HELP PLEASE. TY!

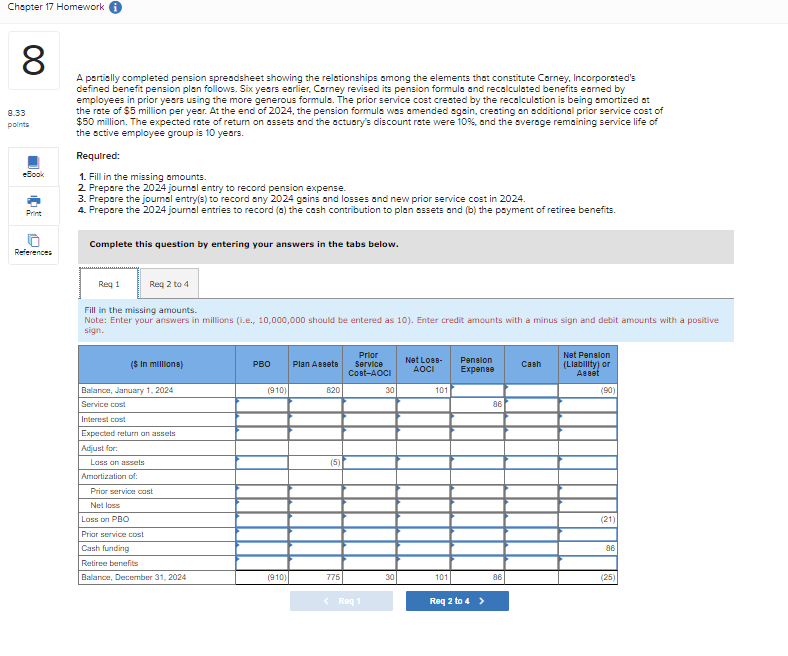

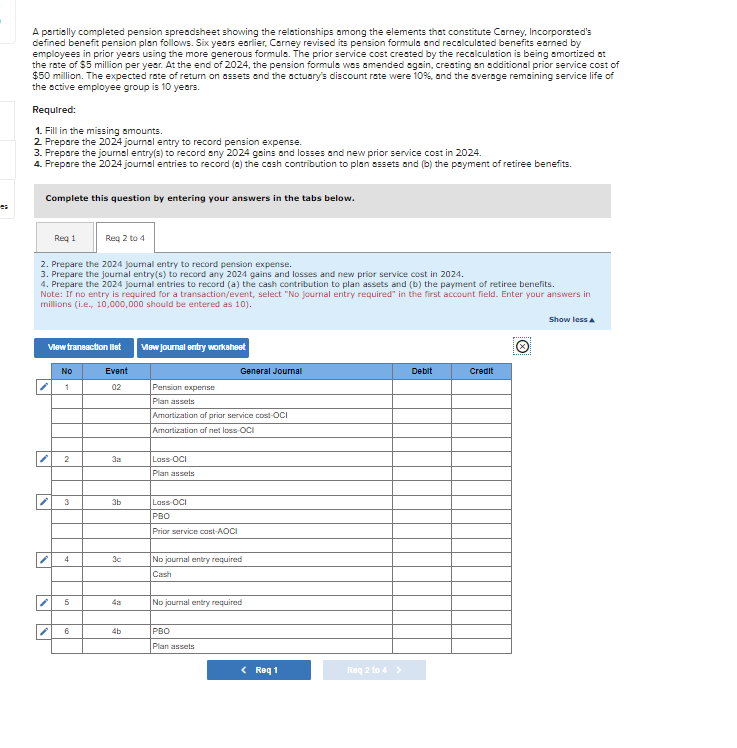

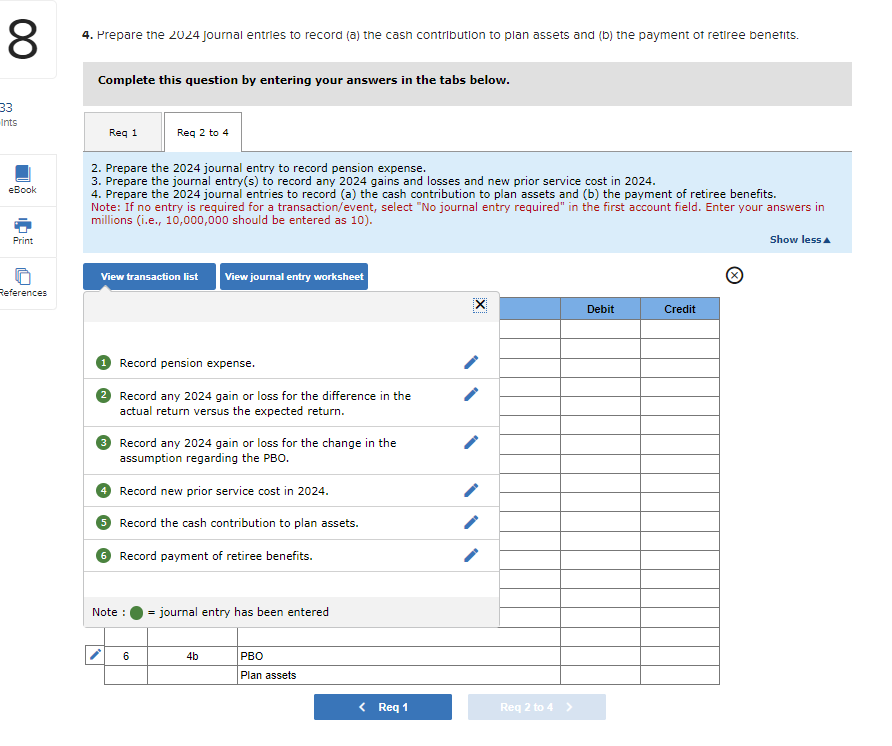

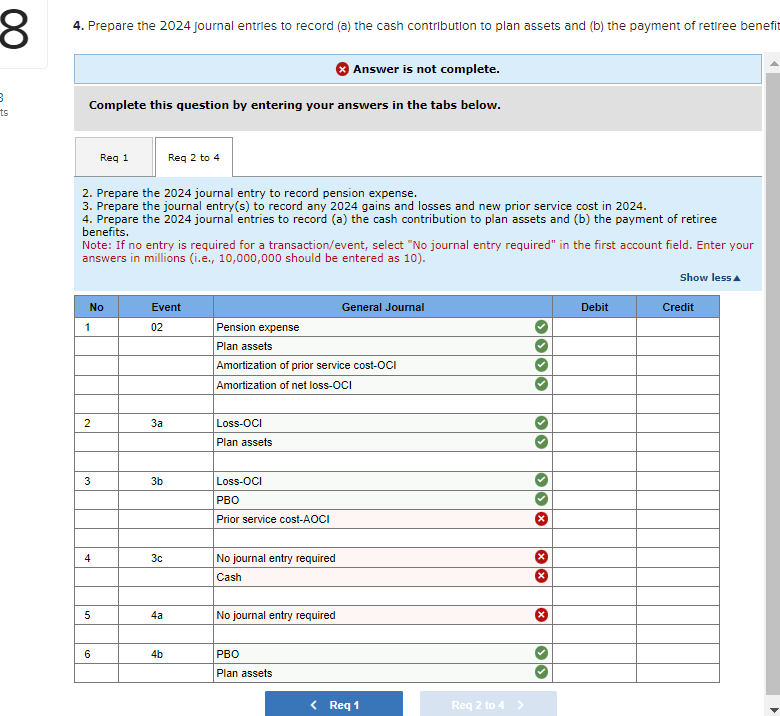

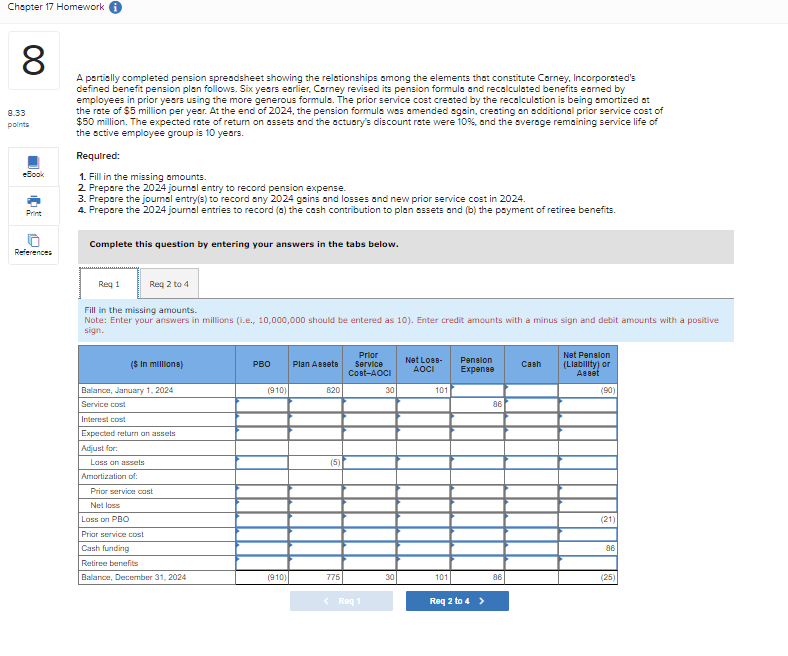

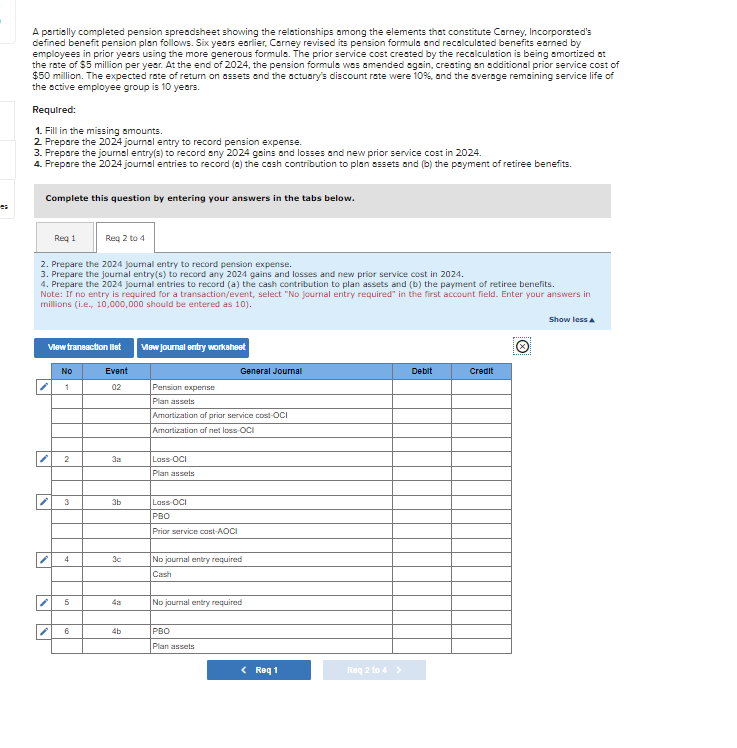

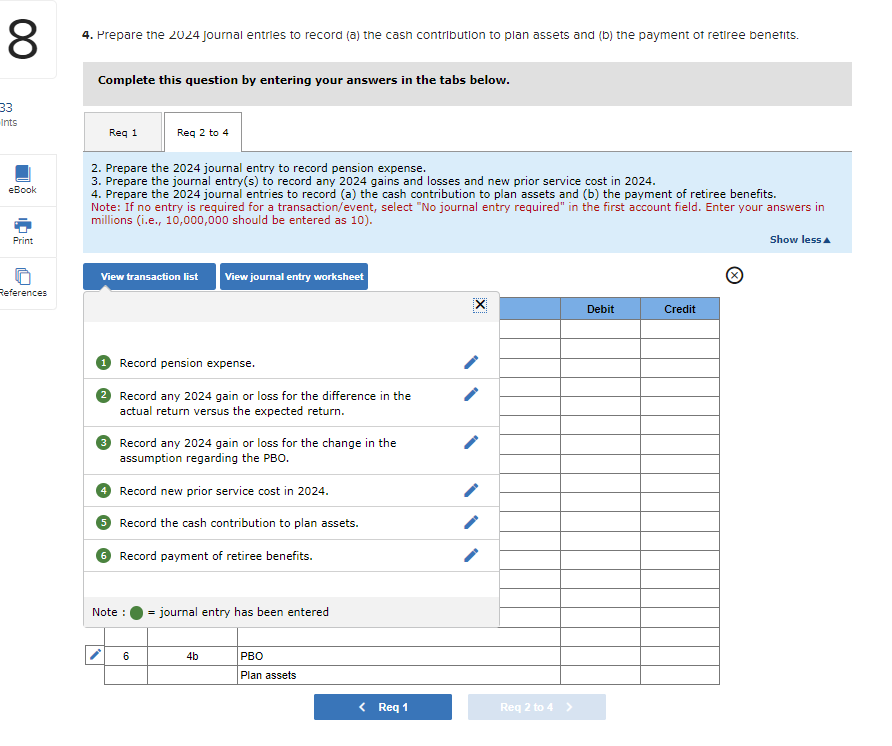

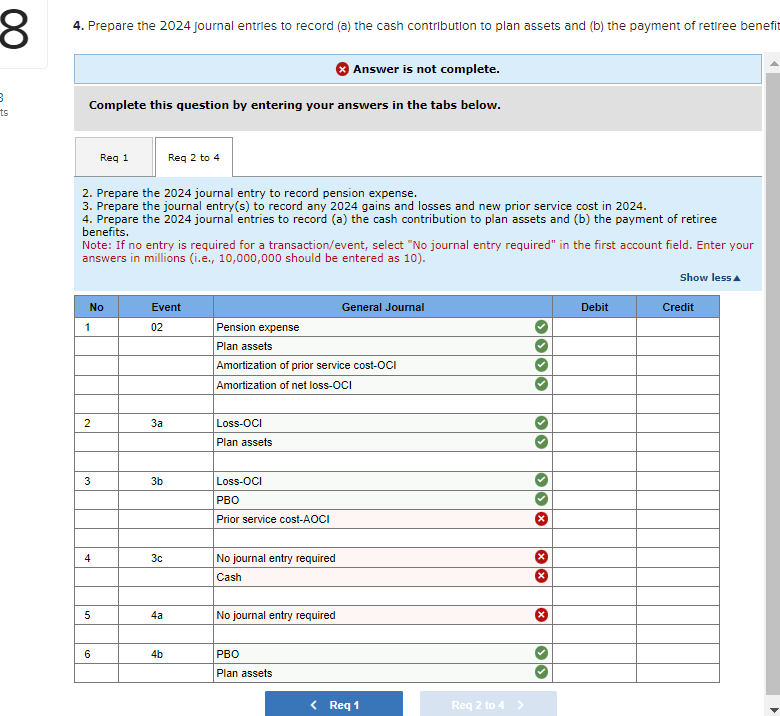

A portislly completed pension sprevolsheet showing the relationships among the elements that constitute Carney, Incorporated's defined benefit pension plan follows. Six years earlier. Camey revised its pension formula and recalculated benefits earned by employees in prior years using the more generous formula. The prior service cost crested by the recalculation is being amortized ot the rate of $5 million per year. At the end of 2024 , the pension formula was amended again, creating an additional prior service coat of $50 million. The expected rote of return on assets and the actuory's discount rate were 10%, and the averoge remaining service life of the sctive employee group is 10 years. Required: 1. Fill in the missing amounts. 2. Prepore the 2024 joums entry to record pension expense. 3. Prepore the journal entry(s) to record any 2024g ins and losses and new prior service cost in 2024. 4. Prepare the 2024 journal entries to record (a) the cash contribution to plan assets and (b) the payment of retiree benefits. Complete this question by entering your answers in the tabs below. Fill in the missing amounts. Note: Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Enter credit amounts with a minus sign and debit amounts with a positive sign. A portislly completed pension spreodsheet showing the relotionships omong the elements that constitute Corney, Incorporated's defined benefit pension plan follows. Six years earlier, Carney revised its pension formula and recalculated benefits earned by employees in prior years using the more generous formula. The prior service cost created by the recalculation is being amortized at the rate of $5 million per year. At the end of 2024 , the pension formula was amended again, creating an soditional prior service cost of $50 million. The expected rate of return on assets and the sctuvry's discount rate were 10%, ond the sveroge remaining service life of the sctive employee group is 10 years. Required: 1. Fill in the migsing omounts. 2. Prepare the 2024 journ: entry to record pension expense. 3. Prepare the joumnl entry(s) to record any 2024g ins and losses and new prior service cost in 2024. 4. Prepare the 2024 journal entries to record (a) the cash contribution to plan assets and (b) the payment of retiree benefits. Complete this question by entering your answers in the tabs below. 2. Prepare the 2024 joumal entry to record pension expense. 3. Prepare the joumal entry(s) to record any 2024 gains and losses and new prior service cost in 2024. 4. Prepare the 2024 joumal entries to record (a) the cash contribution to plan assets and (b) the payment of retiree benefits. Note: If no entry is required for a transaction/event, select "No fournal entry required" in the first account field. Enter your answers in millions (i.e. 10,000,000 should be entered as 10 ). 4. Hrepare the 2024 journal entrles to record (a) the cash contribution to plan assets and (b) the payment ot retiree benetits. Complete this question by entering your answers in the tabs below. 2. Prepare the 2024 journal entry to record pension expense. 3. Prepare the journal entry(s) to record any 2024 gains and losses and new prior service cost in 2024. 4. Prepare the 2024 journal entries to record (a) the cash contribution to plan assets and (b) the payment of retiree benefits. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Show less ) Prepare the 2024 joumal entrles to record (a) the cash contribution to plan assets and (b) the payment of retiree ben X Answer is not complete. Complete this question by entering your answers in the tabs below. 2. Prepare the 2024 journal entry to record pension expense. 3. Prepare the journal entry(s) to record any 2024 gains and losses and new prior service cost in 2024. 4. Prepare the 2024 journal entries to record (a) the cash contribution to plan assets and (b) the payment of retiree benefits. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Show lessa