Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help please Use this information about Carmelita Inc. to answer the question that follows. Carmelita Inc. has the following information available: Costs from Beginning Inventory

help please

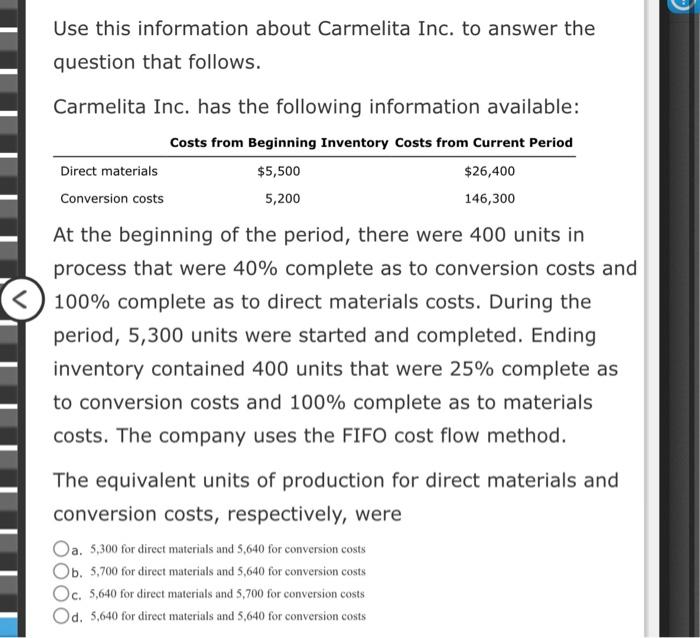

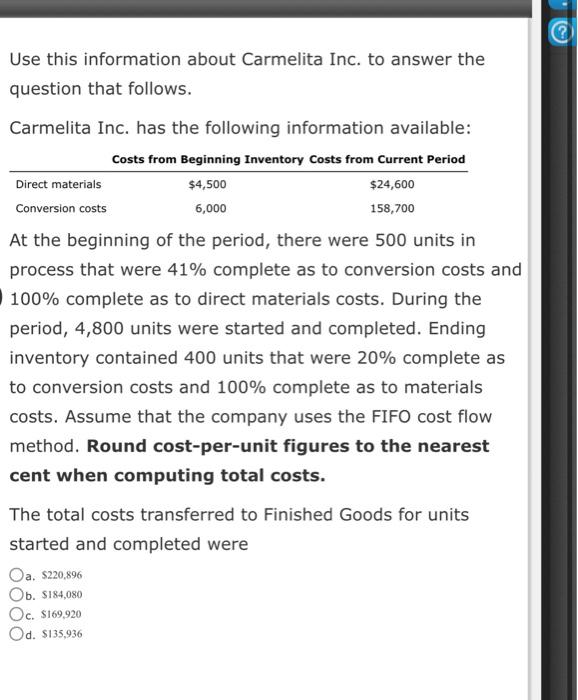

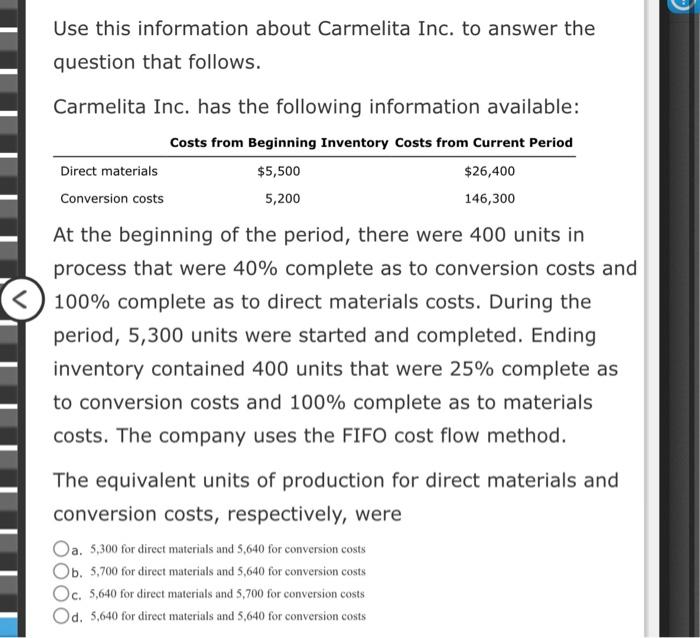

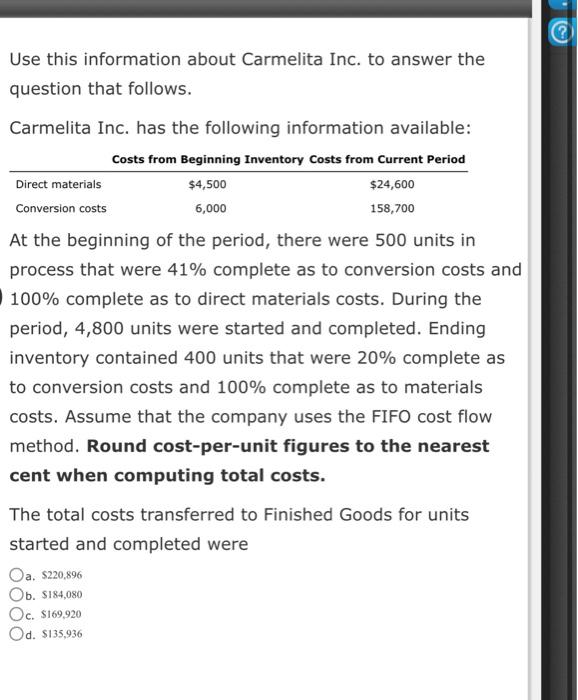

Use this information about Carmelita Inc. to answer the question that follows. Carmelita Inc. has the following information available: Costs from Beginning Inventory Costs from Current Period Direct materials $5,500 $26,400 Conversion costs 5,200 146,300 At the beginning of the period, there were 400 units in process that were 40% complete as to conversion costs and 100% complete as to direct materials costs. During the period, 5,300 units were started and completed. Ending inventory contained 400 units that were 25% complete as to conversion costs and 100% complete as to materials costs. The company uses the FIFO cost flow method. The equivalent units of production for direct materials and conversion costs, respectively, were Oa. 5,300 for direct materials and 5,640 for conversion costs Ob. 5,700 for direct materials and 5,640 for conversion costs Oc. 5,640 for direct materials and 5,700 for conversion costs Od. 5,640 for direct materials and 5,640 for conversion costs Use this information about Carmelita Inc. to answer the question that follows. Carmelita Inc. has the following information available: Costs from Beginning Inventory Costs from Current Period Direct materials $4,500 $24,600 Conversion costs 6,000 158,700 At the beginning of the period, there were 500 units in process that were 41% complete as to conversion costs and 100% complete as to direct materials costs. During the period, 4,800 units were started and completed. Ending inventory contained 400 units that were 20% complete as to conversion costs and 100% complete as to materials costs. Assume that the company uses the FIFO cost flow method. Round cost-per-unit figures to the nearest cent when computing total costs. The total costs transferred to Finished Goods for units started and completed were Oa. S220,896 Ob. $184,080 Oc. $169,920 Od. $135,936

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started