble ncome Tax Expense ncome Tax Payabe (e) 600 (e) 2,000 (g) 2.500 4.000 2000 20,400| 20400 (gl 2,500 () 1,500 (b) 2,800 2,500 1,500 (h) 6,800 6.800 (1 6800860 6,800