Help please!

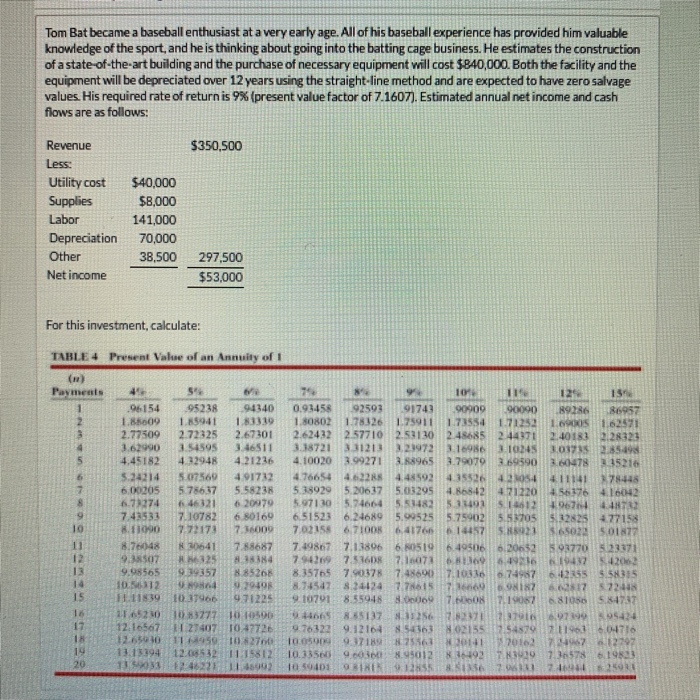

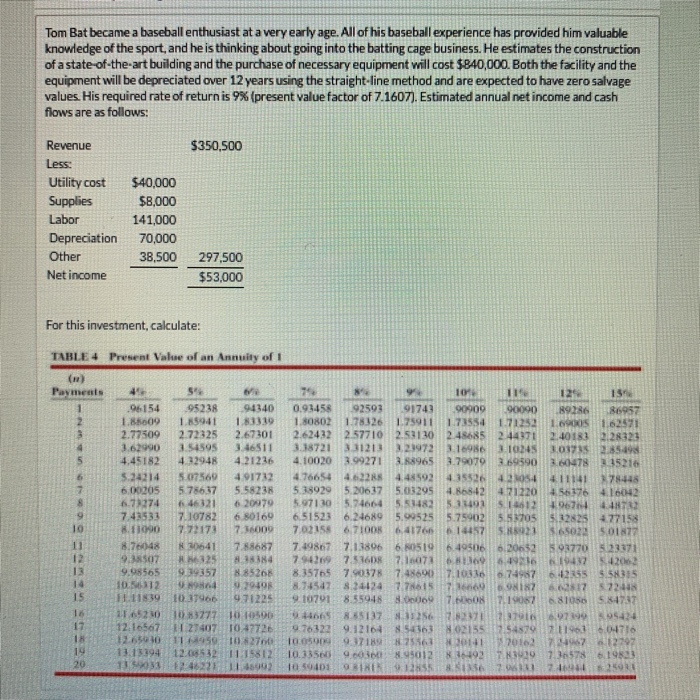

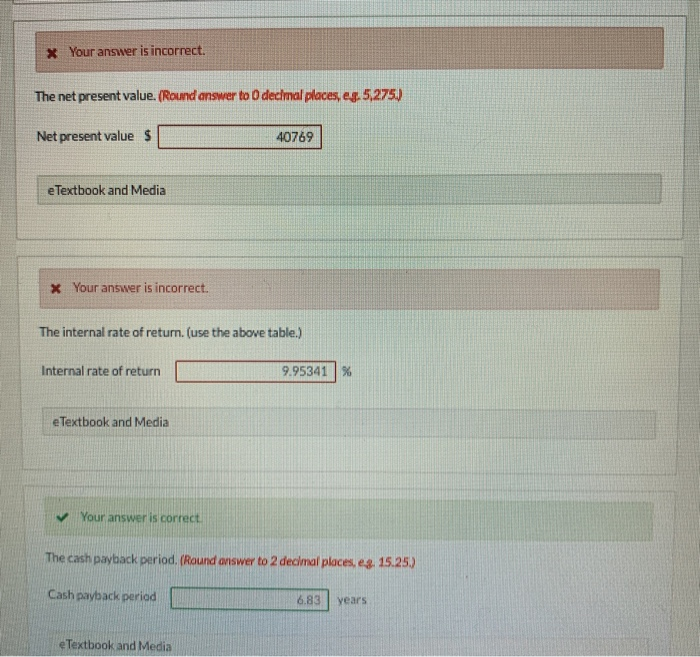

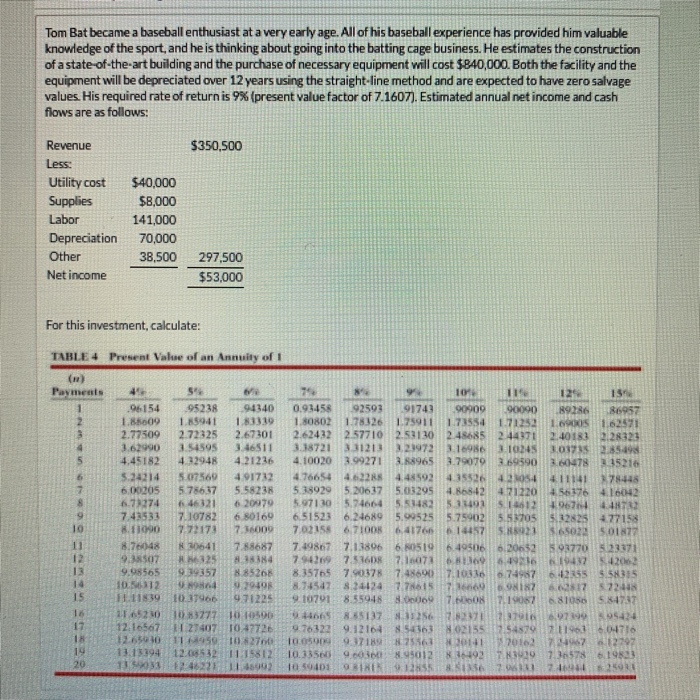

Tom Bat became a baseball enthusiast at a very early age. All of his baseball experience has provided him valuable knowledge of the sport, and he is thinking about going into the batting cage business. He estimates the construction of a state-of-the-art building and the purchase of necessary equipment will cost $840,000. Both the facility and the equipment will be depreciated over 12 years using the straight-line method and are expected to have zero salvage values. His required rate of return is 9% (present value factor of 7.1607). Estimated annual net income and cash flows are as follows: $350,500 Revenue Less: Utility cost Supplies Labor Depreciation Other Net income $40,000 $8,000 141,000 70,000 38,500 297,500 $53,000 For this investment, calculate: TABLE4 Present Value of an Annuity of (n) Payments 45 54 96154 95238 94340 1.8509 1.65941 1.83319 2.77509 2.72325 2.67301 3.62990 3.54595 3.46511 4,45182 4.329:48 4.21236 5.24214 5.07569 4.91732 6.00205 5.786.37 5.58238 6.7274 46321 6 20970 7.43533 7.10782 6.80169 10 8.11000 7.72173 7.36009 11 8.76048 20641 7.88687 12 938507 325 1834 13 9.98565 939357 8.8526 10.52 NA 3940 15 111839 1037966 971225 16 1 6520 103 3777 100500 17 12.16567 21407 10:47726 IN 1159 108 2700 19 13.1339412 1532 11 15812 20 13933 16902 7 10 11 129 15 0.93458 92593 91743 90909 90000 89286 86957 1.80802 1.78326 1.75911 1.73554 1.71252 1.6 62521 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2128321 3.18721 331213.2.1972 3.169156 11025 20373 2.85498 4.10020 3.99271 3.88965 3.79079 3.69590 2.60478 715210 4.76654 4.6228 4.48592 435526 431054 411141 78448 5.38929 5.20637 5.03295 4.86842 4.71220 456176 4.16042 5.97130 5.746645.58482 5 1140 S14612 1967 4.TR 6.51523 6.24689 5.99525 5.75902 5.53705 5.22825 4.77158 7.02155 6.7100 6.4176614457 SMO1 5.650225.0177 7.198677.1.1896 6. N051916.49506 6,20652 5.93770 523371 794219 751608 71007 36.4916 9:32 420 8.35765 7.90378 7.48690 7.103 674987 612355 9 535 8.74547 84124 7.75 716660 9INZ 0.017 5 22:41 9 10791 8.55948 8.369 7.OON 7.1907 81056 5.847 14665 8.55137 3256 201 7379106.97199 05424 076322 9.12104854363 021551545797 1901 6.04776 1005000 937125563 3014101627134712797 10.33500 9.038.9012 81192929736578 6.198.23 10 50401 0311 8.362.01 716951 x Your answer is incorrect. The net present value. (Round answer to decimal places, eg,5,275) Net present value $ 40769 e Textbook and Media X Your answer is incorrect. The internal rate of return. (use the above table.) Internal rate of return 9.95341 % e Textbook and Media Your answer is correct The cash payback period. (Round answer to 2 decimal places, eg. 15.25.) Cash payback period 6.83 years e Textbook and Media